Infrastructure Financing through Islamic

Finance in the Islamic Countries

47

such as murabahah and istisna that create debt are used in infrastructure projects. Note that

these structures can be used to raise funds from both financial institutions and capital markets

by issuing sukuk.

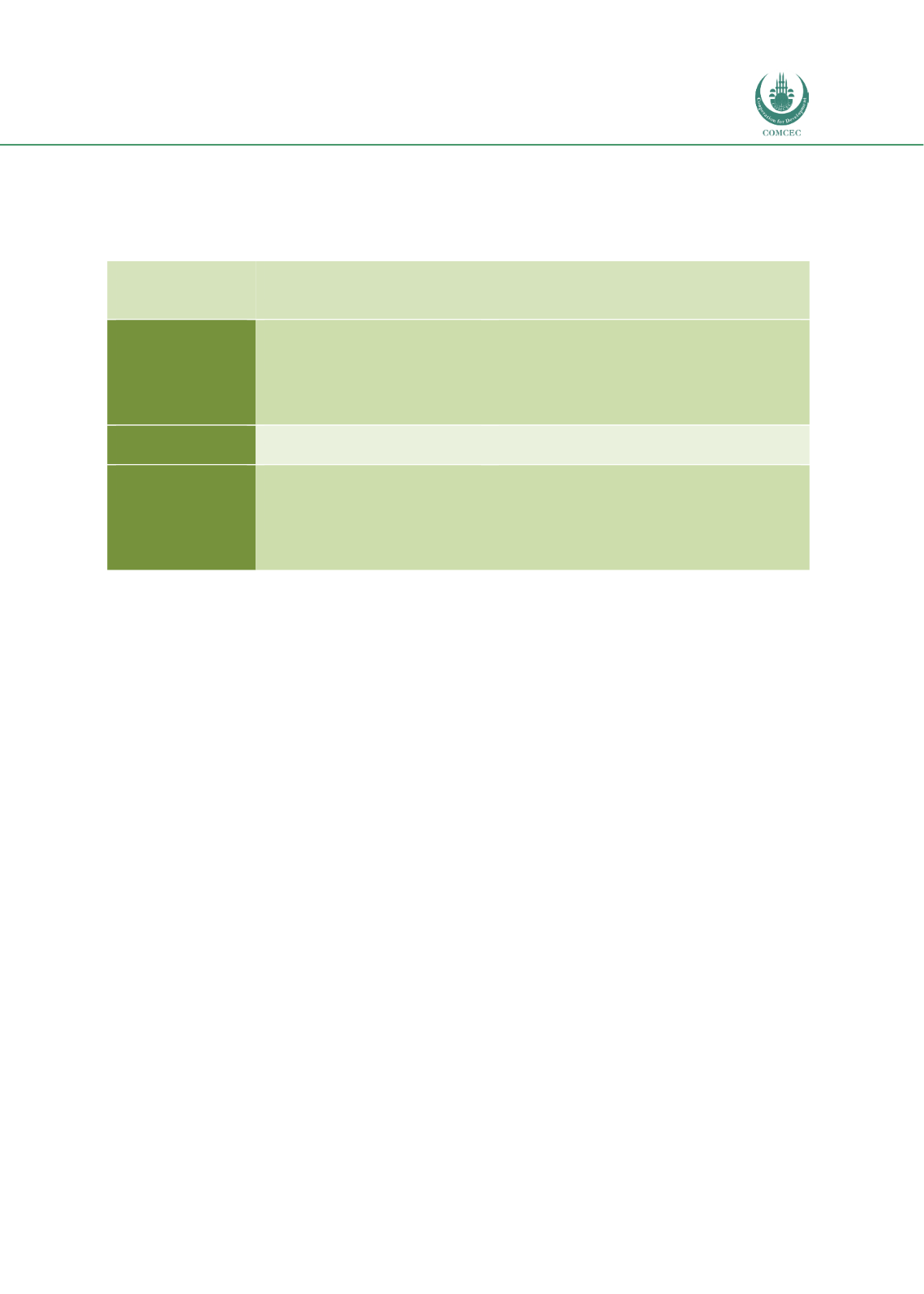

Table 3.2: Conventional and Islamic Finance Contracts for Infrastructure Financing

Contract

Categories

Conventional Finance

Islamic Finance

Equity

Equity provided by sponsors

(ownership shares in the SPV)

Infrastructure Equity funds

Equity provided by sponsors (ownership

shares in the SPV) —can take the form of

musharakah

or

mudarabah

Infrastructure equity funds—the fund

manager works as an agent (

wakil

) to

manage the funds

Debt

Loans with interest

Interest-based bonds

Sale-based instruments (

murabahah

and

istisna

)

Hybrid

Various structures such as

convertible bonds, preferred

shares, mezzanine financing,

etc.

While certain features such as convertibility

of debt to equity are allowed, other

structures such as preferred shares are not

permissible.

Structures combining various contracts

such as

istisna-ijarah

,

wakala-ijarah

, etc.

Source: Author’s own.

The third category of instruments used for infrastructure financing is hybrid contracts. The

conventional financial sector uses various types of hybrid contracts such as convertible bonds,

preferred shares, mezzanine financing, etc. The acceptability of hybrid instruments from a

Shariah point of view will depend on their specific features. For example, while Islamic

principles would not object to a convertibility feature in a debt-based sukuk, preference shares

that pay a fixed dividend are not allowed. Most of the hybrid contracts in Islamic infrastructure

financing take the form of combining two or more Shariah-compliant contracts such as istisna-

ijarah, wakala-ijarah, etc. Some of the specific Shariah-compliant structures that are used in

financing infrastructure projects are discussed below.

Istisna

Since most infrastructure contracts involve the construction of physical facilities,

istisna

is an

appropriate contract that can be used for project financing. After the project specifications and

price are known, the Funding Company takes the responsibility to construct and sell the

project assets to the Project Company under the istisna contract. The former then signs a

parallel

istisna

contract with an EPC company to construct the assets according to the project

specifications. The difference in the prices paid to the EPC company and the sale price received

from the Project company is the profit generated from financing. The Project Company can pay

the price of the asset to the Funding Company in instalments over the tenure of the contract.

The basic structure of financing using the

istisna

mode is shown in Chart 3.1.

Since

istisna

contracts create debt, the financing yields fixed rates of returns. This can expose

the Funding Company to rate-of return risks for longer-term projects since the profit cannot be

adjusted if the market benchmark rates changes. Another problem of using the

istisna

is that

the debt receivables are not tradeable which makes the financing structure illiquid. These

issues can be resolved by structuring an

istisna-ijarah

structure which is discussed next.