Islamic Fund Management

62

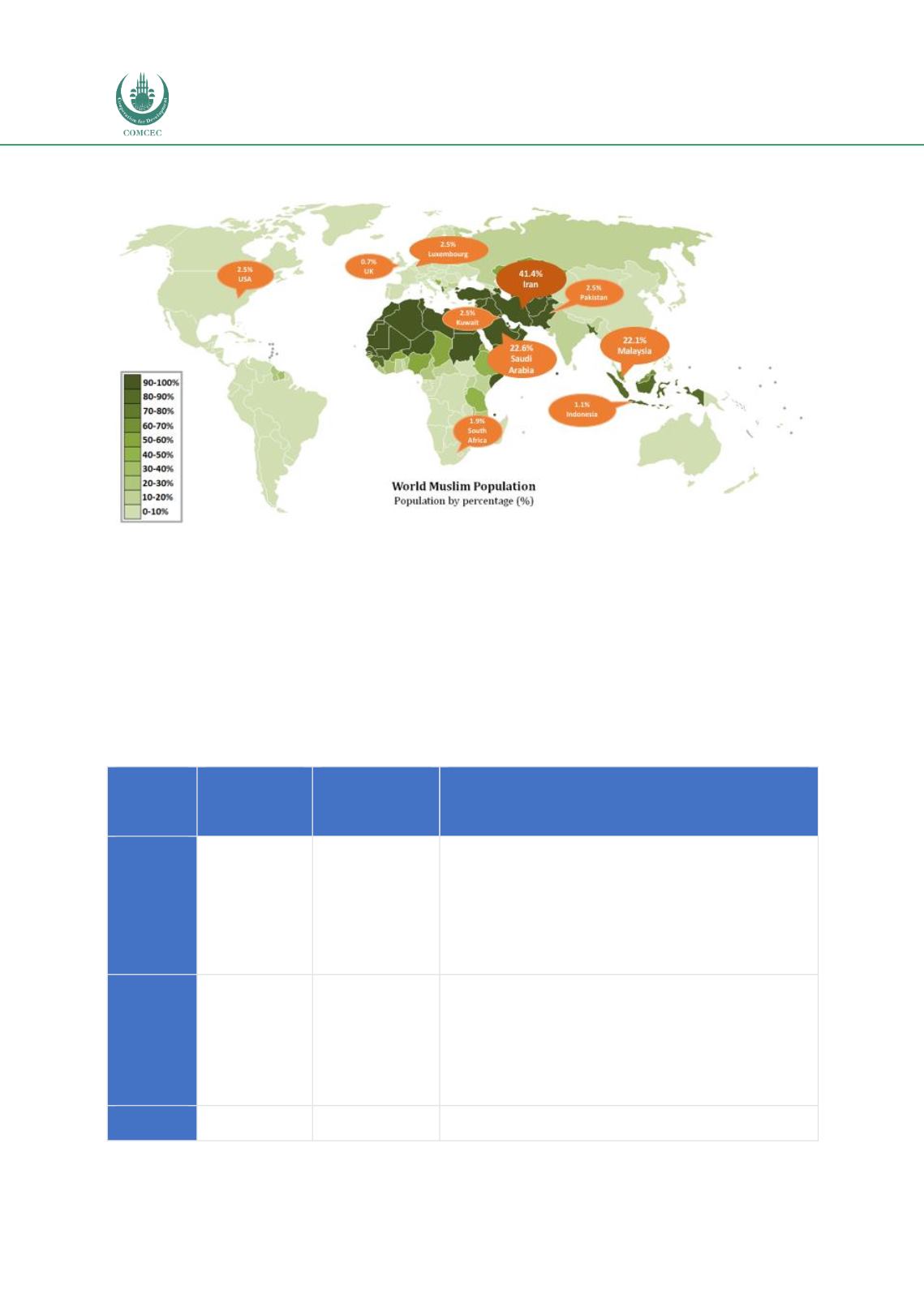

Figure 3.13: Geographical Distribution of Islamic AuM against Muslim Population

Source: RAM

Note: Figures sourced from ICD-Thomson Reuters Report (2017)

3.3

Key Factors Underpinning the Development of Islamic Fund

Management

As described earlier under item 3.1, the five core pillars set the basic critical success factors

required for the development of an Islamic fund management industry. Other important

factors are listed below while the findings are summarised i

n Table 3.8 .Table 3.8: Stage of Country’s Islamic Funds Development and Macroeconomic Factors

Country

and Credit

Ratings

Stage of

Market

Development

% of Shariah-

Compliant

Stocks Against

Total Market

Macroeconomic Brief

Malaysia

A- (S&P),

A3

(Moody’s),

A- (Fitch),

A

2

(RAM)

Matured

Shariah-

compliant

stocks

represent

76.2

% (688

stocks vs 903

listed stocks)

According to RAM, Malaysia’s credit ratings reflect the

country’s resilient economic growth, the government’s

fiscal consolidation efforts and stable GDP growth (i.e.

estimated at 5.8% in 2017). These positive conditions

have significantly supported the growth of the country’s

capital markets. The Malaysian capital markets expanded

12.6% to RM3.2 trillion as at end-2017, making it the fifth

largest in Asia.

Pakistan

B (S&P),

B3

(Moody’s),

B (Fitch)

Developing

(Advanced)

Shariah-

compliant

stocks

represent

44.7

% (250

stocks vs 559

total stocks)

According to S&P, Pakistan’s GDP is expected to grow at

an average rate of 5.7% in 2017-2020. This stronger

growth projection reflects the large-scale investments

under CPEC in the energy and infrastructure sectors of

the economy. Nonetheless, the rating remains

constrained by a narrow tax base and domestic as well as

external security risks.

South

Africa

Developing

(Intermediate)

Shariah-

compliant

According to Moody’s, the earlier weakening of South

Africa’s institutional framework will gradually reverse