Islamic Fund Management

110

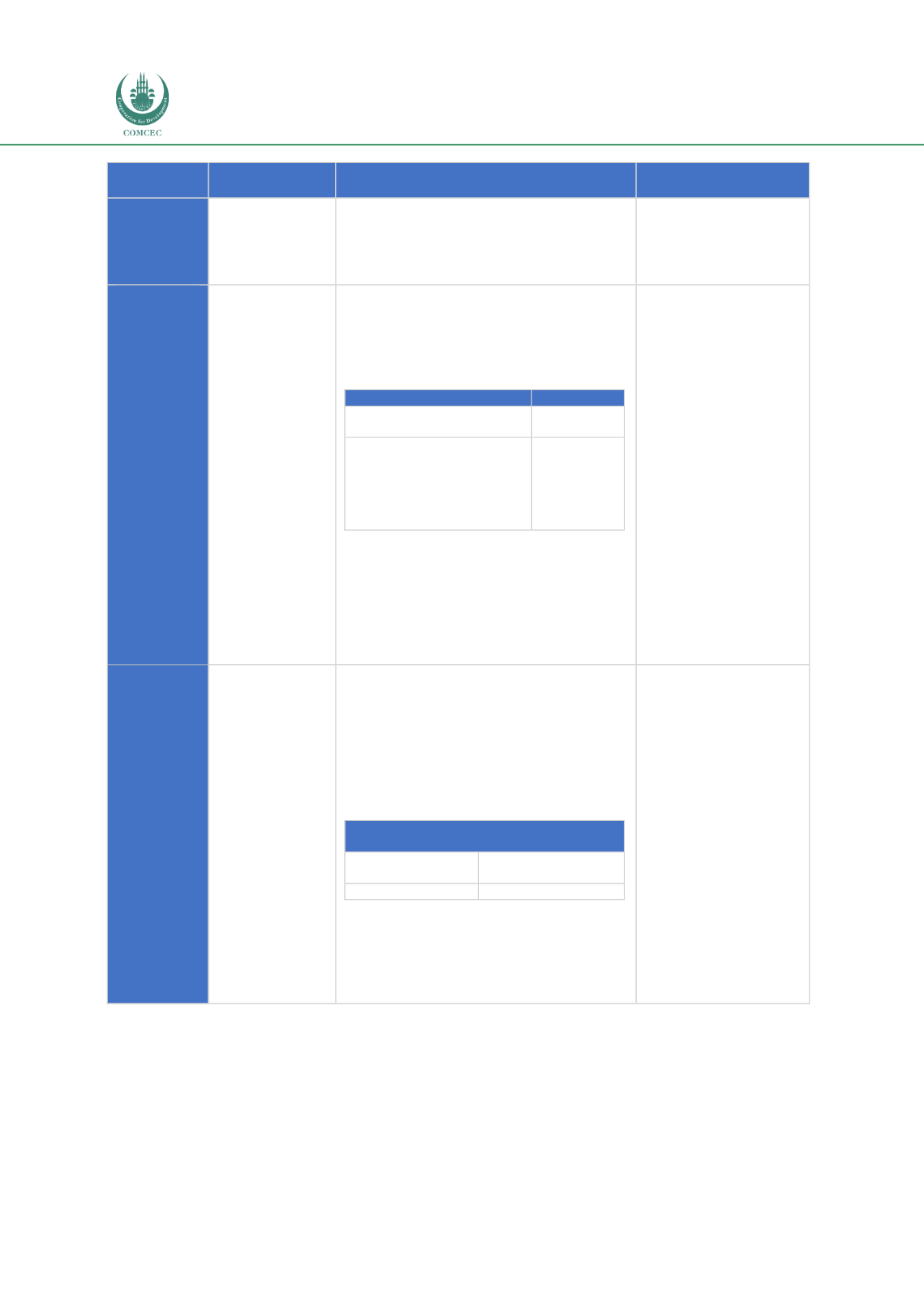

Type of

Fund

Investment

Strategy

Asset Allocation/ Authorised Investment

Product Suitability

philosophy and do not

wish to be dependent

on security selection

and sector allocation

by fund managers.

Shariah-

Compliant

Balanced

Fund

To provide both

growth

and

income,

hence

investing in both

equities

and

fixed-income

securities.

▪

Investment avenues: Shariah-compliant

listed securities, government securities,

cash in bank accounts, money market

placements, deposits, certificate of

musharakas (COM) and sukuk.

Asset allocation

Ratio

Shariah-compliant

listed

equities at all times

30%-70%

Remaining net assets will be

invested

in

fixed-income

securities, where:

-

The rating of the debt

securities is no lower

than A-

30%

Investors who seek:

Moderate risk and

return potential.

Balanced investment

strategy,

both

in

equities

and

debt

markets,

while

avoiding the volatility

of

pure

equity

investments.

Portfolio

diversification

through just one fund

without having to

invest in multiple

funds.

A balanced strategy to

meet their financial

goals within the short

to medium term.

Shariah-

Compliant

Asset

Allocation

Fund

To

invest

in

various

asset

classes based on

the outlook on

such

asset

classes, and may

provide

diversification

benefits through

a

single

investment.

Investment allocation: any type of

securities at any time, with a provision to

diversify its net assets across multiple

types of securities and investment styles,

as specified in their offering documents.

The investment within each asset class

will be governed by the criteria

applicable to schemes of that asset class:

Indicative minimum percentage of

investment allocation

Equity

Fixed income/money

market

0%-100%

0%-100%

Each scheme must disclose the following

in its offering document:

i.

Authorised investments

ii.

Ratings of the securities that it will

invest in

Investors who seek:

Allocation of funds in

both risky and non-

risky assets, with an

assurance that the

fund manager will

actively

allocate

assets between the

two classes according

to their outlook.

Capital appreciation

over the long term.

Diversification

by

combining

various

asset classes in their

overall

investment

portfolio.