Islamic Fund Management

111

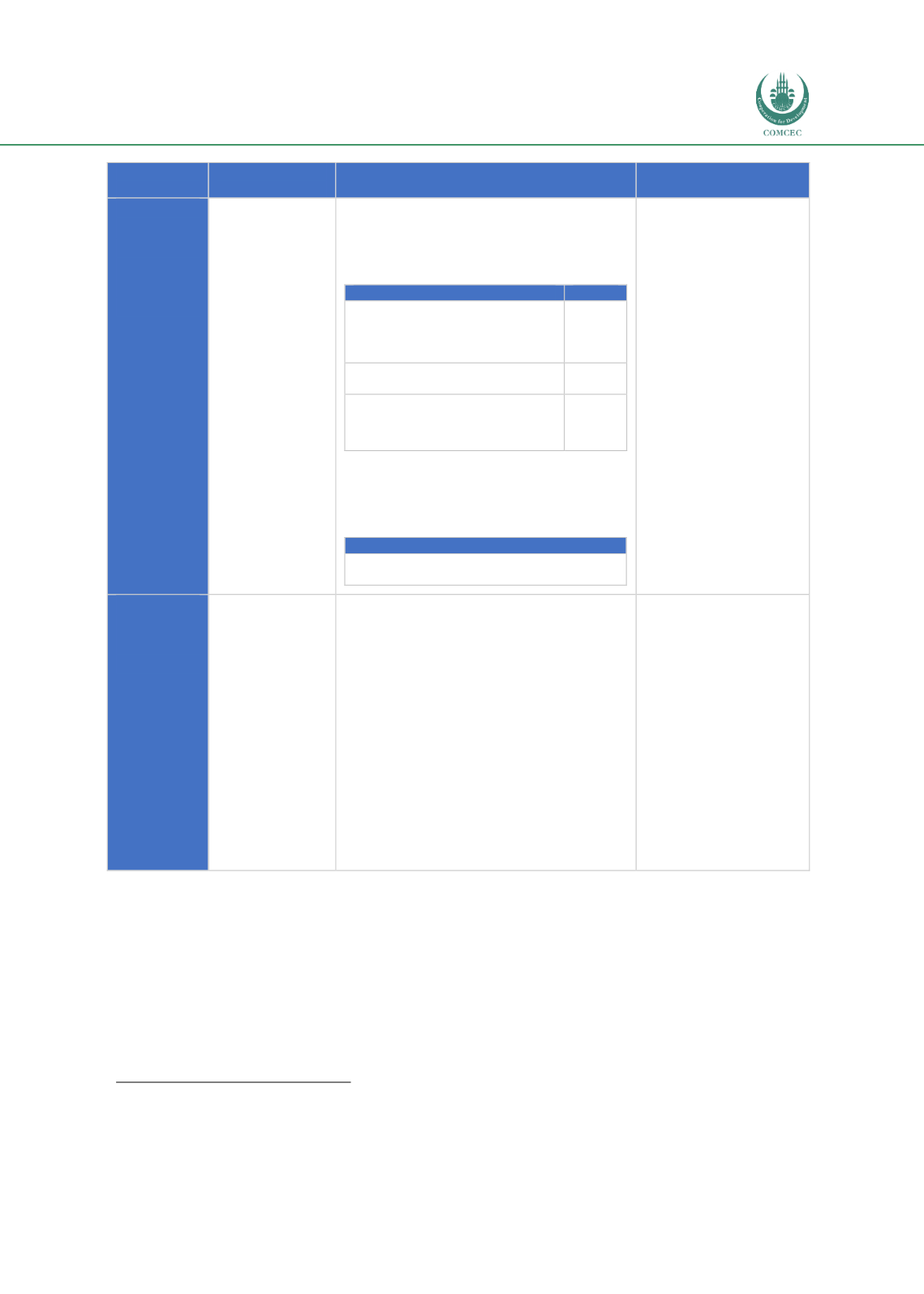

Type of

Fund

Investment

Strategy

Asset Allocation/ Authorised Investment

Product Suitability

Shariah-

Compliant

Income/

Money

Market

Fund

To

provide

regular

and

steady income to

investors.

Income fund: government securities,

cash in bank accounts, money market

placements, deposits, certificate of

musharakas (COM) and sukuk.

Asset allocation

Ratio

Exposure to CFS and spreads

Below

40% of

net

assets

Cash and near-cash instruments

At least

25%

Non-traded securities, with more

than 6 months’ maturity which is

not a marketable security

Less

than

15%

Money

market

fund:

government

securities,

cash

and

near-cash

instruments.

Asset Allocation

No direct/indirect exposure to equities, CFS

and spread transactions.

Investors who seek:

Moderate risk and

return potential.

Protection

of

investments

from

stock

market

volatility,

while

providing

diversification to the

overall

investment

portfolio.

Long-term

regular

income.

Shariah-

Compliant

Fund of

Funds

To

invest

in

other

mutual

funds.

Can only invest its net assets in other

schemes.

Every scheme must mention its type

with respect to the asset class, e.g. equity

fund of funds or income fund of funds, in

its offering document.

Every scheme will be invested in either

the units of other collective investment

schemes as per its investment policy, or

in cash and/or near-cash instruments,

including cash in bank accounts

(excluding TDRs).

Every scheme must ensure that it does

not invest in the seed capital of any other

collective investment scheme.

Investors who seek:

Different allocation

strategies that suit

varying risk profiles.

A

targeted

investment strategy

to achieve desired

financial goals.

Investment

in

a

disciplined manner

through risky funds,

but

have

the

comfort of not being

penalised

should

they

miss

any

monthly payment.

Source: SECP Circulars on Categorization of Open-End Collective Investment Schemes

10

10

Note that the SECP, as at end-2017, has been issuing a series of circulars on the categorisation of open-end CIS starting

with Circular No. 7 of 2009, followed by other circulars, including Circular No. 16 of 2010, Circular No. 4 of 2011, Circular No.

32 of 2012, Circular No. 9 of 2013, Circular No. 3 of 2015, Circular No. 1 of 2016 and Circular No. 10 of 2016.