Islamic Fund Management

116

the availability of a common technology-led platform for individuals to access and use a full

suite of payment, savings, insurance and credit services (IMF, 2017).

As a result, the number of individuals that are holders of mutual funds has increased

significantly since 2015, as depicted i

n Table 4.15 .Even so, more concerted efforts are needed

to create greater awareness among retail investors, particularly unbanked.

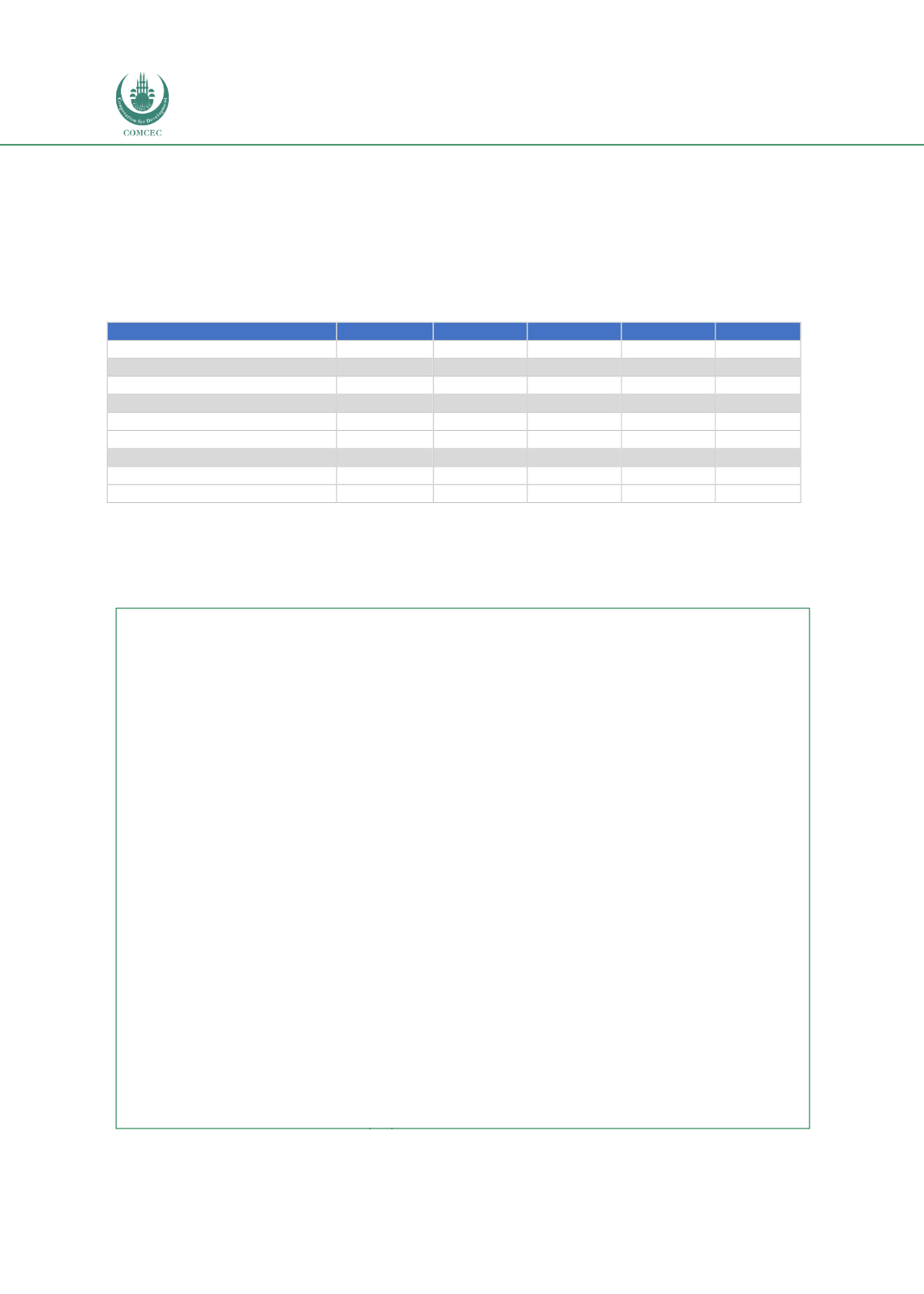

Table 4.15: Number of Investors' Accounts (Open- and Close-Ended Mutual Funds)

Category

2013

2014

2015

2016

2017

Individuals

203,560

209,297

228,906

246,043

270,386

Banking & financial institutions

839

787

682

724

819

Provident & pension funds

2,198

2,369

2,789

3,098

3,805

Public limited companies

612

734

600

601

305

Associated companies

451

435

401

420

320

Others

3,127

3,026

3,051

2,792

28,460

Fund of funds*

141

Total including fund of funds

210,787

216,648

236,429

253,678

304,236

Total excluding fund of funds

210,787

216,648

236,429

253,678

304,095

Source: MUFAP (2017)

* Effective 27 April, 2017, AMCs are required to exclude the amount invested by fund of funds schemes in the

underlying funds managed by the same AMC while publishing the amount of assets under its management in

advertisements.

Box 4.5: Pakistan’s NFIS (2015-2020)

Overview:

In May 2015, the Pakistan government

launched and adopted the NFIS, the key

objective of which is to set a national

vision for the achievement of universal

financial inclusion in the country. The

NFIS underlines the government’s vision,

framework, action plans and target

outcomes for financial inclusion. It aims to

increase formal financial access to 50% of

the adult population by 2020.

Key Enablers:

1.

Public and private sector commitment

2.

An enabling legal and regulatory

environment

3.

An adequate supervisory and judicial

capacity

4.

Financial, payment and ICT

infrastructure

Key Drivers:

1.

Promoting digital transactions and

achieving scale through bulk payments

2.

Expanding and diversifying access

points

3.

Improving the capacity of financial

service providers

4.

Enhancing financial capability

Key Milestones of the NFIS:

1.

Enhancement of biometric infrastructure to aid real-time account

opening (2015).

2.

Payment systems interoperability of the MFS platform with core

banking accounts through financial switch (1-Link) enabling ATM,

POS and interbank funds transfers through m-wallets (2015).

3.

The Government of Pakistan accepts membership of the UN’s

Better than Cash Alliance

(2015).

4.

Establishment of three centres of excellence in Islamic finance

education to ensure an adequate supply of trained human capital

for the industry (2015).

5.

Incorporating the Pakistan Mortgage Refinance Company to

address the long-term funding constraints hindering the growth of

the primary mortgage market (2015).

6.

Launch of the CGSMF with funding support from the Government

of Pakistan, to share the losses with banks against their collateral-

free financing to small and marginalised farmers (2016).

7.

The NFIS Council approved key strategic actions such as:

The development of a National Payment Gateway.

Automation of government collections and disbursements.

Introduction of a warehouse receipt financing system.

Integration of the National Savings Scheme with the national

payment system.

Initiation of new schemes for registered prize bonds.

8.

Development of mobile accounts - DTA Scheme – AMA to support

the rapid expansion of digital transactions, particularly in rural

areas. The unified DTA scheme is expected to help design a

common technology-led platform for individuals to access and use

a full range of payment, savings, insurance and credit services

(2017).

9.

Launch of the Home Remittance Account (HRA), a branchless

banking account to promote a swift and cost-effective mode of

receiving money from abroad (2017).

Sources: SBP (2015), IMF (2017), Pakistan Economic Survey 2017-18 (2018)