Islamic Fund Management

120

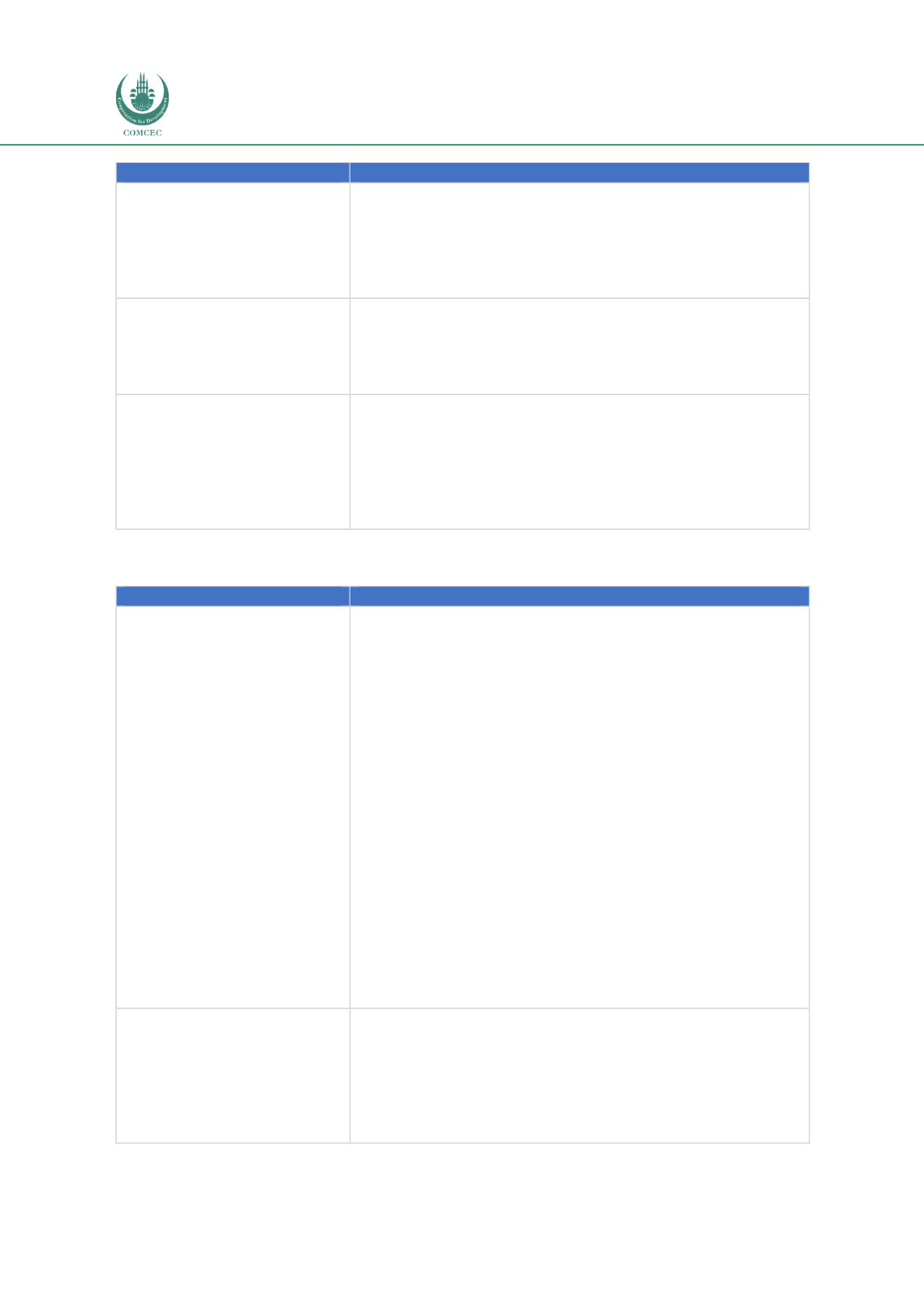

Issues and Challenges

Demand (Buy Side) Opportunities

Centralised KYC Organisation (CKO) with a centralised

database to record, maintain and verify the registration of

investors. The SECP’s issuance of Centralised KYC

Organisation Rules 2017, under which CKO licensing has

been granted to the NCCPL, is expected to streamline the

consolidation of KYC process for all AMCs.

4.

Taxation issues and

challenges

The limit of a four-year holding period for CGT should be

abolished to attract more investors to mutual funds.

Grant more tax incentives to investors to promote long-

term savings and investments, instead of the current

practice of limiting it to two years.

5.

Capital protection in

National Savings Scheme

The government should reconsider the policy of

guaranteeing capital and providing higher returns under

the National Savings Scheme, as it would hinder the growth

of the overall fund management industry. Investors would

prefer to invest in this scheme instead of Islamic funds

which are more risky and may yield lower returns due to

additional expenses incurred by the funds.

Sources: MUFAP (2017), SECP (2016), ISRA

Table 4.17: Recommendations on Improving Supply (Sell Side)

Issues and Challenges

Supply (Sell Side) Opportunities

1.

Limited Shariah-compliant

investment avenues

Introduction of short-term Islamic money market

instruments such as Shariah-compliant T-bills and other

similar government instruments.

Improving more transparency and good governance of

Modarabas by promoting mergers between small

companies. In addition, regulation on Modarabas can be

further enhanced by either of the following:

-

Increasing the limit on capital for the establishment or

operation of a

modaraba

company.

-

Increasing supervision to ensure compliance with

regulations.

This would eliminate the trust deficit that

modarabas

face,

thus creating more avenues for investible assets.

Deepening the Islamic domestic debt market by getting

more corporates to issue sukuk. However, this should be

preceded by long-term sovereign sukuk for benchmarking

and price discovery.

Realignment and consolidation of various occupational

savings, pension and retirement schemes in terms of their

investment avenues and criteria.

2.

Limited product

innovation

Creating an enabling framework for the introduction of

Islamic ETFs through:

-

The amendment of some regulations pertaining to

authorised participants and market makers: to allow

AMCs to invest in ETFs and a constituent basket of

securities; to enable banks and DFIs to act as

authorised participants or market makers; exposure