Infrastructure Financing through Islamic

Finance in the Islamic Countries

157

728 million. A total of seven Shariah-compliant ETFs and 65 sukuk worth USD 48 billion are

listed in LSE. The country also issued the first sovereign sukuk worth GBP 200 million in 2014

that was oversubscribed with orders of GBP 2.3 billion.

A key aspect of the UK’s role in Islamic finance relates to the provision of specialist legal

expertise on Islamic finance by 25 major law firms. The role is apparent since English law is a

common choice for many international Islamic financial transactions including sukuk. The

legal firms also provide other specialist services related to tax, listings, structuring

transactions, regulations and compliance (TheCityUK 2015).

4.6.2.

Current Status of Infrastructure and Projected Investments

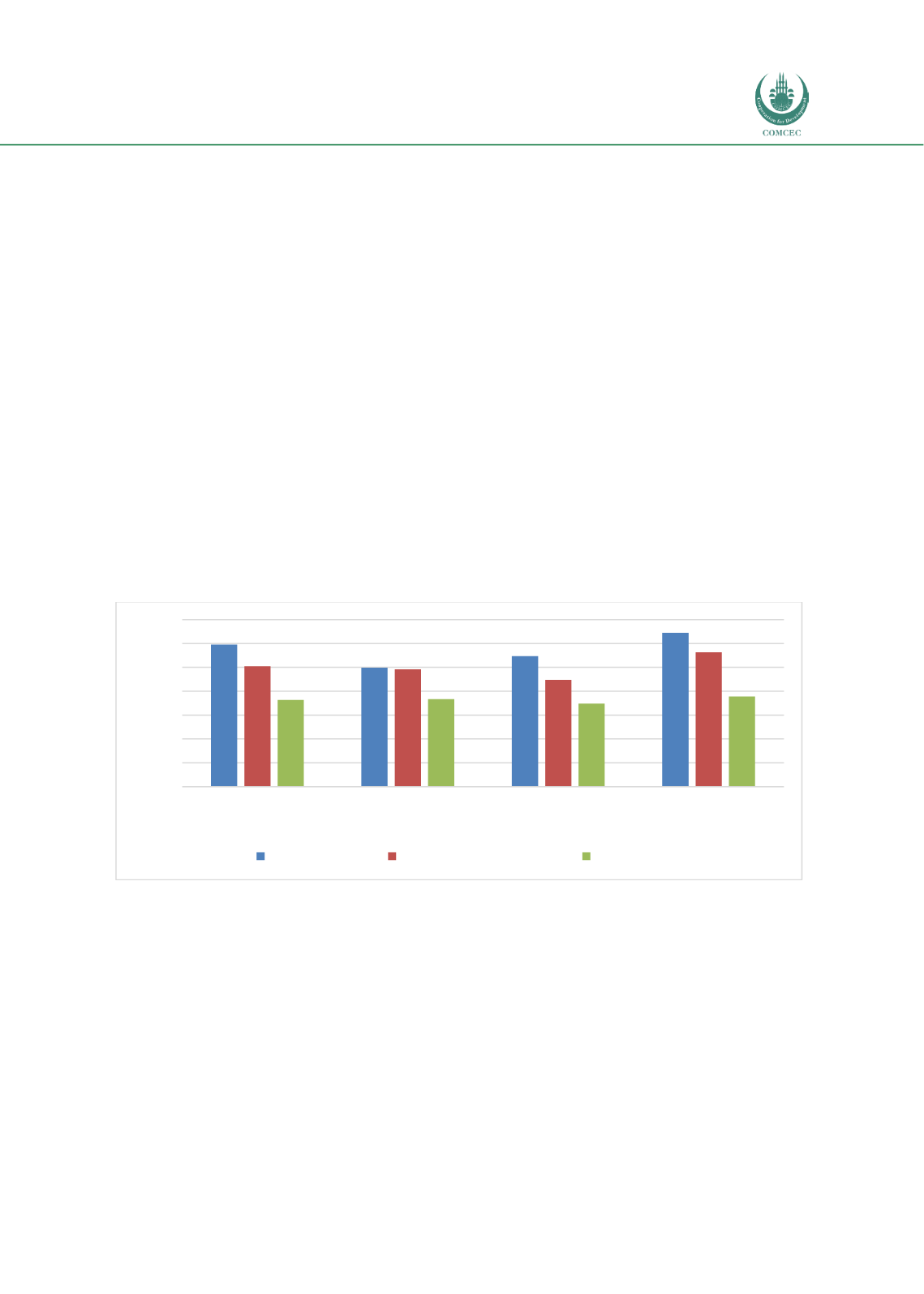

The status of the infrastructure and its quality in the UK compared to Europe and the North

American region and OIC countries are shown in Chart 4.6.1. While the index of overall

infrastructure in the UK (6.0) is significantly better than the average of Europe and North

America (5.1) and OIC countries (3.6), the index of infrastructure quality in the country (5.0) is

similar to that of the former region. Similar trends can be observed in transport infrastructure

(5.5) and electricity and telephony infrastructure (6.5), which are much better than the indices

for the Europe and North American region (4.5 and 5.6 respectively) and OIC countries (3.5

and 3.8 respectively).

Chart 4.6. 1: Relative Status of Infrastructure in United Kingdom (2017) (0-7 Best)

Source: WEF (2018), The Global Competitiveness Index Historical Dataset

The pipeline in terms of number of infrastructure projects and value in the UK for 2016-2021

is shown Chart 4.6.2. A total of 319 infrastructure projects valued at GBP 425.6 billion are

planned during the period with the bulk of the projects (166) worth GBP 134.5 billion going to

the transport sector. In terms of value, the energy sector will have the highest investments

amounting to GBP 255.7 billion for 109 projects. The plan is to get over 50% private sector

financing in the overall infrastructure investments during the period (IFA 2016: 19).

6.0

5.0

5.5

6.5

5.1

4.9

4.5

5.6

3.6

3.7

3.5

3.8

0

1

2

3

4

5

6

7

Overall Infrastucture

Quality of overall

infrastructure

Transport infrastructure Electricity and telephony

infrastructure

Index (0-7 best)

United Kingdom Europe and North America OIC Average