Risk Management in

Islamic Financial Instruments

75

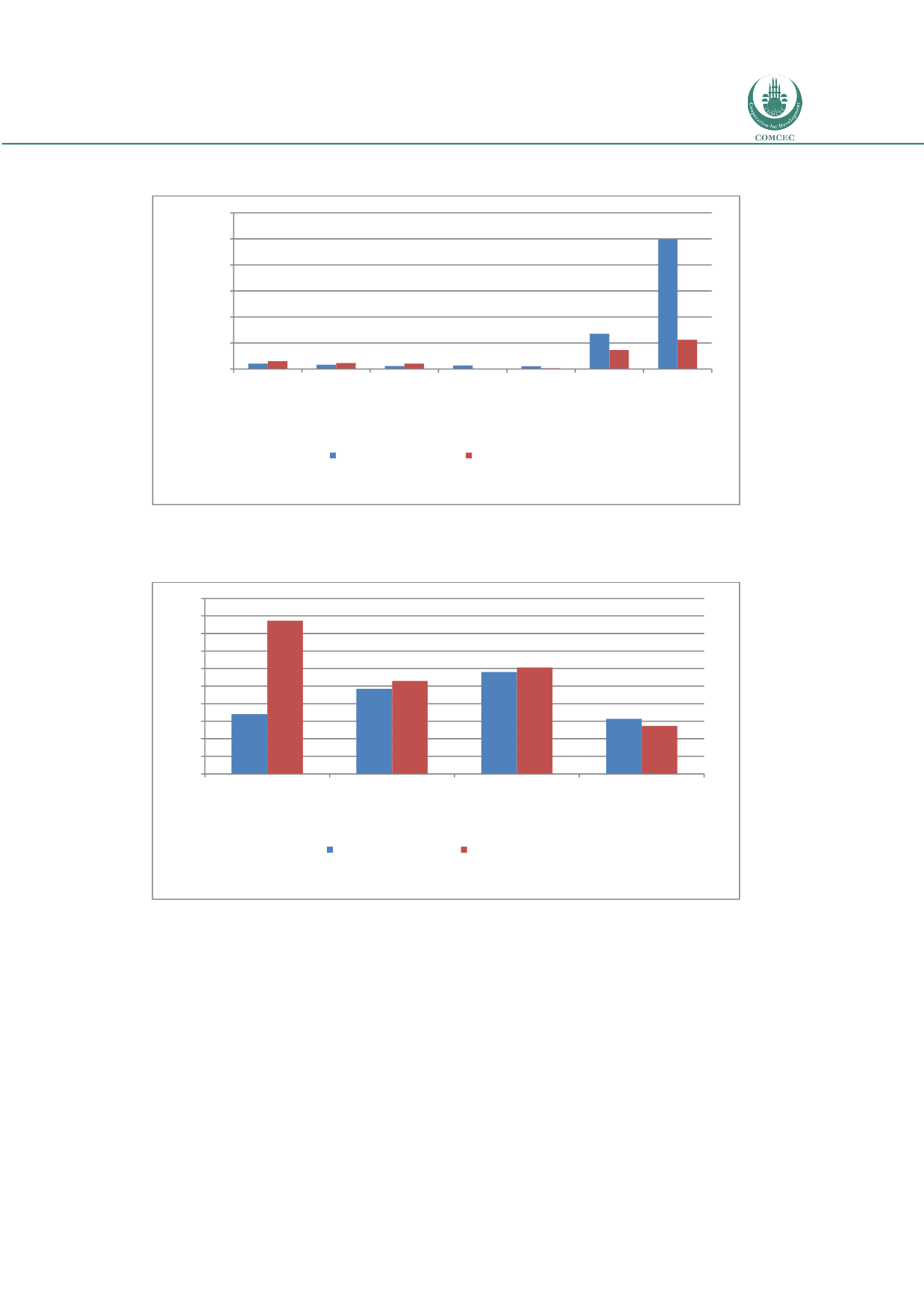

Chart 4.15: Operational Efficiency Ratios for Malaysian Banks

Source: BankScope Database 2013

Chart 4.16: Liquidity Ratio for Malaysian Banks

Source: BankScope Database 2013

4.4.2 Republic Of Turkey

Located between Asia and Europe, Turkey has a developed financial market with a large

potential consumer base for the Islamic financial services industry. Turkey is home to a diverse

option of deposit and financing facilities for both corporate and commercial clients. The

Islamic capital markets remain relatively nascent, however, with Ijarah being the main

principle for fund raising activities. The country has a well-regulated stock exchange that has

both sukuk and Shariah-compliant ETFs listed. In addition, the central bank supports Shariah-

2,16

1,68

1,15

1,40

1,12

13,58

49,81

3,03

2,29

2,13

0,21

0,35

7,35

11,28

0

10

20

30

40

50

60

Net Interest

Margin

%

2011

Net Int Rev /

Avg Assets

%

2011

Non Int Exp /

Avg Assets

%

2011

Pre-Tax Op

Inc / Avg

Assets

%

2011

Return On

Avg Assets

(ROAA)

%

2011

Return On

Avg Equity

(ROAE)

%

2011

Dividend

Pay-Out

%

2011

Malaysia Conventional

Malaysia Islamic

34,04

48,44

58,05

31,36

87,19

52,86

60,59

27,32

0

10

20

30

40

50

60

70

80

90

100

Interbank Ratio

%

2011

Net Loans / Tot Assets

%

2011

Net Loans / Dep & ST

Funding

%

2011

Liquid Assets / Dep & ST

Funding

%

2011

Malaysia Conventional

Malaysia Islamic