Infrastructure Financing through Islamic

Finance in the Islamic Countries

93

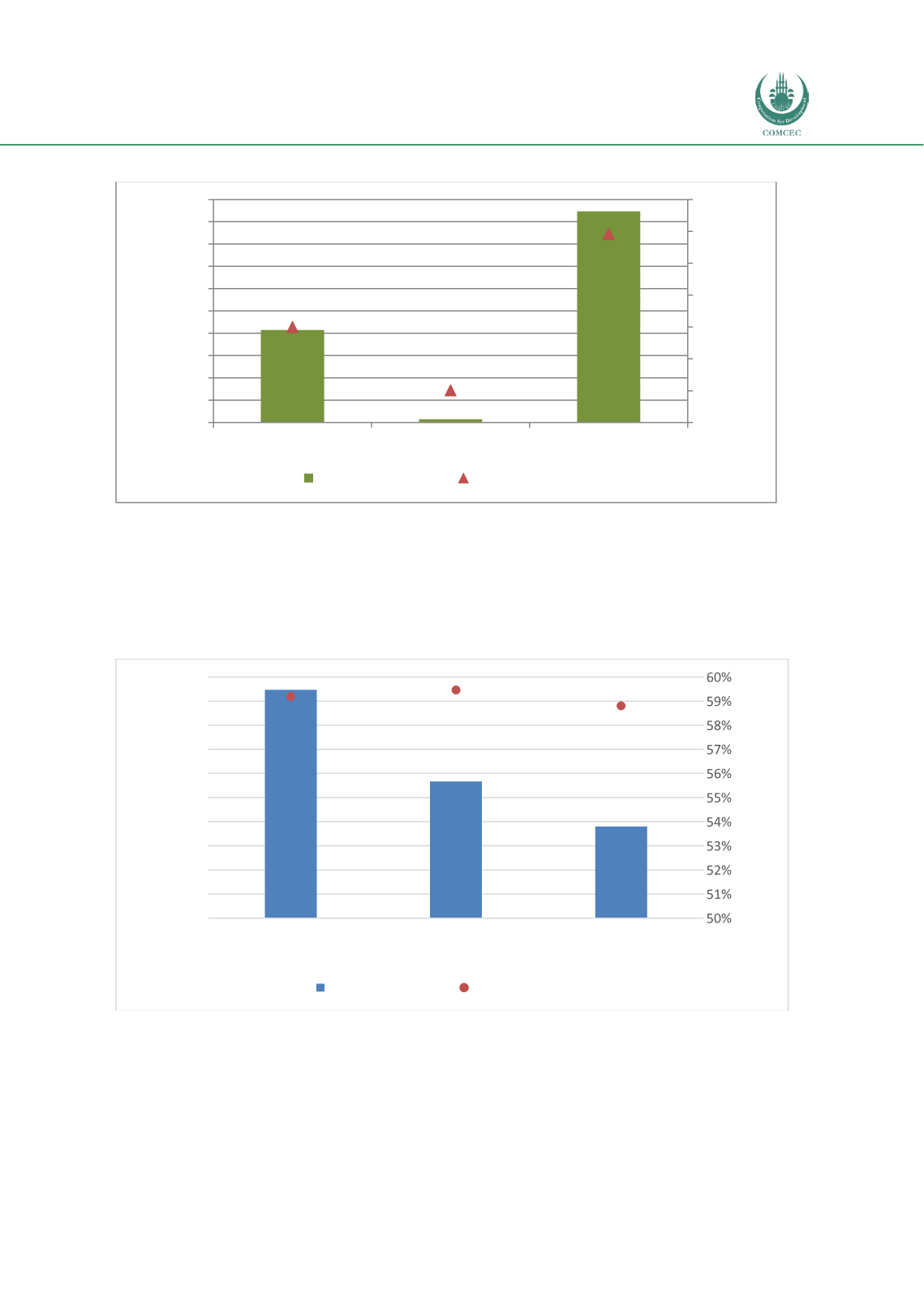

Chart 4.2. 3: Islamic Financial Sector Composition: Malaysia (2017) (RM billion)

Source: BNM (2017) and SCM (2017)

The size and share of different Islamic capital market segments in Malaysia are shown in Chart

4.2.4. While the market capitalization of Islamic stocks is RM 1.133 trillion constituting 59.5%

of the domestic stock market, the value of the total sukuk outstanding is RM 759.64 billion,

representing close to 59% of the overall bonds/sukuk markets.

Chart 4.2. 4: Islamic Capital Market Segments Malaysia (2017)

(RM billion)

Source: SCM (2017)

The assets and wealth management segments of the Islamic financial industry and their

relative sizes are presented in Chart 4.2.5. The value of Islamic assets under management

(AUM) in Malaysia is RM 172.16 billion, constituting 22.2% of the overall AUM. While the

Islamic unit trust funds form the bulk (RM 77.78 billion) of the Islamic AUM, it constitutes a

relatively small proportion (18.2%) of the overall unit trust funds managed. The size of Islamic

829.82

29.29

1,893.47

30.0%

10.1%

59.2%

0%

10%

20%

30%

40%

50%

60%

70%

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

Islamic Banking Assets Takaful Fund Assets Islamic Capital Markets

% of overall industry

RM billion

Value (RM Billion)

% of overall sector

1,893.47

1,133.83

759.64

59.2%

59.5%

58.8%

0

200

400

600

800

1,000

1,200

1,400

1,600

1,800

2,000

Size of Islamic Capital

Markets

Market Capitalization of

Islamic stocks

Total sukuk Outstanding

(Govt. & Corp)

% of total

RM Billion

Value (RM Billion)

% of overall industry