Islamic Fund Management

92

universe, Malaysia is currently the largest SRI funds

market in Asia (excluding Japan) with 30% market

share. The SC recently issued the Guidelines on

Sustainable and Responsible Investment (SRI)

Funds to facilitate and encourage further growth of

SRI funds in Malaysia, in anticipation of an uptrend

in SRI assets in this region. The new Guidelines will

widen the range of SRI products in the market and

attract more investors into the SRI segment.

3.

Facilitating new digital business models

and seamless interaction with mass

affluent investors.

The next step forward will be the digitalisation of

wealth management and financial planning. The

creation of seamless platforms and mobile

applications will gain greater traction among mass

affluent investors and improve financial inclusion.

Source: RAM

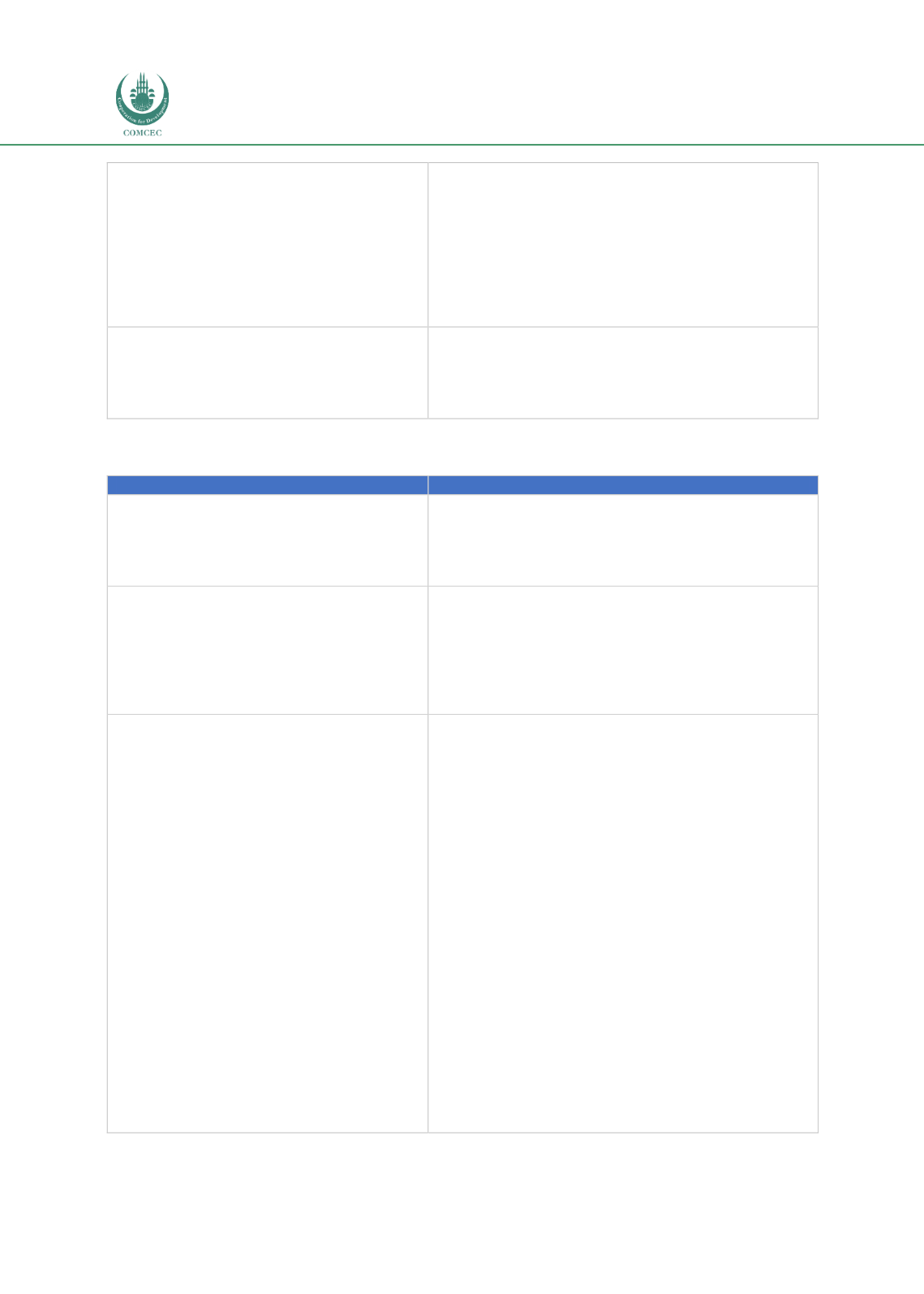

Table 4.9: Recommendations on Improving Supply (Sell Side)

Issues and Challenges

Supply (Sell Side) Opportunities

1.

Enhance regional collaboration for cross

border offerings.

Regional collaboration via bilateral and multilateral

arrangements can be further enhanced for broader

market

access

and

greater

international

connectivity. Luxembourg success in becoming a

global funds centre can be a good business case.

2.

Earmarking of institutional funds for

Shariah-compliant investment or SRI

investing.

The EPF has led the way through the launch of its

RM100 billion Simpanan Shariah in 2016, which had

catalysed market players to increase the supply of

Shariah-compliant assets. As more institutions (e.g.

Khazanah, KWAP) move to provide similar fund

allocations, this will further strengthen the pipeline

for Shariah-compliant assets.

3.

Advance Malaysia’s position as a hub for

investment support services.

Malaysia actively promotes shared services and

outsourcing activities under the segment of the

Business Services industry. This segment has been

successfully built and has hosted many international

providers. These competitive strengths can be

leveraged on in operational, tax and human capital

infrastructure to attract more international fund

administration service providers to establish their

regional and international base in Malaysia. At the

same time, further development of domestic firms

operating in this market segment will also be

facilitated.

The presence of a broad range of international and

domestic firms will enhance competitive positioning

of the industry, providing a spectrum of fund

administration service offerings including custody,

trustee, clearing, fund accounting and transfer

agency services. Recognition as an international hub

for fund administration will enhance Malaysia’s

competitiveness in attracting a wide array of

international

funds,

especially

Islamic

and

sustainable responsible investment (SRI) funds, to

be domiciled in the country.

Source: RAM