Infrastructure Financing through Islamic

Finance in the Islamic Countries

94

private retirement scheme funds (RM 720 million) and Islamic ETFs (470 million) are

relatively small, but these represent 32.3% and 24.2% of the overall funds respectively,

indicating the overall small size of these fund segments.

Chart 4.2. 5: Islamic Asset/Wealth Management Segments (2017) (RM billion)

Source: SCM (2017)

4.2.2.

Current Status and Projected Investments in Infrastructure Sectors

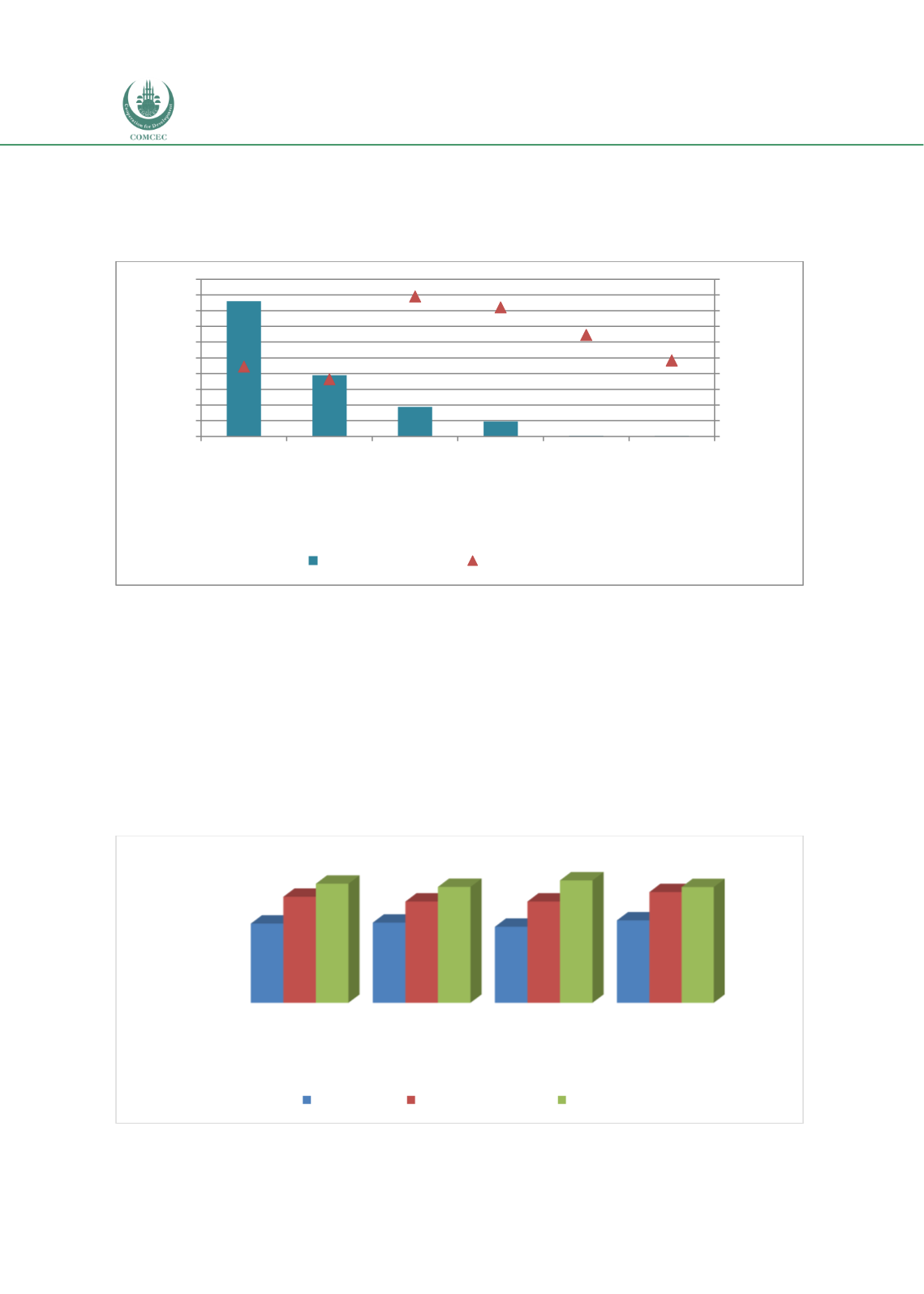

Malaysia has relatively good infrastructure compared to its peers in both the OIC and the East

Asia and Pacific (EAP) region. Chart 4.2.6 shows that not only is the overall index of

infrastructure of Malaysia better (5.5) than the averages of the OIC (3.6) and EAP region (4.9).

The quality of the infrastructure is also ranked higher than the two country groupings. The

average index of the two infrastructure segments related to transportation and electricity and

telephony are also higher than the averages of the two country groupings.

Chart 4.2. 6: Relative Status of Infrastructure in Malaysia (2017) (1-7 Best)

Source: WEF (2018), The Global Competitiveness Index Historical Dataset

172.16

77.78

37.72

19.07

0.72

0.47

22.2%

18.2%

44.5%

41.0%

32.3%

24.2%

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

0

20

40

60

80

100

120

140

160

180

200

Islamic Assets

Under

Management

Islamic Unit

Trust Funds

Islamic

Wholesale

Funds

Islamic REITs Islamic

Private

Retirement

Scheme

Funds

Islamic ETFs

Percentage of total

RM Billion

Value (RM Billion)

% of overall industry

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Overall

Infrastucture

Quality of overall

infrastructure

Transport

infrastructure

Electricity and

telephony

infrastructure

3.6

3.7

3.5

3.8

4.9

4.6

4.6

5.1

5.5

5.3

5.6

5.3

Index Value (1-7 best)

OIC Average East Asia and Pacific Malaysia