Infrastructure Financing through Islamic

Finance in the Islamic Countries

49

the rent adjusts accordingly.

12

Since the Funding Company owns the project assets, it can sell

its stakes in the market if needed. While the

istisna-ijarah

structure resolves the benchmark

and liquidity risks, it introduces the risks related to the ownership of assets for the Funding

Company, which can be insured. Another issue relates to whether the Funding Company can

earn a return during the construction period, which can be long in the case of infrastructure

projects. In such cases, a forward lease (

ijara mausufa fil dhimmah

) can be used whereby the

Project Company pays advance rentals to the Funding Company during the construction

period.

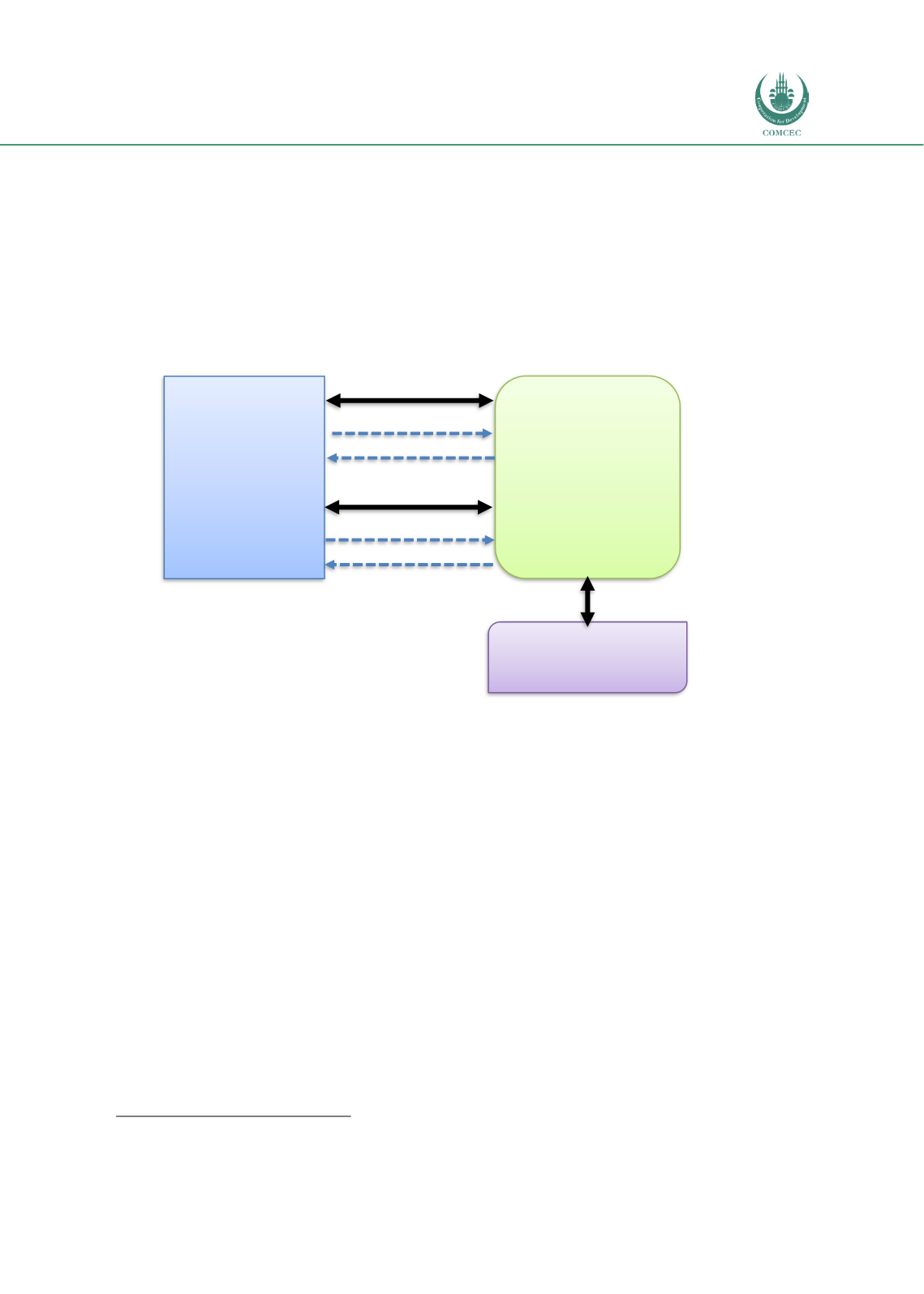

Chart 3.3: Wakala-Ijarah Structure for Infrastructure Finance

Source: Adapted from Ahmed (2009a) and Khaleq et al (2012).

Wakala-Ijarah

The

wakala-ijarah

structure is similar to the

istisna-ijarah

structure with the difference that

instead of a sale contract between the Funding Company and the Project Company, the former

appoints the latter as an agent to construct the project assets. After the assets are constructed

and delivered to the Funding Company, it is leased back to the Project Company. While rents

are paid during the contract period, the project asset is transferred to the Project Company at

the completion of the contract period. The

wakala-ijarah

structure to finance infrastructure

projects is shown in Chart 3.3.

Musharakah

Under a

musharakah

structure, the Funding Company and Project Company form a joint-

venture

Musharakah

Company which owns the infrastructure projects. The Funding Company

contributes funds as its share in the

musharakah

and the contribution of the Project Company

is in-kind inputs such as land. The Project Company acting on behalf of the musharakah

appoints an EPC Company to build the project assets. When completed, the Funding Company

leases its share of the project assets to the Project Company and derives rental income during

12

Shariah scholars allow for both fixed and flexible rental rates in ijarah contracts. In the latter, the rental payments are set for a

fixed term (say after 3 months) and can then be adjusted periodically.

Funding Company

Project Company

EPC Company

Wakala

Ijarah

4

3

2

1

1-Transfer of funds for construction of project

2-Delivery of project assets

3-Lease of project assets

4-Rental Payments