Infrastructure Financing through Islamic

Finance in the Islamic Countries

48

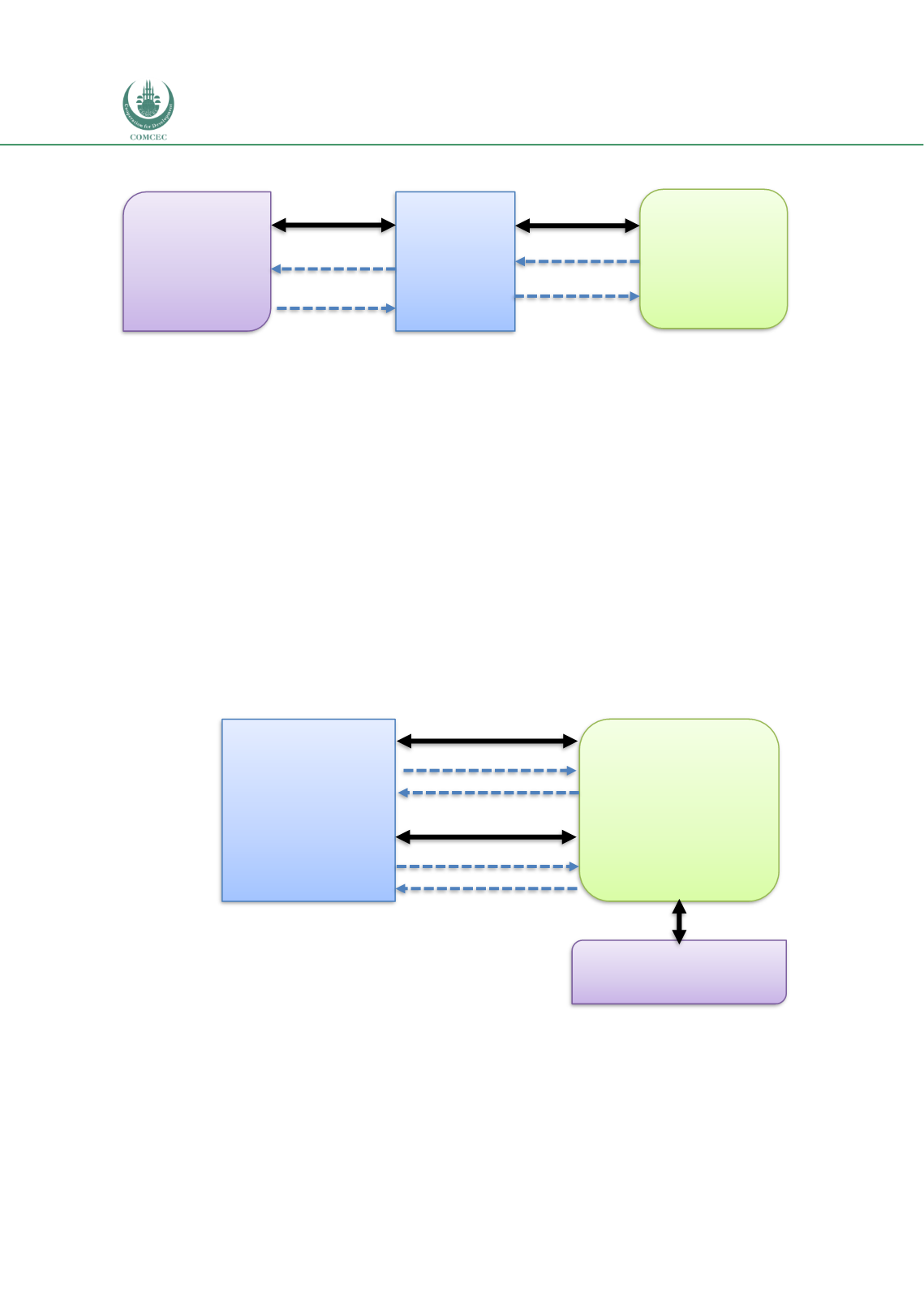

Chart 3.1: Istisna Contract for Infrastructure Finance

Source: Adapted from Ahmed (2009a) and Khaleq et al (2012).

Istisna-Ijarah

In the first phase of this structure, the Funding Company buys the project assets from the

Project Company using an

istisna

contract and pays for the costs of construction for different

phases of the project. The Project Company builds the assets using an EPC company and

delivers it to the Funding Company after its completion. In the second stage of the contractual

framework, the Funding Company leases the project asset to the Project Company which pays

rent for the duration of the contract. At maturity, the ownership of the project asset is

transferred to the Project Company. The features of the

istisna-ijarah

structure used for

infrastructure financing is shown in Chart 3.2.

Chart 3.2: Using Istisna-Ijarah for Infrastructure Finance

Source: Adapted from Ahmed (2009a) and Khaleq et al. (2012).

The advantage of the

istisna-ijarah

financing structure is that it provides flexible returns and

liquidity. The rent can be linked to the market benchmark rate so that when the rate changes

Funding

Company

Project

Company

EPC Company

Istisna

Parallel

Istisna

4

3

2

1

1-Payment for construction of project

2-Delivery of project assets

3-Delivery of project assets

4-Payment for project assets in installments

Funding Company

Project Company

EPC Company

Istisna

Ijarah

4

3

2

1

1-Payment for construction of project

2-Delivery of project assets

3-Lease of project assets

4-Rental Payments