Risk Management in

Islamic Financial Instruments

77

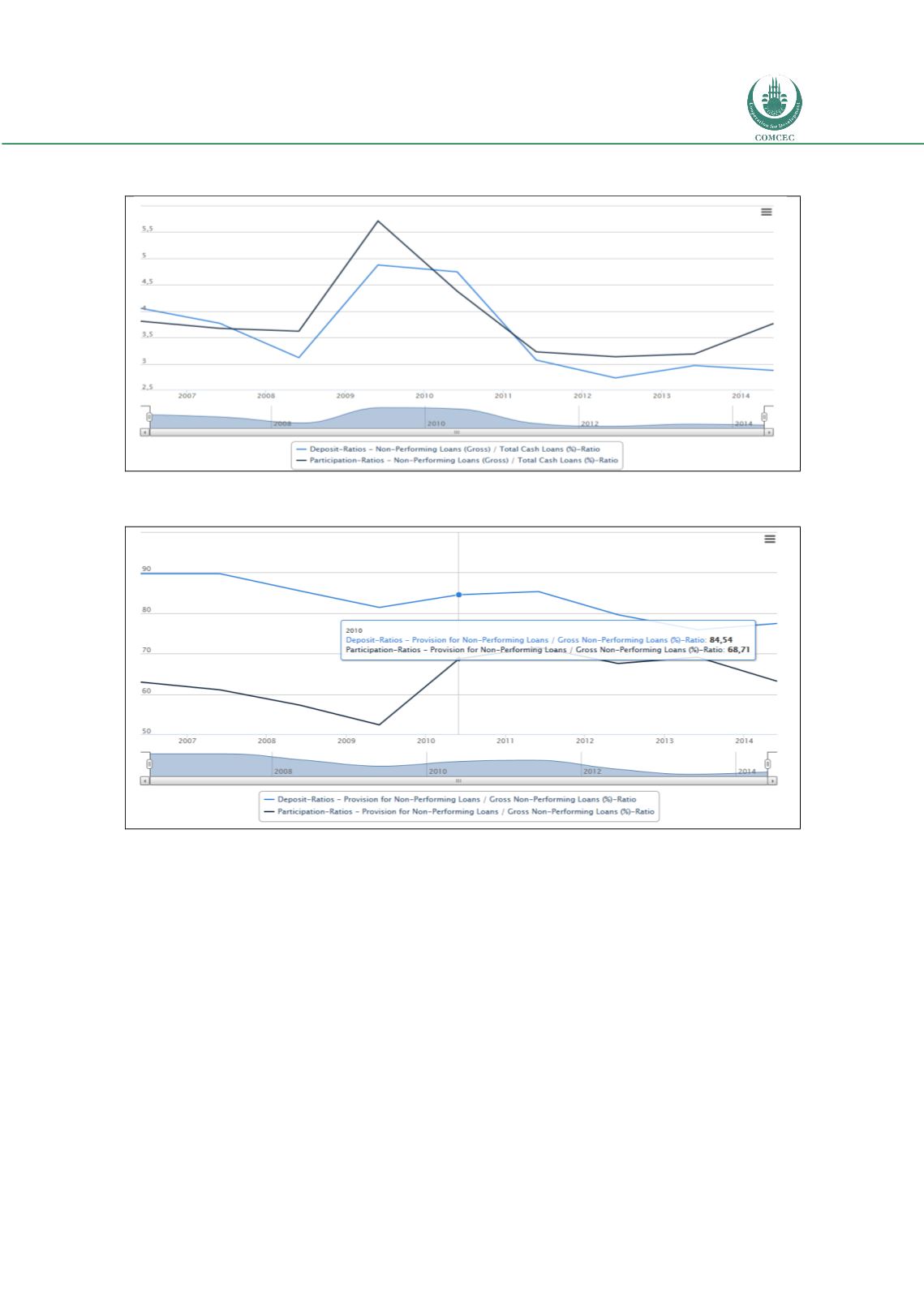

Chart 4.17: Non-Performing Loans (Gross) / Total Cash Loans (%)-Ratio

Source: Turkish Banking Sector Interactive Bulletin 2014

Chart 4.18: Provision for Non-Performing Loans / Gross Non-Performing Loans (%)-Ratio

Source: Turkish Banking Sector Interactive Bulletin 2014

Capital Adequacy Ratios

For capital adequacy, two ratios are considered, a) Demand Deposit (Funds Collected) / Total

Deposit (Funds Collected) (%) Ratio and b) Shareholder's Equity Ratios / Total Risk Weighted

Assets (%) Ratio, which are presented in Chart 4.19 and Chart 4.20, respectively.

The Demand Deposit (Funds Collected) / Total Deposit (Funds Collected) (%)-Ratio does not

reveal any specific trend over the 2005 to 2014 period for the conventional and Islamic banks;

however, the Islamic banks, in general, tend to have higher ratios, compared to the

conventional banks. On the other hand, Islamic banks generally maintain lower Shareholder's

Equity Ratios / Total Risk Weighted Assets (%)-Ratios, compared to their conventional

counterparts. (see Chart 4.19 and Chart 4.20).