Infrastructure Financing through Islamic

Finance in the Islamic Countries

162

companies. Similarly, in 2007 the Financial Services Authority (FSA) issued regulations on

home purchase plans and HM Revenue and Customs provided guidance on tax treatments on

value-added tax and capital gains tax. HM Land Registry issued guidance on public registration

requirements when Islamic financial instruments of

ijarah wa iqtina

, diminishing

musharakah

and

murabaha

are used to purchase land.

73

4.6.5.

Role of Islamic Finance in Infrastructure Finance

Though Islamic finance forms a small part of the overall financial sector, the industry has

contributed to the development of a few infrastructure projects in the UK. The projects that

have had Islamic finance components include Battersea Power Station regeneration, the

redevelopment of Chelsea Barracks, and the Olympic Village. While AlRayyan Bank has not

played any role in these projects, partly due to its small size, funds have come from Islamic

investment banks. Gatehouse Bank, an Islamic investment bank, also invested GBP 700 million

to develop 6,500 homes in the North West and Midlands (UKTI 2014 and BEB 2015). Table

4.6.2 shows the size of the Islamic banking sector and the investments made in the

infrastructure sector. With assets worth GBP 4.07 billion, only 1.77% of these are invested in

the infrastructure sector. However, the table shows that a significant part (11.1%) of Islamic

bank assets in the UK are in sukuk holdings.

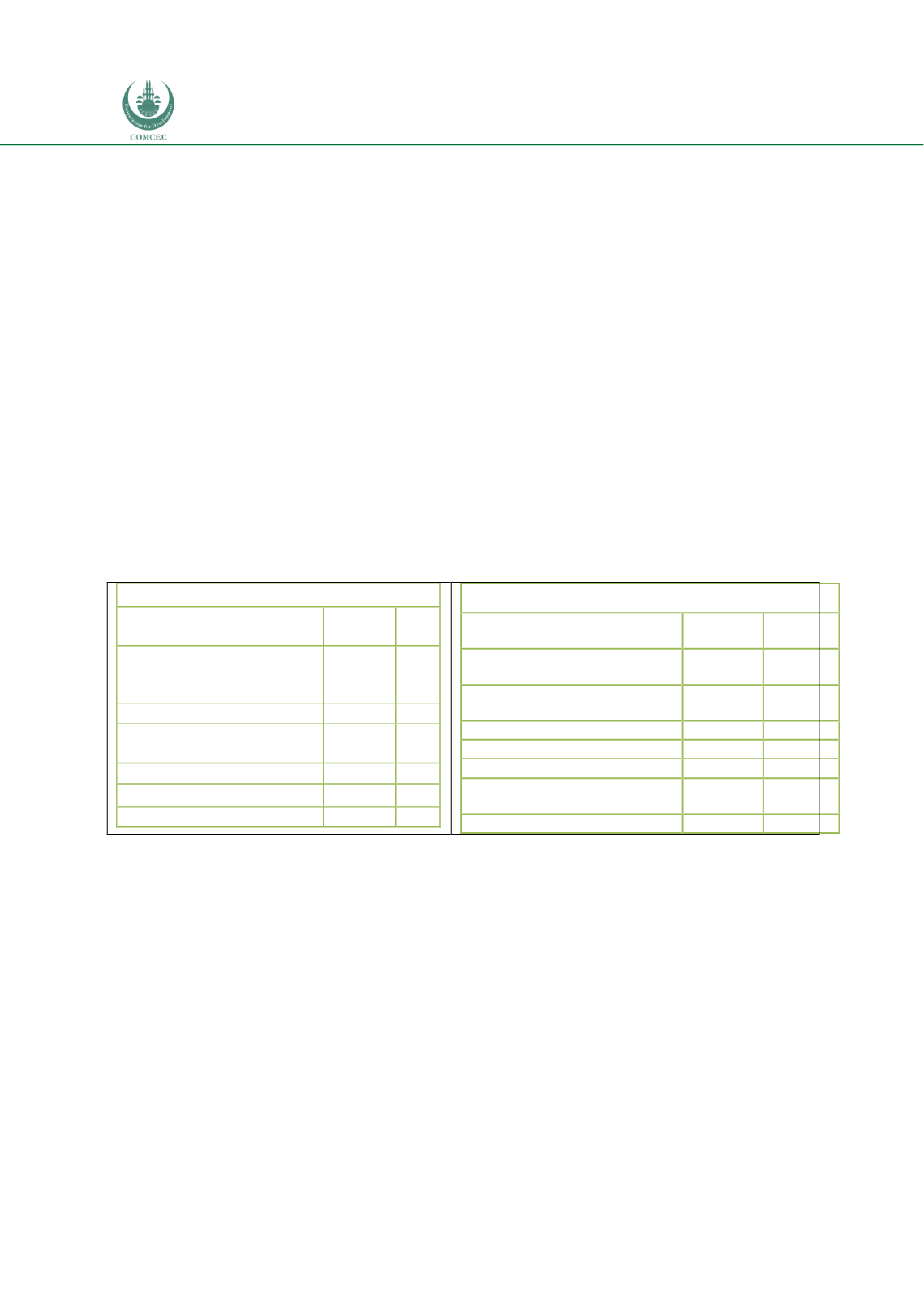

Table 4.6. 2: Islamic Bank Asset Structure and Financing of the Infrastructure Sector, UK (Q1

2018) (GBP million)

Total Islamic Banking Assets

Asset Composition

GBP

(Million)

% of

total

Total

Shariah-compliant

financing (excluding interbank

financing)

2,752.3

67.6%

Sukūk holdings

453.0

11.1%

Other

Sharī`ah-compliant

securities

82.2

2.0%

Interbank financing

642.6

15.8%

All other assets

140.2

3.4%

Total assets

4,070.2

100%

Infrastructure Financing by Islamic Banks

Financing

going

to

infrastructure

GBP

(Million)

% of

total

Electricity, gas, steam and air-

conditioning supply

5.1

0.16%

Water supply; sewerage and

waste management

14.6

0.47%

Transportation and storage

9.3

0.30%

Information and communication 21.0

0.68%

Education

0.0

0.00%

Human health and social work

activities

5.0

0.16%

Total Infrastructure

55.0

1.77%

Source: IFSB Prudential and Structural Islamic Financial Indicators (PSIFIs)

As indicated, the government issued a sovereign sukuk valued at GBP 200 million in 2014.

While there is no indication that the funds raised by the government were used for specific

infrastructure projects, the huge demand of the sukuk with GBP 2 billion in orders indicate the

potential for using the instrument to raise funds for infrastructure projects in the country.

Case Study: Green Investment Group

The UK government initiated a unique financial institution, Green Investment Bank plc in

2012, to invest in green energy infrastructure. The bank was acquired by Macquarie Group

Limited in 2017 and changed their name to Green Investment Group (GIG). GIG invests equity

and debt in different types of green energy infrastructure technologies including wind, solar,

hydro and waste and bioenergy. Other than investments, GIG also provides other services that

include green impact reporting, green bank advisory and merger and acquisitions in a low

73

See:

https://www.gov.uk/government/publications/islamic-financing/practice-guide-69-islamic-financing