Infrastructure Financing through Islamic

Finance in the Islamic Countries

161

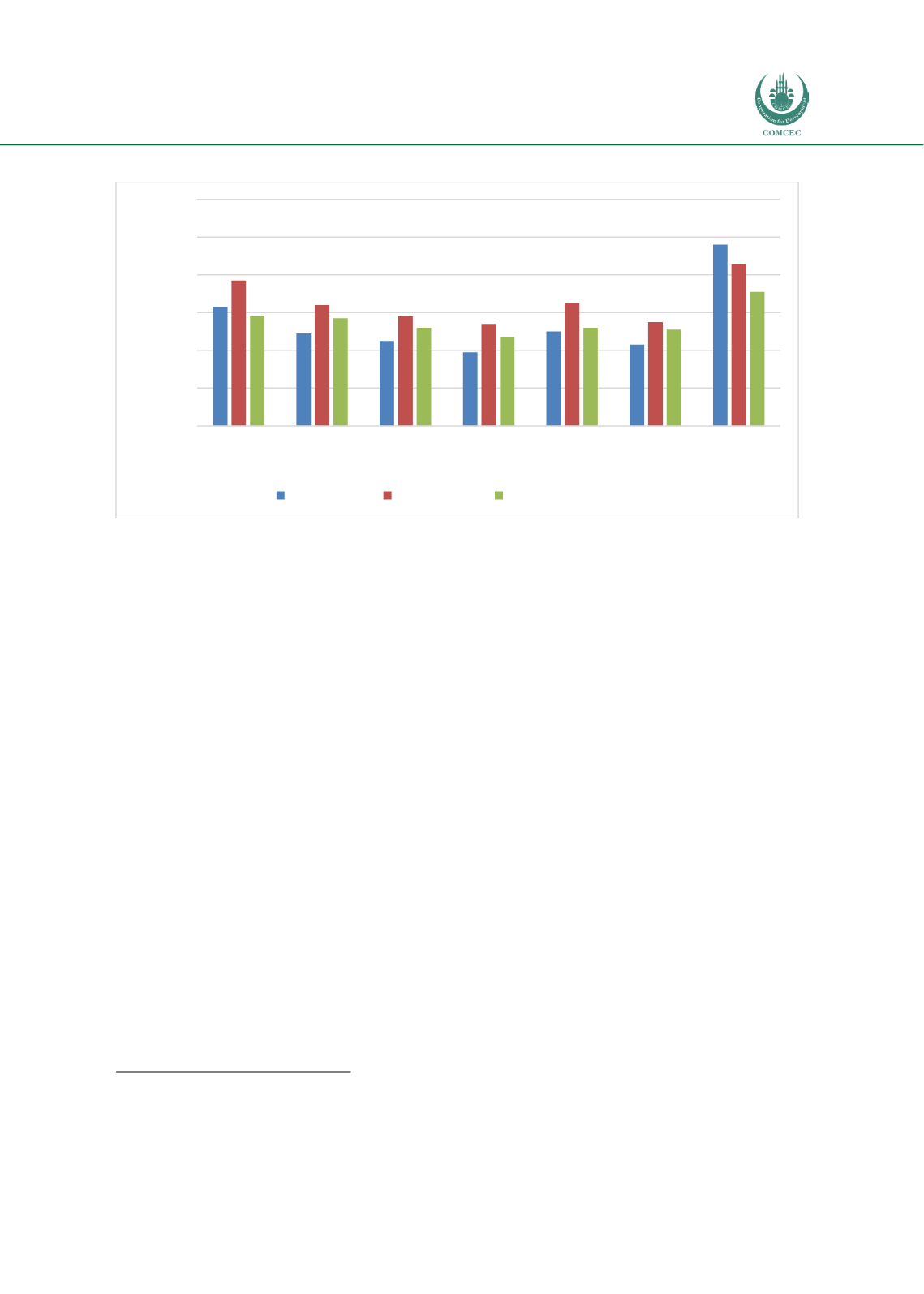

Chart 4.6. 3: Procurement Regime of PPPs: United Kingdom (0-100 Highest)

Source: World Bank (2018f)

4.6.4.1. Laws and Regulations Supporting Islamic Finance

Islamic finance has operated in the UK since 1982 and the government has taken initiatives to

provide a sound legal and regulatory framework for the development of the industry. This has

been done not only to promote London as an international Islamic financial centre but also to

provide financial services to the Muslim citizens of the country at the retail level. Other than

instituting supporting laws and regulations related to Islamic finance, various consultative

bodies were formed to promote the industry in the country. These initiatives include the

Islamic Finance Working Group established by Bank of England in 2001, Tax Technical Group

established by HM Treasury and HM Revenues and Customs in 2003, HM Treasury Islamic

Finance Experts Group formed in 2007, the UK Islamic Finance Secretariat (UKIFS) formed in

2011, and the ministerial-led Islamic Finance Task Force (IFTF) established in 2013 (UKTI

2013).

Since the UK is a member of the EU, most of the legal and regulatory framework governing the

financial sector is governed at the EU level.

71

The regulatory approach towards Islamic finance

has been facilitative but within existing regulations. For example, while no specific law for

sukuk exists, the instrument can be issued under the “alternative finance investment bonds”

framework.

72

One area in which the UK government has control is on the taxation regime.

Accordingly, specific steps have been taken to accommodate Islamic finance through

Alternative Finance clauses to various Taxation Acts (COMCEC 2016). In the Finance Act 2003,

the Stamp Duty Land Tax (SDLT) was amended to accommodate Islamic mortgage financing to

avoid double taxation. The legislation of 2005 recognized murabahah, a finance contract, and

the SDLT was extended to cover profit-sharing contracts. In 2006, diminishing musharakah

was classified as an asset financing contract and an SDLT treatment was also applied to

71

Currently, the UK is in the process of negotiating an exit from the EU, and if Brexit materializes this may not apply.

However, currently the UK is still following the financial laws and regulations of EU.

72

See, for example, Schedule 2 to the Taxation (International and Other Provisions) Act 2010,

http://www.legislation.gov.uk/ukpga/2010/8/schedule/2, or the Alternative Finance Investment Bonds (Consequential

Amendments) Instrument 2010,

https://www.handbook.fca.org.uk/instrument/2010/2010_6.pdf.63

49

45

39

50

43

96

77

64

58

54

65

55

86

58

57

52

47

52

51

71

0

20

40

60

80

100

120

High income Upper-middle

income

Lower-middle

income

Low income Europe and

Central Asia

OIC Members

(40)

United

Kingdom

Index (0-100 highest)

Preparation Procurement

Contract management