Islamic Fund Management

113

Formation cost under the CIS, not exceeding 1%

of the pre-IPO capital in the case of an open-

ended fund and 1% of the paid-up capital in the

case of a close-ended fund, or five million

rupees, whichever is lower.

Taxes, fees, duties and other charges applicable

to the CIS on its income or properties, including

taxes, fees, duties and other charges levied by a

foreign jurisdiction on investments made

oversees.

Fees payable to the Commission.

Any other expense or charges as may be allowed

by the Commission.

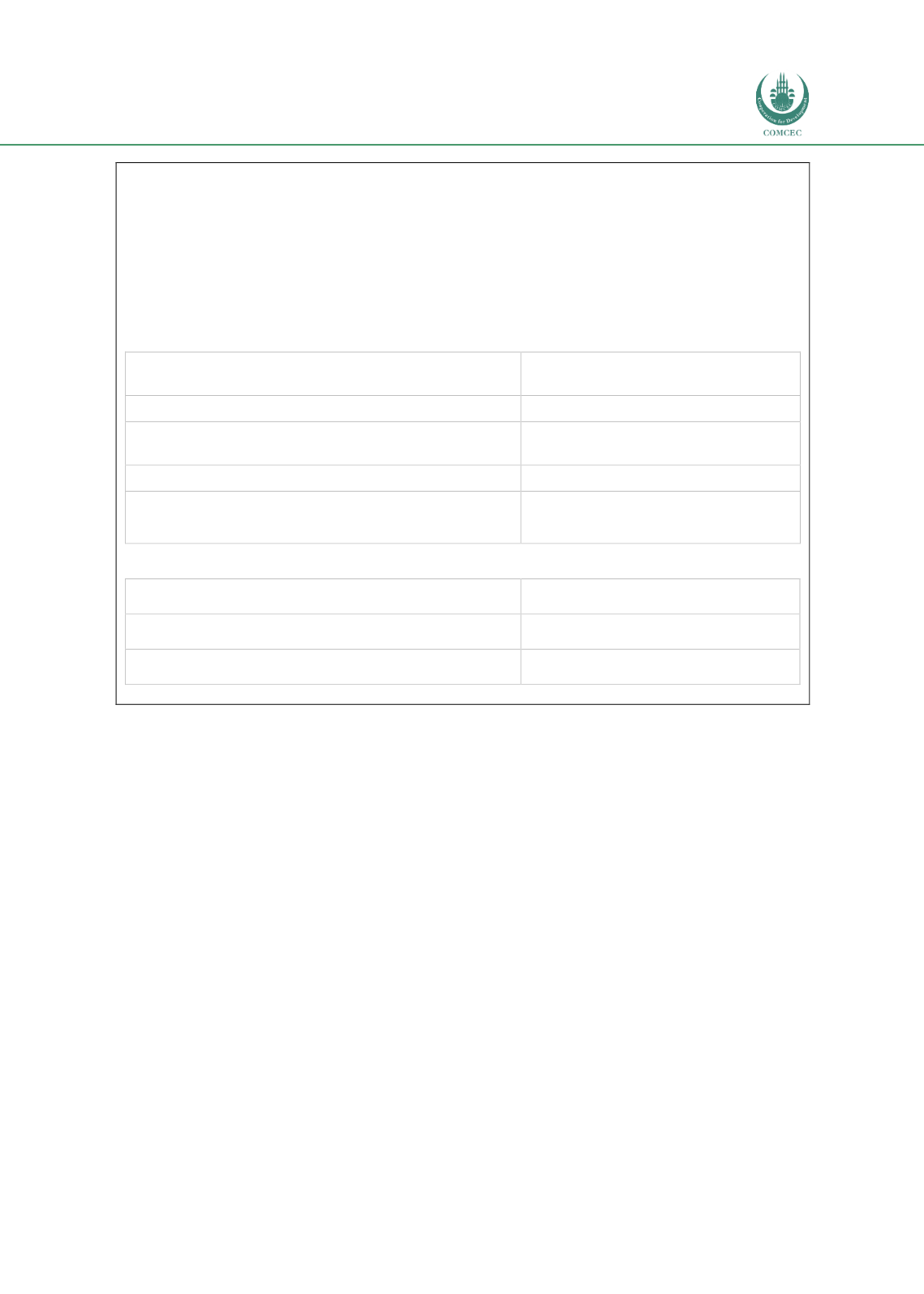

Maximum Limit for the Allowable Total Expenses of a Fund:

Equity, balanced, asset allocation and capital-protected

(dynamic asset allocation-direct exposure) schemes

Up to 4%

Money market

Up to 2%

Income, aggressive income, capital-protected, index and

commodity schemes (cash settled)

Up to 2%

Commodity schemes (deliverable)

Up to 3%

Fund of funds

Up to 2.5% if management fee is charged

Up to 0.5% if no management fee is

charged

Maximum Limit for Management Fees under Different Funds

Equity, balanced, asset allocation and capital-protected

(dynamic asset allocation-direct exposure) schemes

2% of average annual net assets

Income, aggressive income, index, fund of funds and

commodity schemes (cash settled)

1.5% of average annual net assets

Money market, commodity schemes (deliverable) and

capital-protected schemes

1% of average annual net assets

Source: SECP (2008)

Nonetheless,

the real challenge lies in the effective implementation and enforcement of the

laws and regulations. Supervision and enforcement capabilities also need attention as there

are some gaps, especially for self-regulatory organisations (SROs).

Shariah Governance Framework

Comparable to Malaysia, Pakistan has a robust Shariah framework vis-à-vis the governance

and compliance of Islamic capital-market activities, particularly Islamic funds-related

businesses. To comply with international best practices and to promote harmonisation and

standardisation in the business operations of Shariah-compliant companies across the

industry, the regulator, i.e. the SECP, has been issuing notices for the adoption of various

AAOIFI Shariah Standards since January 2016.

The SECP has established its central Shariah Advisory Board to provide opinions on Islamic

capital market-related matters. The Board regularly reviews the regulatory framework for

Shariah compliance and evaluates Islamic financial accounting standards in consultation with

industry stakeholders―to ensure uniformity in the Shariah governance and compliance

processes.