Infrastructure Financing through Islamic

Finance in the Islamic Countries

50

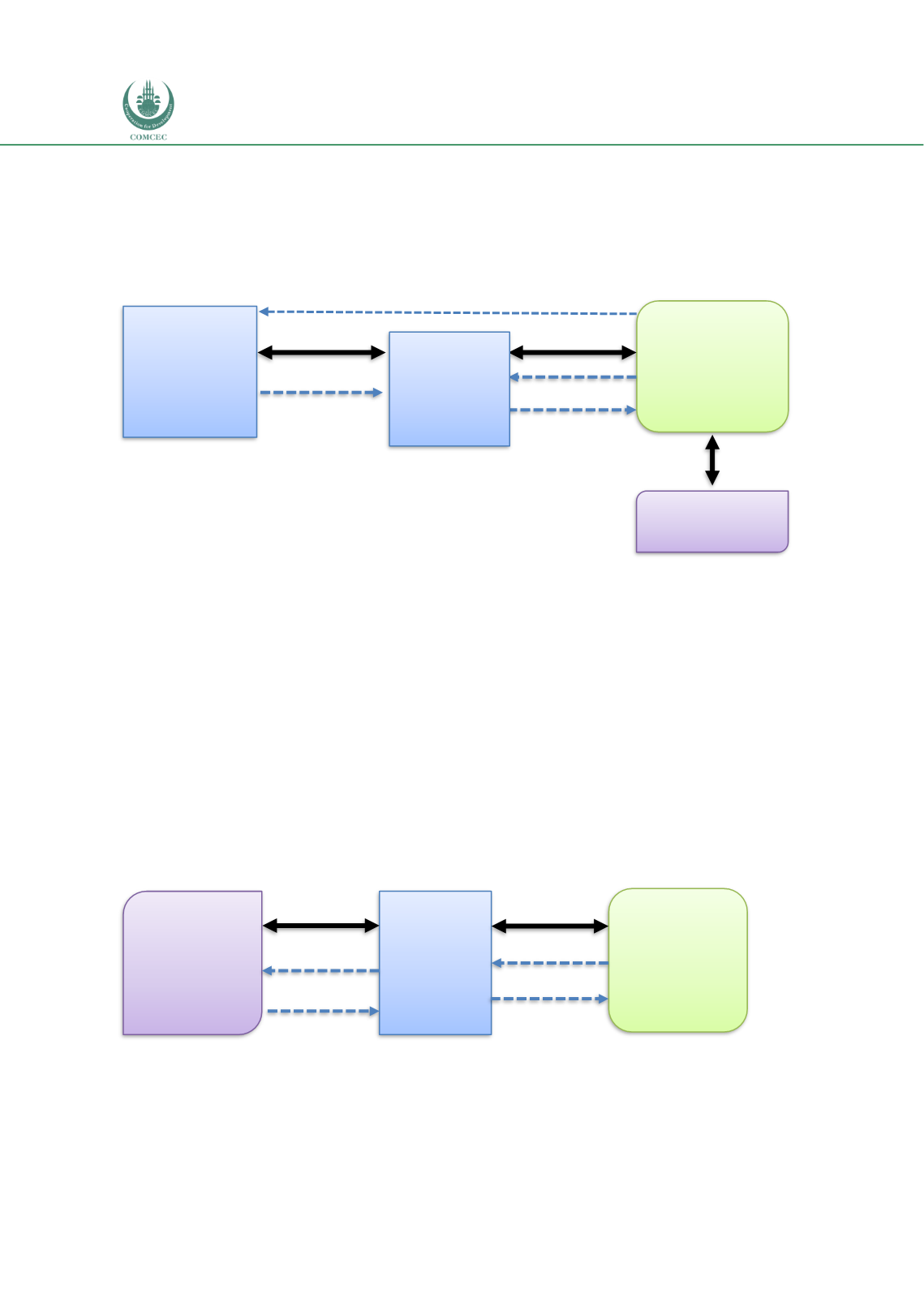

the operation phase. Under the diminishing musharakah framework, the periodic payments to

the Funding Company include imbursements of the principal that result in the gradual transfer

of project assets to the Project Company. The structure of the

musharakah

-based

infrastructure financing is shown in Chart 3.4.

Chart 3.4: Musharakah Structure for Infrastructure Finance

Source: Adapted from Ahmed (2009a) and Khaleq et al (2012).

Murabahah

Under the

murabahah

structure, the Funding Company buys assets/inputs from a vendor and

sells it to the Project Company at a mark-up. For the murabahah to be valid, the Funding

Company must own and possess the asset before entering into the sale contract with the

Project Company. The price of the asset/inputs can be paid in the future in instalments. Since a

debt is created, the Funding Company can ask for guarantees and collateral for protection

against defaults. Being a debt instrument, the amount due cannot be increased in case of

delinquency and the bills of trade resulting from a

murabahah

transaction cannot be traded at

a discount. Due to these reasons,

murabahah

will usually be used for financing specific assets

that have short-term tenor. The

murabahah

structure for infrastructure financing is shown in

Chart 3.5.

Chart 3.5: Murabahah Contract for Infrastructure Finance

Source: Adapted from Ahmed (2009a) and Khaleq et al (2012)

Funding

Company

Project

Company

EPC Company

Musharaka

h

Musharakah

4

3

2

1

1-Contribution to

Musharakah

Company

2-Construction of project assets

3-Funding company leases its share to Project Company

4-Payments of rent and principal (

musharakah

assets)

Musharakah

Company

1

Funding

Company

Project

Company

Suppliers

Sale

Purchase

4

3

2

1

1-Payment for asset/input

3-Delivery of asset/input

2-Delivery of asset/input

4-Payment for asset/input in installments