Infrastructure Financing through Islamic

Finance in the Islamic Countries

163

carbon economy. During the year beginning in August 2017 when GIG was formed, the

institution arranged for investments of over GBP 1.6 billion for different projects, which led to

the generation of 84,941 GWh of renewal energy, avoiding 17,190 kt of CO

2

emissions and

15,652 kl of waste in landfills.

74

GIG has made investments in green energy infrastructure

beyond the UK and is planning to expand its activities to other regions such as Europe, North

America and Asia.

4.6.6.

Conclusion and Recommendations

Being a developed economy, the UK has a relatively well-built infrastructure. However, moving

forward, the existing infrastructure has to be upgraded and new infrastructure has to be

added. The estimates show that the transportation sector may face significant funding gaps in

the next couple of decades. Although the Islamic financial industry in the country is relatively

small, there have been a few cases in which the Islamic financial institutions have funded

infrastructure projects. The over subscription of the sovereign sukuk issued in 2014 indicates

the potential of using the instrument to raise funds for infrastructure investments.

A key feature of the infrastructure financing provided by the Islamic financial sector is that the

funds are sourced from overseas investors. Thus, Islamic finance provides an alternative

source for raising funds for infrastructure projects in the UK, both in terms of direct financing

by Islamic financial institutions and by issuing sukuk.

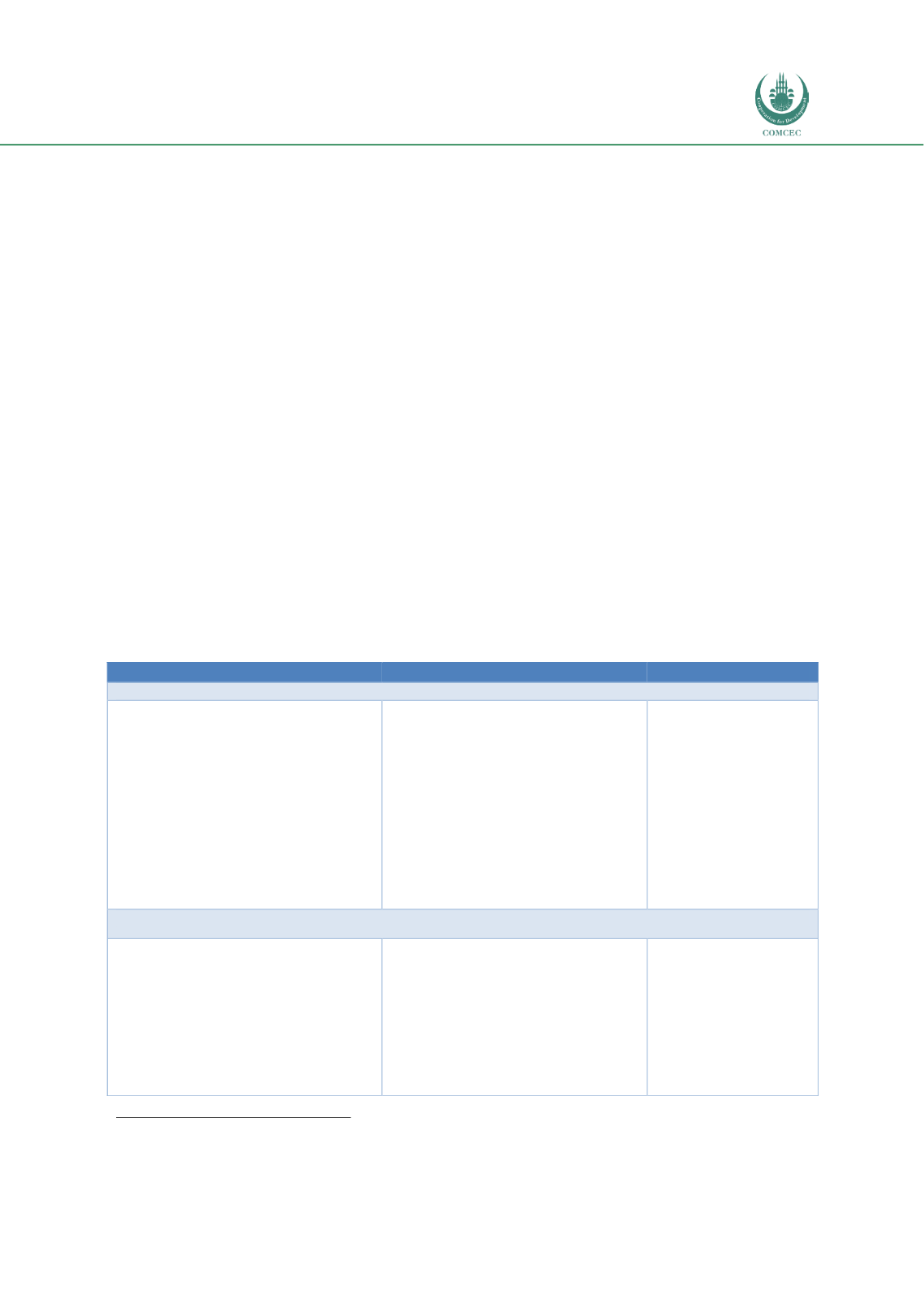

The issues and recommendations to further enhance the role of Islamic finance in

infrastructure development in UK are presented in Table 4.6.3.

Table 4.6. 3 Issues and Policy Recommendations: United Kingdom

Issues

Recommendations

Implemented by

Legal and Regulatory Regimes

The financial laws and regulations in

the UK are governed by the EU legal

and

regulatory

framework.

The

government has changed the tax laws

and regulations to level the playing

field.

Guarantee is provided by the UK

Guarantee Scheme for infrastructure

projects.

Take steps on tax related issues

arising in applying Islamic finance in

infrastructure projects to level the

playing field.

Extend the guarantee to cover

Islamic financing structures to create

incentives for Islamic banks to

finance projects.

Relevant government

ministry

UK Guarantee Scheme

Islamic Financial Institutions

It becomes difficult for Islamic banks

to participate in infrastructure projects

given their smaller size.

The Islamic nonbank financial

institutions in the UK are mainly

investment banks, the financial

institutions such as takaful and

pension funds are non-existent.

Increase the participation of Islamic

banks in project financing through

syndicated structures with other

conventional banks.

Increase the contribution of Islamic

investment banks in investments in

infrastructure projects.

Islamic banks and

conventional banks

Islamic nonbank

financial institutions

74

http://greeninvestmentgroup.com/media/209163/green-investment-group-progress-report.pdf