Islamic Fund Management

115

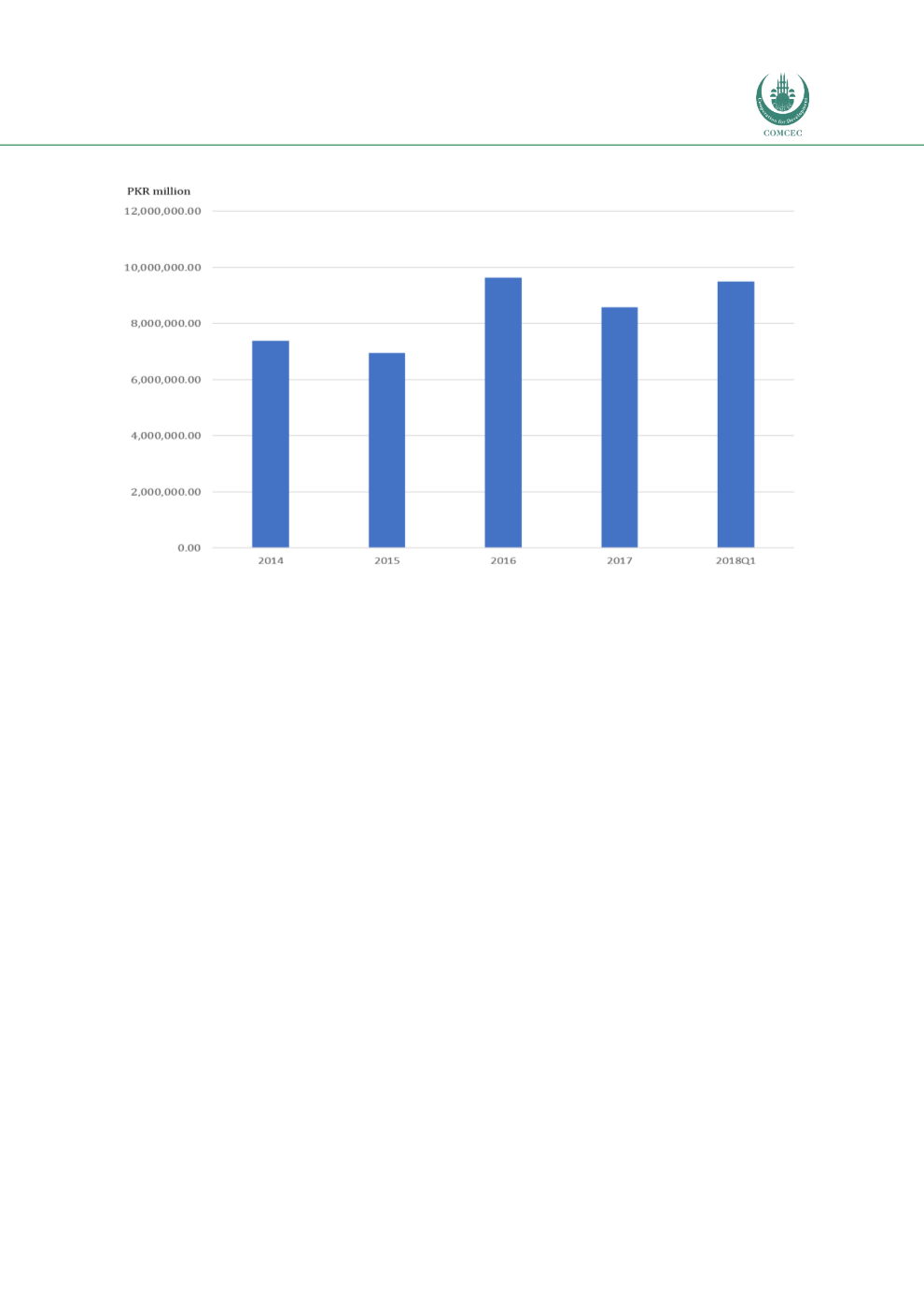

Chart 4.15: Total Market Capitalisation of the PSX (2014−1Q 2018)

Source: Pakistan Stock Exchange

Tax Framework

Although investors enjoy some tax relief when investing in funds, this is still limited, as

described earlier in

Table 4.13 .No tax incentive is provided to AMCs offering Islamic funds or

at the fund level. Both conventional and Islamic funds are treated the same. This is different

from the Malaysian experience, where some tax benefits are given to fund managers to

incentivise them to develop more Islamic wealth-management products (refer to

Table 4.5 : Tax Incentives for the Malaysian Fund Management Industry ).

Demand Side

Retail investors:

Pakistan has a large untapped Muslim population that remains out of the

financial system. Pakistan’s population numbers about 200 million, and the vast majority of

them are Muslims (about 95%-98%). Nonetheless, the financial inclusion rate for Pakistan is

significantly lower than its peers’. Based on the SBP’s Access to Finance Survey 2015, about

53% of the population are financially excluded while 24% have access to informal financial

services such as cooperatives and local committees, and loans offered by shopkeepers and

others. Only 23% have access to formal financial services (banks: 16%; NBFCs and national

savings schemes: 7%); a clear majority of them live in Karachi, Lahore and Islamabad. The

capital market presence and outreach are limited to these three main cities (SECP, 2016).

Accordingly, the government, spearheaded by the SBP, has launched the NFIS (2015-2020) to

provide a comprehensive framework and roadmap for priority actions to increase access to

and the use of quality financial services.

Box 4.5 provides an overview of the NFIS and its

current progress in driving the growth of Islamic funds, particularly the introduction of Digital

Transaction Accounts (DTAs)―mobile account scheme―in rural areas. This initiative facilitates