Infrastructure Financing through Islamic

Finance in the Islamic Countries

44

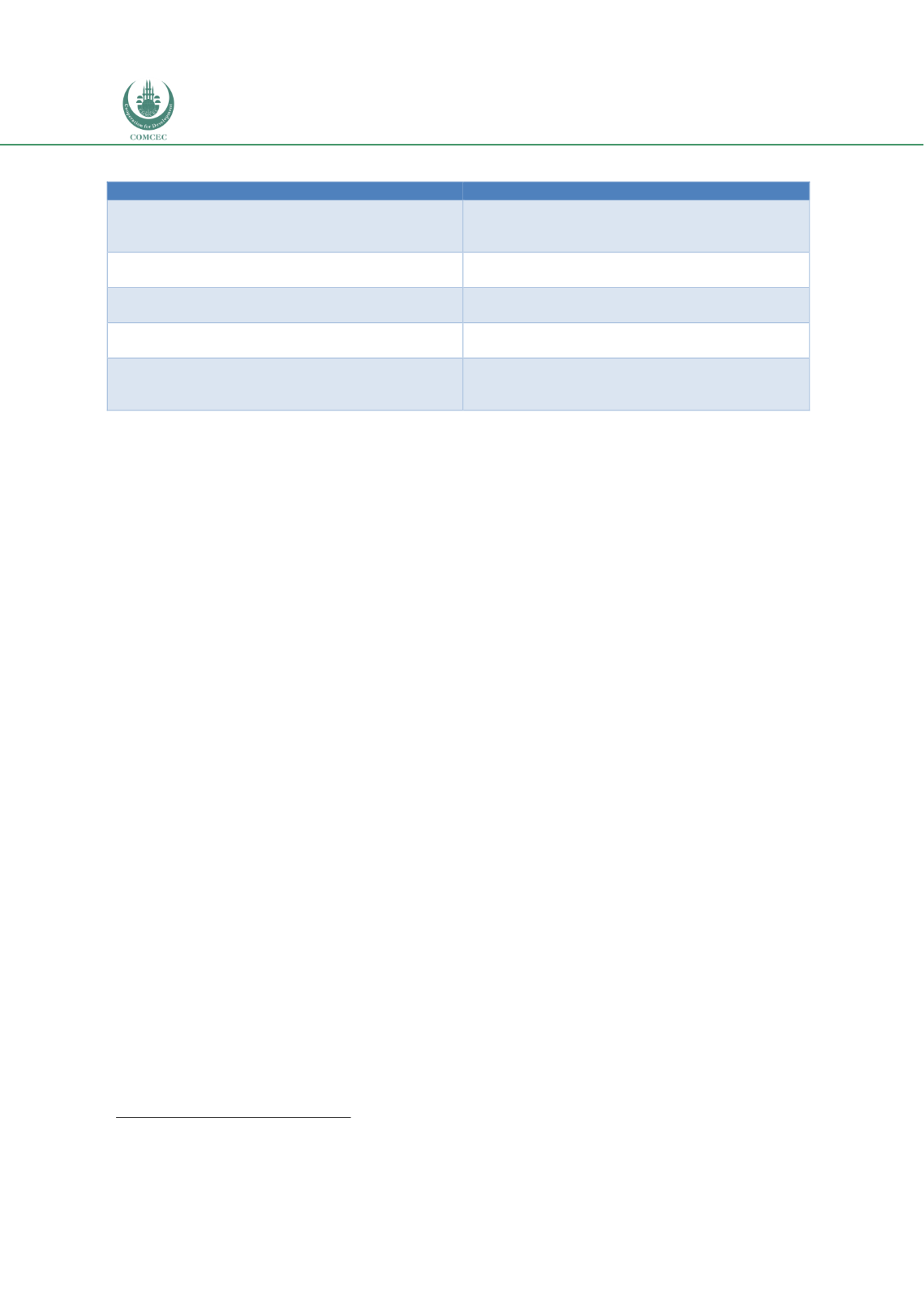

Table 3.1: Principles of Islamic Finance and Features of Infrastructure Projects

Principles of Islamic Finance

Infrastructure PPP Project

Returns should be linked to profits/earnings and be

derived from commercial risk taken by the financier.

Infrastructure PPP projects allow risk to be shared

among the parties involved in the project, including

financiers.

Islamic financiers are partners in a project.

PPP projects allow Islamic financiers to become a

party to the project and not just a mere lender.

Transaction should be free from speculation or

gambling (maysir)

Infrastructure PPP projects are by nature free from

speculation or gambling.

Existence of excessive uncertainty in a contract is

prohibited

Project contracts are generally well defined with no

uncertainty (such as lump-sum, EPC contracts)

Investments related to prohibited goods and

activities such as alcohol, gambling, and weapons are

prohibited.

Infrastructure projects exclude these projects.

Source: World Bank et. al. (2017)

3.2.

Islamic Financial Contracts

The basic framework of Islamic commercial law is permissibility (

ibahah

), which suggests that

all transactions are permitted except what is prohibited by Shariah. Two broad categories of

prohibitions recognized by Islamic law are

riba

(literally meaning ‘excess’) and

gharar

(legal

ambiguity or excessive risk). While

riba

is usually translated into interest, it has wider

connotations such as the prohibition on the sale of debt.

Gharar

can include many aspects

related to deception, excessive uncertainty and contractual ambiguity in transactions.

9

One of

the implications of

gharar

during contemporary times is the prohibition of derivative products

such as forwards, swaps and options.

Since interest is prohibited, Islamic finance uses various other permissible contracts to

structure financial products. The contracts used in practice can be broadly classified as sale,

leasing, partnership and agency. The basic features of the key contracts used in Islamic finance

are presented below.

10

Murabahah

is a cost-plus sale where the seller adds a profit component (mark-up) to the cost

of the item being sold.

Bai-muajjal

is a contract where the purchase is made on credit and the

payment for a good/asset is delayed. A variant would be a sale where the payments are made

in instalments. These contracts create debt and can have both short and long-term tenors.

Salam

sale is a pre-paid or product-deferred sale of a generic good. In a

salam

contract, the

buyer of a product pays in advance for a good that is delivered at a later agreed upon date. The

contract is applied mainly in financing agricultural goods.

Istisna

contract is similar to the

salam

contract with the difference being that, in the former,

the good/asset is produced according to the specifications given by the buyer. This contract

mainly applies to manufactured goods and real estate. Furthermore, in

istisna

, the payments

can be made in instalments over time with the progression of the production.

Ijarah

is a lease contract in which the lessee pays rent for use of a usufruct. In

ijarah

the

ownership and right to use an asset (usufruct) are separate. It falls under a sale-based contract

as it involves the sale of usufructs. A lease contract that results in the transfer of an asset to the

9

For a discussion on

gharar

see ElGamal (2001) and Al-Dhareer (1997).

10

For a discussion on Islamic modes of financing see Ayub (2007) and Usmani (1999).