Islamic Fund Management

121

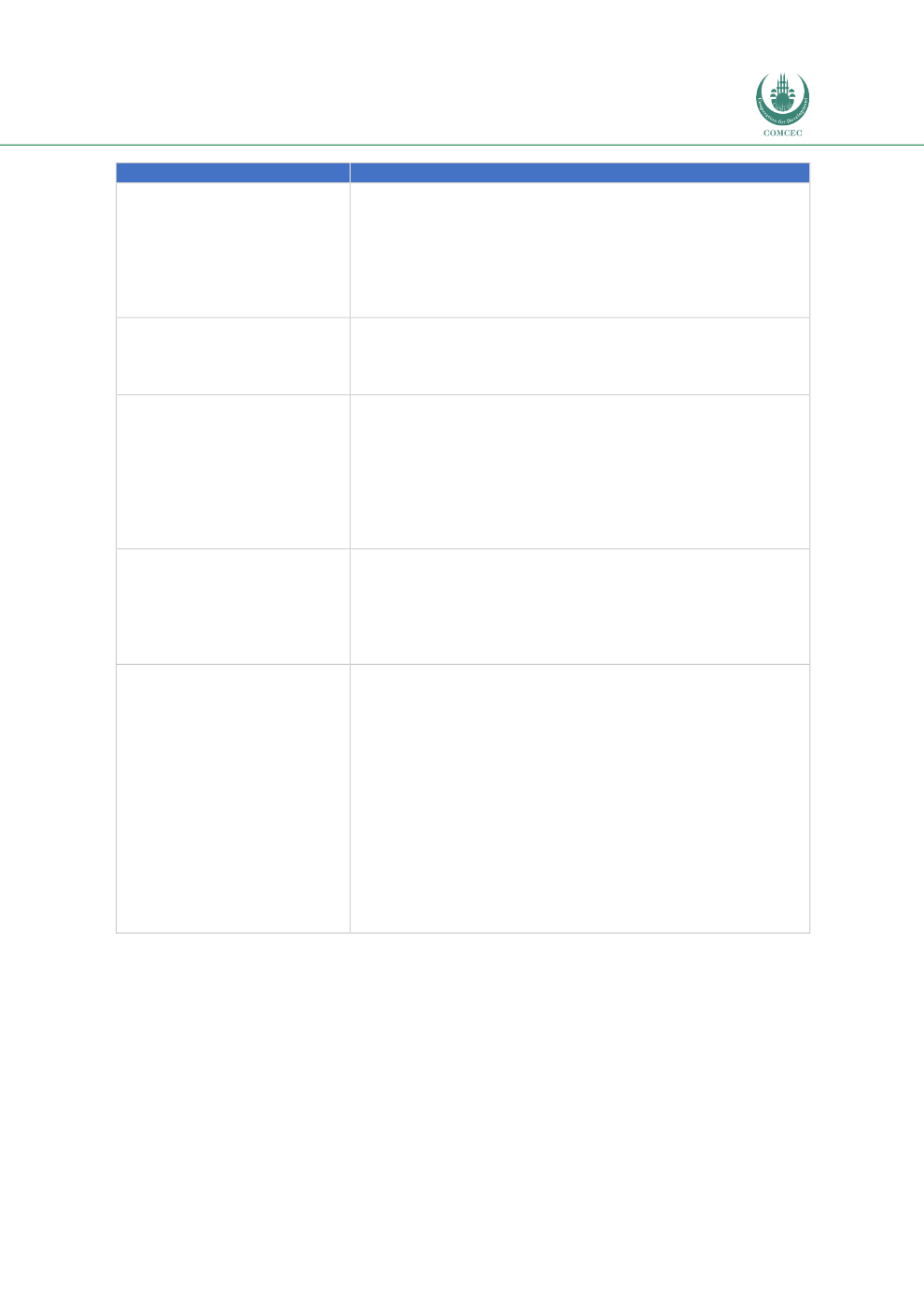

Issues and Challenges

Supply (Sell Side) Opportunities

limit under PR-6 should be amended.

-

Amendments to tax laws: transfer of securities to/from

authorised participants to ETFs should not attract any

capital gains tax.

-

Amendments by the PSX/SECP pertaining to the

removal of circuit breakers and the breaking up of

marketable lots.

3.

Limited foreign investors

The introduction of a structured plan to attract more

foreign investors and the liberalisation of policies for AMCs

to open up their business will provide more opportunities

for the growth of Islamic funds.

4.

Small market

capitalisation

Studies show a correlation between stock market

capitalisation and the growth performance of mutual

funds. This is evident in the case of Pakistan, where equity

funds hold the biggest market share. Although the PSX has

become one of the best performers in South Asia in 2016,

its market capitalisation is still limited. More concerted

efforts are required to encourage the listing of new

companies, particularly those that are Shariah-compliant.

5.

Shortage of talent in

Islamic fund management

The establishment of three centres of excellence for Islamic

finance has, to some extent, filled the knowledge gap in the

overall Islamic finance industry. Nonetheless, more

initiatives should be taken to train professionals and

distributors of Islamic funds, particularly on product

development.

6.

Taxation issues and

challenges

Reduction of withholding tax for AMCs, from 8% to 2% (as

proposed by the Mutual Funds Association of Pakistan

(MUFAP)), should be given consideration by the Federal

Bureau Revenue (FBR) to increase AMCs’ capacity to

operate and offer more competitive products.

The requirement to obtain an exempt certificate for

exempt entities like mutual funds should be withdrawn, as

the process is operationally cumbersome. In the interim,

tax is withheld while funds end up being owed refunds that

are difficult to extract from the FBR.

Granting tax incentives to companies listed on the PSX will

help raise the Islamic market’s capitalisation, which would

eventually provide more avenues for Islamic funds to

invest in.

Source: MUFAP (2017), ISRA