Infrastructure Financing through Islamic

Finance in the Islamic Countries

51

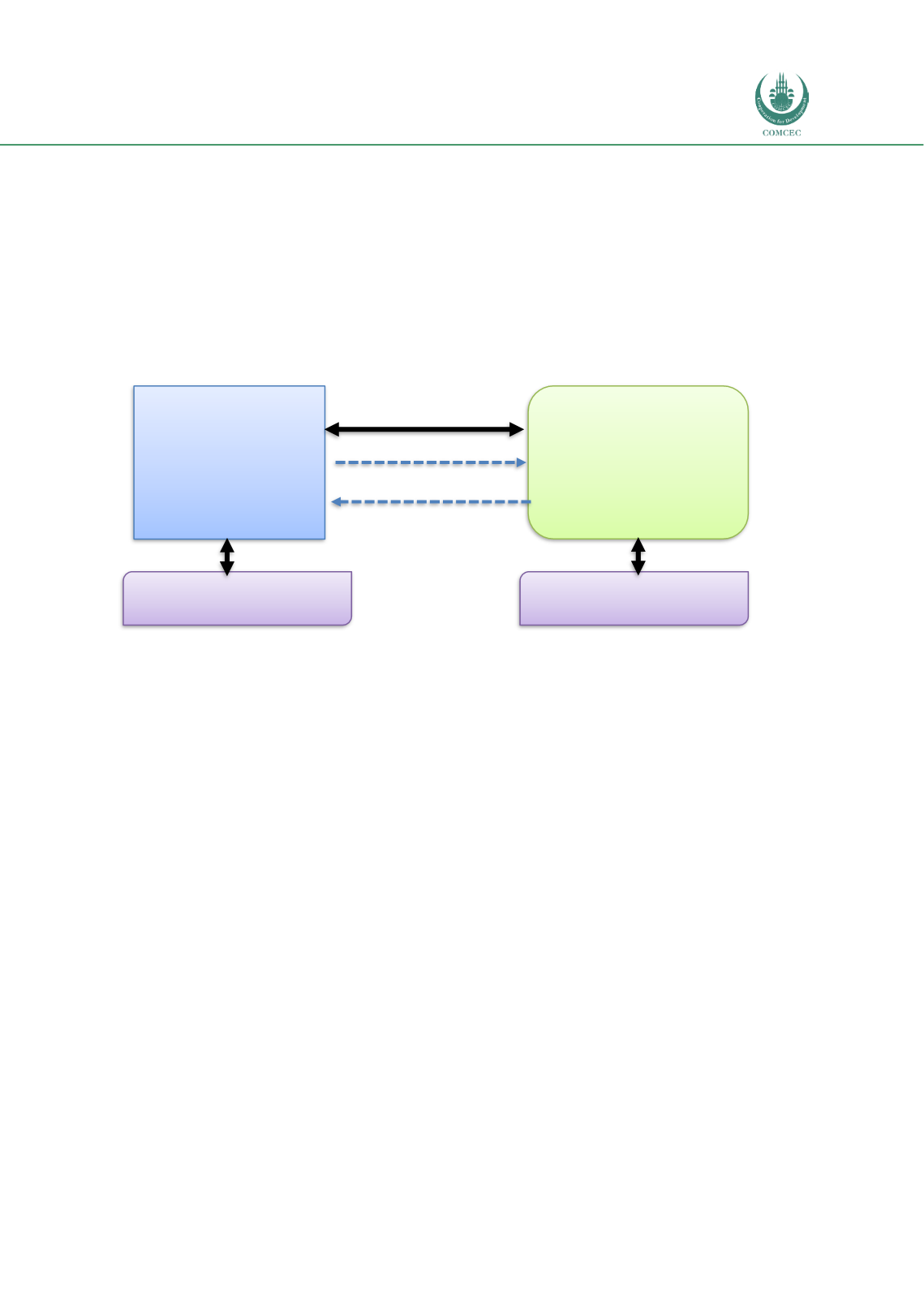

Tawarruq (Commodity Murabahah)

Tawarruq

(or commodity

murabahah

) can be used by the Funding Company to provide cash

funds to the Project Company. The Funding Company buys a commodity from a broker and

sells it to the Project Company at a mark-up payable in the future in instalments. The Project

Company then sells the commodity to another broker and gets the cash. However, in practice,

organised

tawarruq

is used whereby the Funding Company acts as an agent for the Project

Company and sells the commodity and delivers the payment to the latter. Chart 3.5 shows the

structure of an organized

tawarruq

operation.

Chart 3.6: Tawarruq Structure for Infrastructure Finance

Source: Adapted from Ahmed (2009a) and Khaleq et al (2012).

3.3.3. Shariah Compliant Project Finance

The structuring of Islamic project financing requires fulfilling both Shariah principles and

project-specific financing requirements. The latter will depend on various factors such as the

asset’s types and the kinds of contracts used. For example, for brownfield projects a simple

sale and leaseback (

ijarah

) structure can be employed and for greenfield projects a

combination of

istisna

and

ijarah

can be used (Clifford Chance 2013; GIFR 2016).

Furthermore, the financing has to adhere to the principles of project financing such as limited

or nonrecourse financing. Similar to conventional financiers, Islamic financial institutions

would also consider the financial merits of the project, including the strength of the security

package and risk mitigants to make decisions to invest. Given the complexities of

infrastructure financing, however, some issues may arise in applying Islamic modes for

financing projects. Some of these issues are discussed below.

Under the traditional

istisna

contract, the financiers would agree to develop the infrastructure

by using the contractor and then would sell it to the project company. By doing so, however,

the financier takes on the performance risk of the contractor along with the credit risk of the

project company. Due to this reason, this form of

istisna

contract is rarely utilized and instead

other methods such as sub-contracting and procurement structures are used. Under the

procurement arrangement, the financiers and project company sign an agency contract that

Funding Company

Project Company

Broker Y

Murabahah

4

3

2

1

1-Purchase of commodity by Funding Company

2-Sale of commodity at mark up

3-Sale of commodity by Project Company

4-Payment of price of commodity in installments

Broker X

Commodity purchase