Islamic Fund Management

90

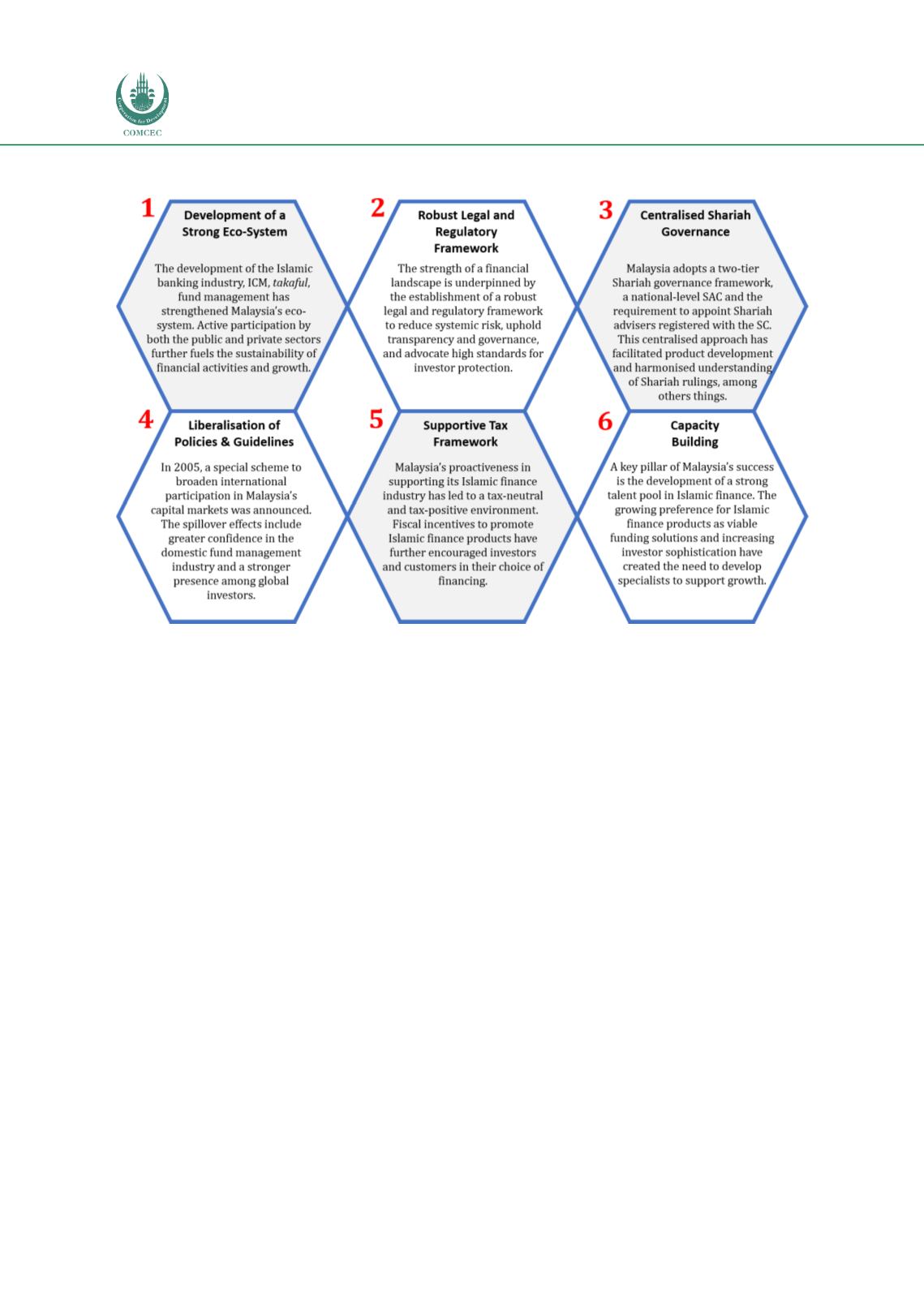

Figure 4.7: Lessons from Malaysia’s Experience

Source: RAM

Note: Systemic risk refers to the potential of any widespread effect on the financial system and, thereby, on the

wider economy. Factors which can give rise to systemic risk may include the design, distribution or behaviour

under stressed conditions of certain investment products; the activities or failure of a regulated entity; market

disruption; or the impairment of a market’s integrity as well as the gradual erosion of market trust or confidence

(SC’s Regulatory Philosophy, 2015).

Given its well-developed eco-system, Malaysia is the leader in terms of the number of Shariah

funds launched.

Chart 4.6depicts the factors influencing the development of Malaysia’s

domestic Shariah funds market while

Table 4.8 and

Table 4.9outline the policy

recommendations to further strengthen the progress of the Islamic funds landscape.