Risk Management in

Islamic Financial Instruments

83

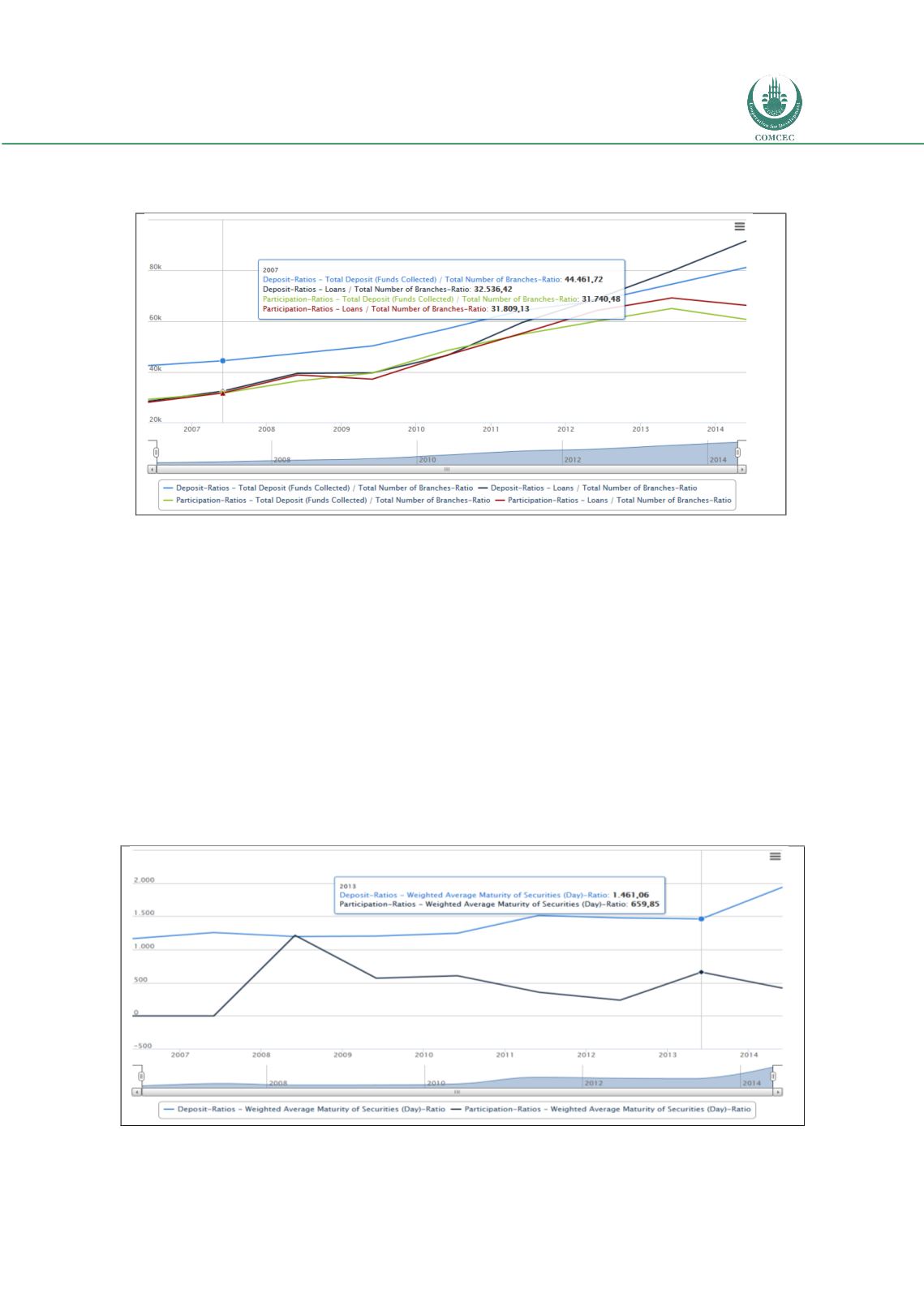

Chart 4.28: Branch Performance (Total Deposit (Funds Collected)/Total Number of Branches-

Ratio & Loans/Total Number of Branches-Ratio)

Source: Turkish Banking Sector Interactive Bulletin 2014

Liquidity Ratios

Two liquidity ratios are analyzed, a) Weighted Average Maturity of Securities (Day) Ratio and

b) Weighted Average Maturity of Securities Held for Trading (Day) Ratio. An Increasing trend

in the Weighted Average Maturity of Securities (Day) Ratio suggests that, in general, Turkish

conventional banks are investing more in less liquid assets. However, the trend is otherwise

different and downward since 2007 for Islamic banks. Generally, the Islamic banks tend to

hold lower ratios (568.91 in 2009 and decreasing towards 419.09 in 2014), compared to their

conventional counterparts (1203.20 in 2009 and increasing towards 1938.50 in 2014). The

trend in the Weighted Average Maturity of Securities Held for Trading (Day) Ratio is rather

stable for conventional banks. However, for the Islamic banks, the trend shows some

interesting caveats. After 2008, Islamic banks have stopped holding securities for trading

purpose, as the ratios are zero since 2009.

Chart 4.29: Weighted Average Maturity of Securities (Day)-Ratio

Source: Turkish Banking Sector Interactive Bulletin 2014