Risk Management in

Islamic Financial Instruments

78

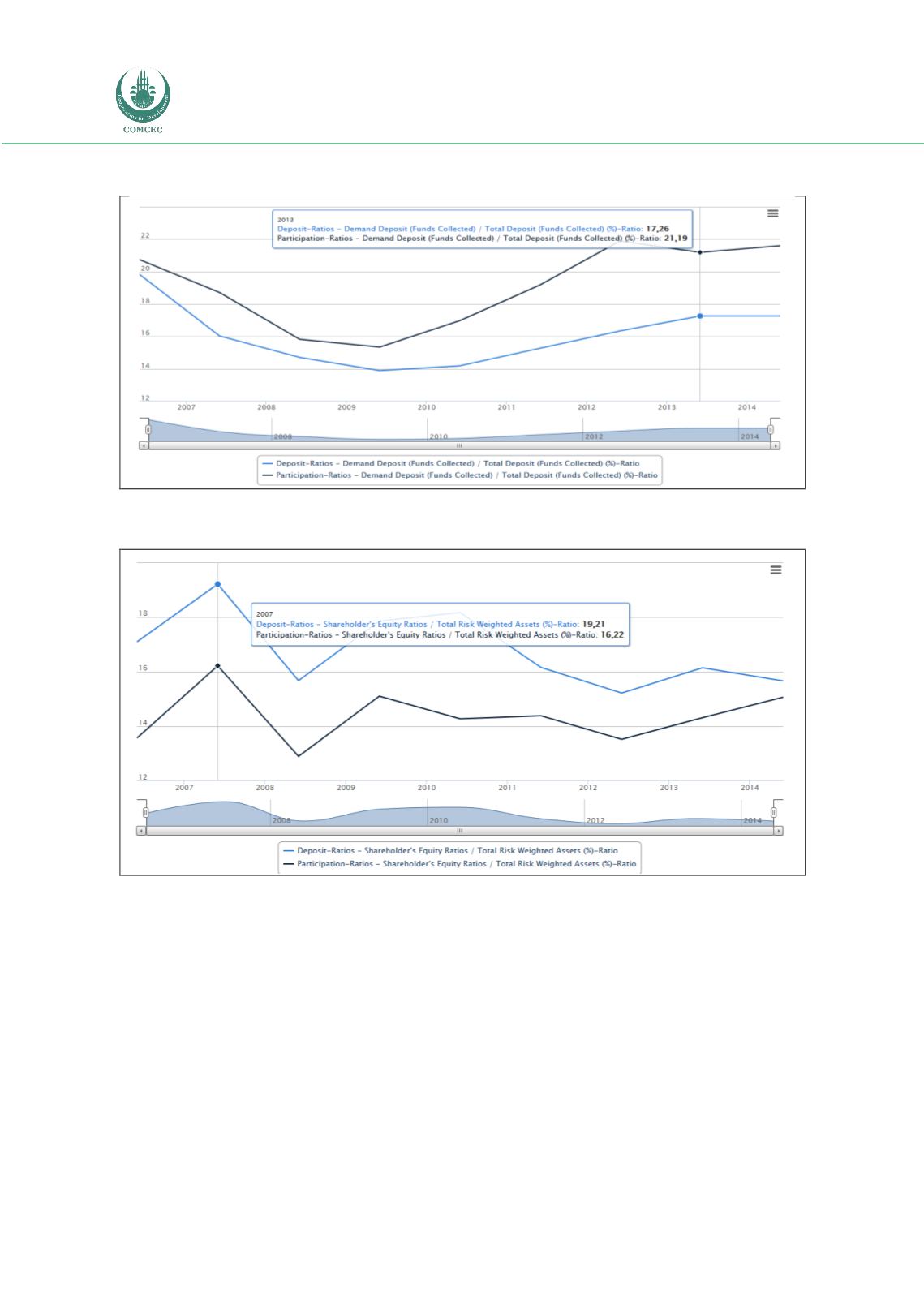

Chart 4.19: Demand Deposit (Funds Collected) / Total Deposit (Funds Collected) (%)-Ratio

Source: Turkish Banking Sector Interactive Bulletin 2014

Chart 4.20: Shareholder's Equity Ratios / Total Risk Weighted Assets (%)-Ratio

Source: Turkish Banking Sector Interactive Bulletin 2014

Operational Efficiency Ratios

Two sets of operational efficiency ratios are analyzed. The first set consists of the return ratios,

namely a) Net Income / Average Total Assets (%)-Ratio, b) Net Income / Average

Shareholder's Equity (%)-Ratio, c) Total Interest (Profit Share) Income / Interest (Profit)

Bearing Assets Average (%)-Ratio, d) Net Interest (Profit) Revenues (Expenses) / Average

Total Assets (%)-Ratio Fees, and e) Commission and Banking Services Revenues / Average

Total Assets (%)-Ratio, as depicted in Chart 4.21 through Chart 4.25, respectively.

From 2005 to 2014, ROA or Net Income / Average Total Assets (%) for the conventional banks

has been consistently higher than those of the Islamic banks. However, for both types of banks,

ROAs are decreasing over time. A similar trend is also evident for ROEs, or Net Income /