78

Domestic Market – Public Sector Issuance

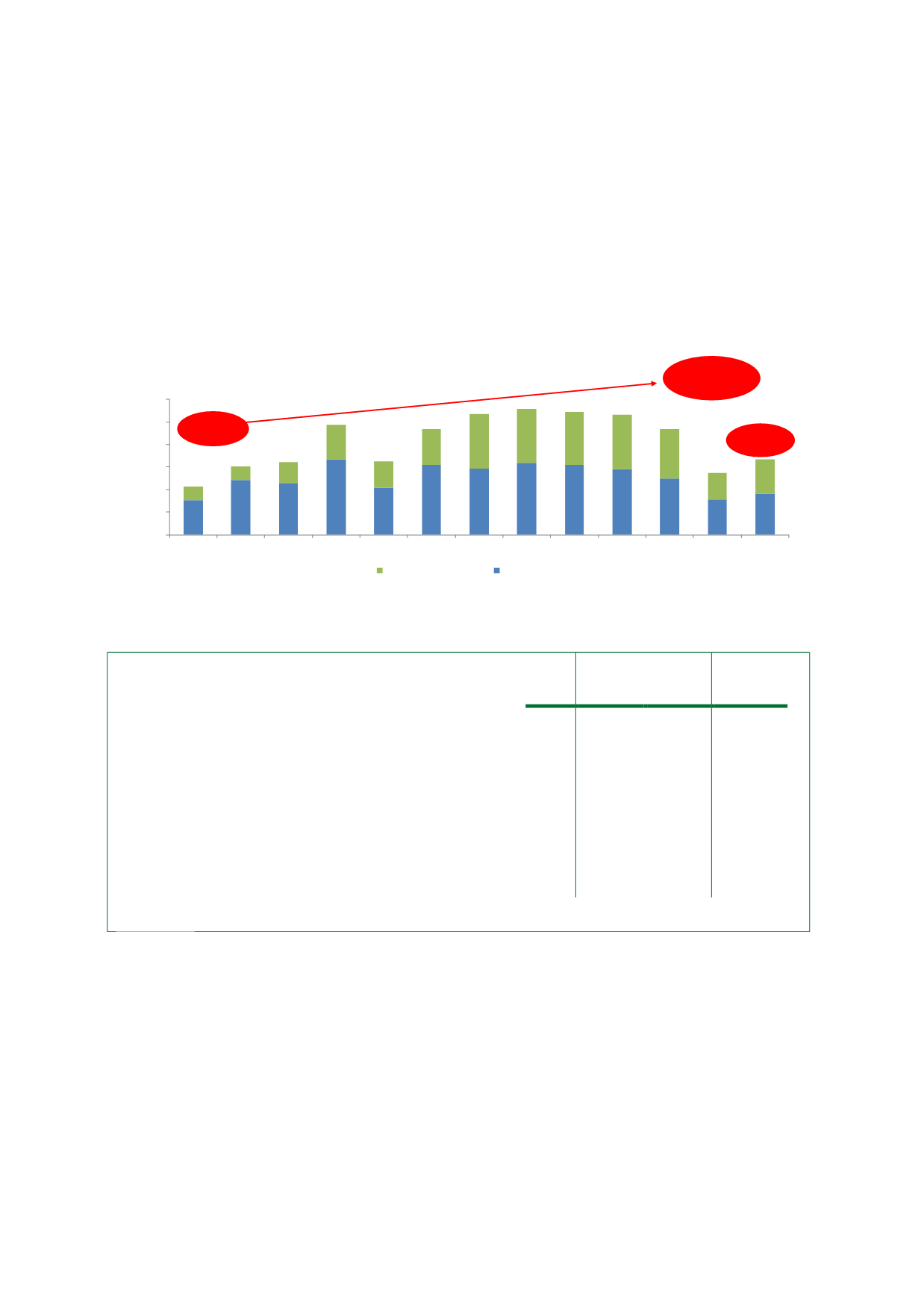

Over the years, in support of its aspiration to turn Malaysia into an international ICM, the GoM

has progressively increased the percentage of government investment issues (GII) compared

to Malaysian government securities (MGS) (as described in Box 4.4). Chart 4.4 shows that as at

end-June 2017, a total of RM67.0 billion of government securities had been issued, of which

46% constituted sukuk, compared to only 27% as at end-2006.

Chart 4.4: Malaysia’s Sovereign Sukuk vs Conventional Issuance (2006-June 2017)

0.00

20.00

40.00

60.00

80.00

100.00

120.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June 2016 June 2017

RMbillion

Sukuk issuance

Conventional issuance

RM42.4

billion

46

%

RM67.0

billion

RM94.0

billion

27

%

Source: Bond Pricing Agency Malaysia (BPAM)

Box 4.4: Malaysia’s GII

In 1983, the Malaysian Parliament passed the Government

Investment Act to enable the GoM to raise funds through

the issuance of non-interest-bearing certificates, known as

GII. The first GII issuance took place in July 1983. The

primary reason for the introduction of GII had been to

enable Islamic banks to hold first-class liquid

assets/instruments to meet the statutory liquidity

requirements and also for investment.

GII had first been issued based on the Shariah contract of

qard hasan

(benevolent loan). Since 22 July 2014, GII

issuance has adopted the

murabahah

concept. As at end-

2016, the percentage of GII relative to the GoM’s

borrowings had increased to 39.6%, from only 10.0% a

decade ago - indicating the GoM’s commitment to

supporting the growth of Islamic finance.

GII

(RM

billion)

MGS

(RM

billion)

% of GII

to total

issuance

2006

19.6

174.3

10.0

2007

28.0

191.7

12.7

2008

42.5

231.8

16.6

2009

66.0

242.3

21.4

2010

81.5

261.0

23.8

2011

110.0

277.7

28.4

2012

143.5

292.1

32.9

2013

172.5

305.1

36.1

2014

185.5

329.6

36.0

2015

214.0

340.1

38.6

2016

234.5

357.4

39.6

Source: BNM

Historically, a large portion of the GoM’s budget deficit has been funded by capital-market

instruments. Hence given the larger budget deficit projected for 2017 (as depicted in Table

4.3), our analysis concludes that the GoM will remain committed to supporting the issuance of

Islamic securities to finance its budget shortfall.