Risk Management in

Islamic Financial Instruments

84

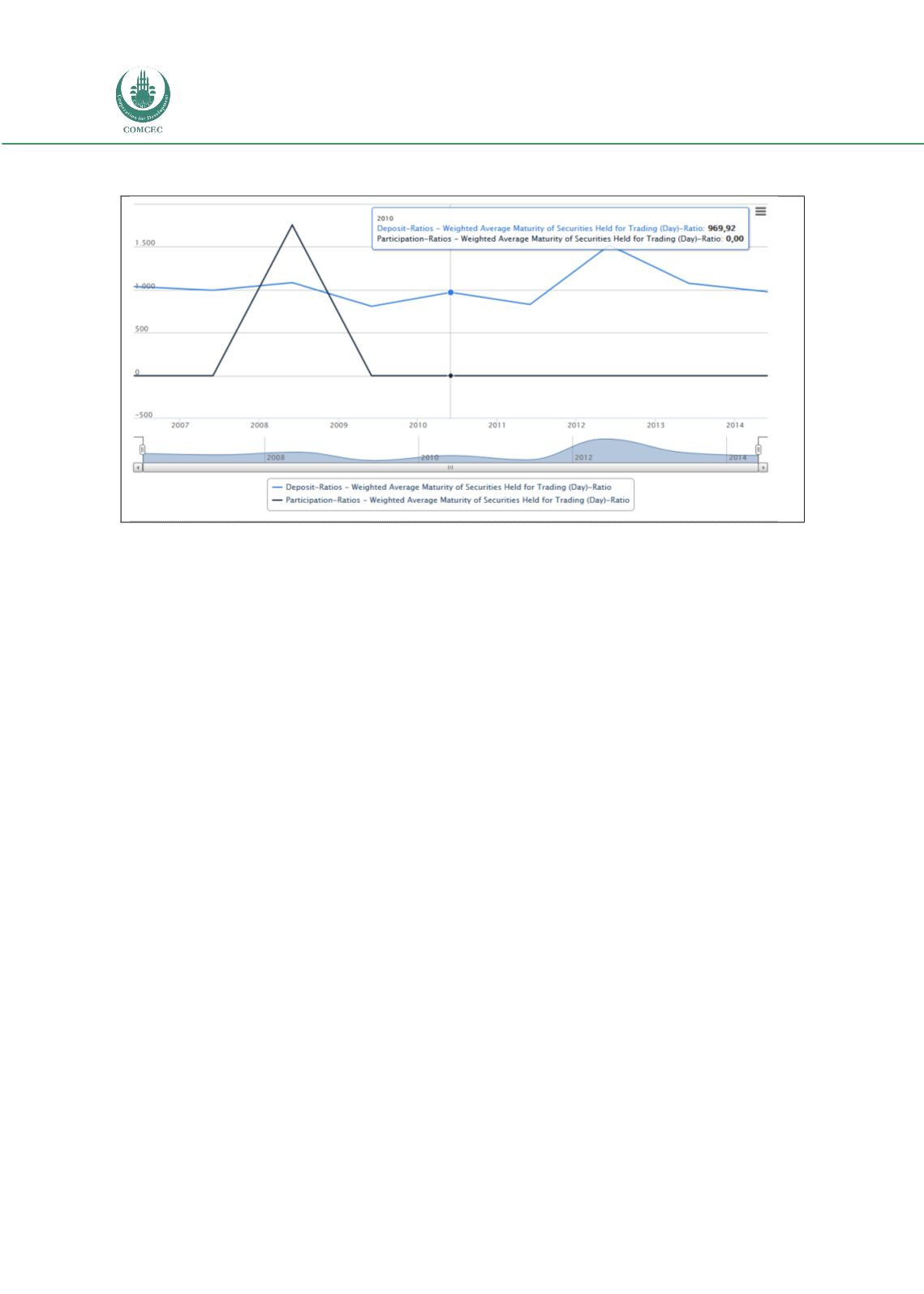

Chart 4.30: Weighted Average Maturity of Securities Held for Trading (Day)-Ratio

Source: Turkish Banking Sector Interactive Bulletin 2014

4.4.2.3 Risk Matrices

The following the comparison between the risk matrices for Islamic and conventional banks in

the Turkish banking sector is based on the BankScope dataset.

Asset Quality Ratios

Asset qualities for the Turkish Islamic banks are mixed when compared to their conventional

banking competitors. While the Average Loan Loss Res/Gross Loans ratio is lower for Islamic

banks at 2.11%, compared to that of the conventional banks of 4.97%, other ratios are higher.

(See Chart 4.31)

Capital Adequacy ratios

In general, conventional banks in Turkey keep a higher capital cushion, compared to their

Islamic banking counterparts. Chart 4.32 shows that The Equity / Tot Assets ratio and the

Equity / Net Loans ratio of the Islamic banks, at 9.76% and 10.87%, respectively, are lower

than those of the conventional banks, at 10.52% and 15.29%, respectively. These ratios reflect

the fact that Islamic banks in Turkey may be prone to insolvency risk compared to

conventional banks at the advent of financial crisis.

Operational Efficiency ratios

In general, higher operating ratios represent lower cost of funds, higher efficiency, and higher

yields on equity and assets. Higher ratios for NIM, Net Int Rev/Average Asset and Non Int Exp/

Avg Assets for the Turkish conventional banks (4.93%, 4.45% and 4.47%), compared to those

of the Islamic banks (3.48%, 2.94% and 3.19%) reflect that conventional banks, in general,

enjoy benefits from cheaper sources of funding. However, the Return On Avg Assets (ROAA)

and Return On Avg Equity (ROAE) are both higher for Islamic banks (1.24% and 11.05%),