Islamic Fund Management

91

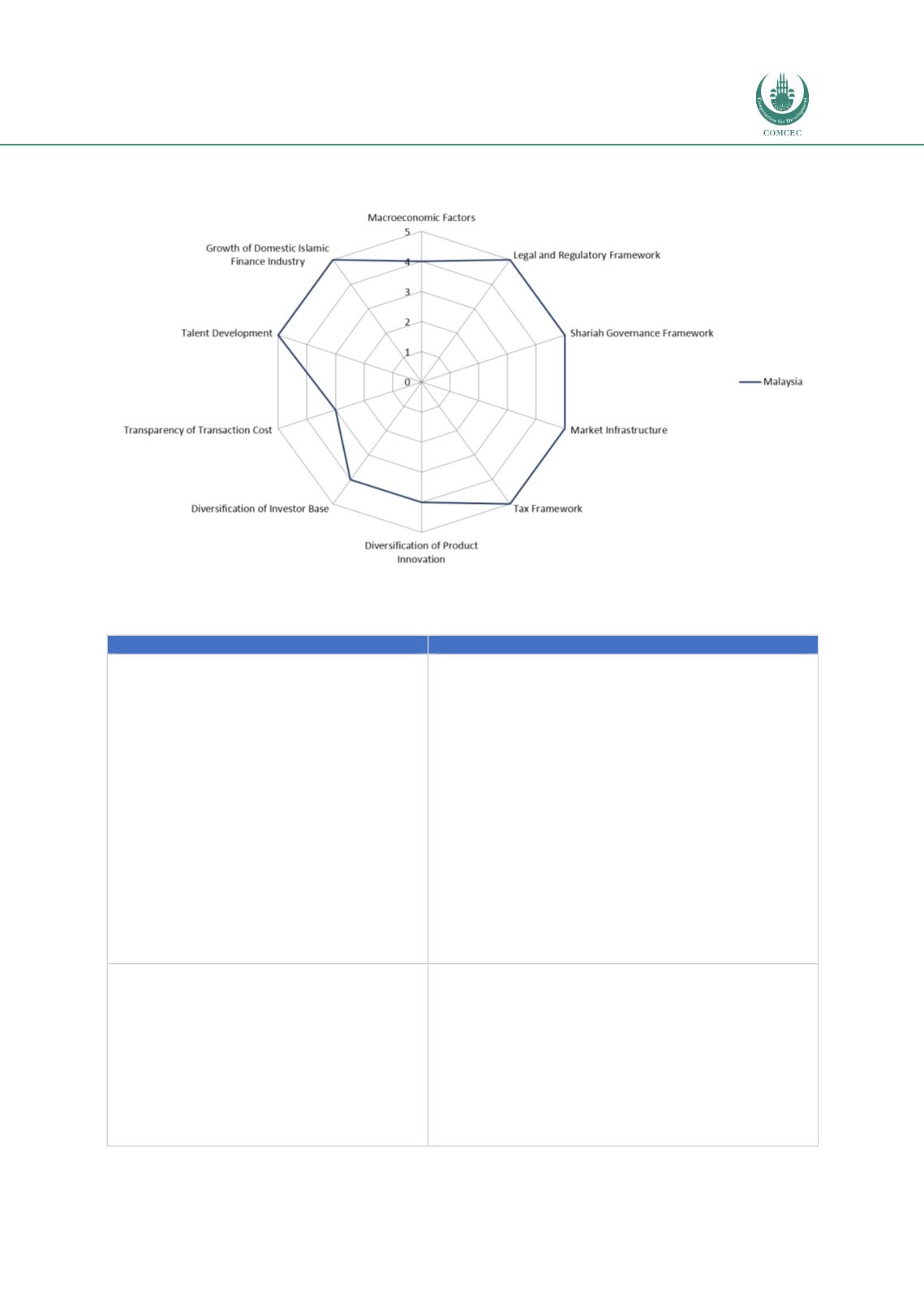

Chart 4.6: Factors Influencing the Development of Malaysia’s Islamic Fund Management

Industry

Sources: RAM, ISRA

Table 4.8: Recommendations on Improving Demand (Buy Side)

Issues and Challenges

Demand (Buy Side) Opportunities

1.

Continuous enhancement of financial

literacy, education and awareness

programmes for retail investors.

The need for investor education and financial

literacy has never been greater. As the financial

marketplace continues to evolve and innovate,

investment products are becoming increasingly

complex and financial services increasingly diverse.

Greater understanding of key financial concepts is

required on the part of retail investors to

understand and evaluate the choices available to

them and avoid fraud. Investor education and

financial literacy programs also have the potential

to help improve financial outcomes for retail

investors. Benefits include more informed savings

and investment decision-making, better financial

and retirement planning, greater confidence and

higher participation in the securities markets,

greater wealth accumulation, and increased

awareness of investor rights and responsibilities.

2.

Strengthening Malaysia’s value

proposition as an international hub for

SRI funds

There are opportunities to attract foreign

investments into domestic funds. Growing interest

and popularity of SRI segment from developed

market provide an opportunity for Malaysia to

profile Islamic funds internationally as both Islamic

investing and SRI adopt similar underlying

principles. Global sustainable investment AuM

reached USD22.89 trillion in 2016, compared with

USD18.28 trillion in 2014, an increase of 25%. With

Islamic funds being recognised as part of the SRI