81

BSAS is an international commodity platform that is able to facilitate commodity-based Islamic

financing and investment transactions under the Shariah principles of

murabahah

,

musawwamah

and

tawarruq

. Following the establishment of BSAS, there was a spike in

murabahah

sukuk issuance in 2010; this has remained one of the preferred contracts for sukuk

issuance. Our analysis indicates that the reasons for this increase point to ease of

implementation and issuers’ choice to not utilise existing assets, or insufficient assets to

comply with the SC’s asset-pricing guidelines. There are other platforms in the market that

offer similar services such as AbleAce Raakin’s platform, which was established in 2006, and

Sedania As Salam Capital Sdn Bhd’s As-Sidq in 2009 (collectively referred to as “approved

platforms”). Nonetheless, BSAS is still the preferred platform for the issuance of commodity

murabahah

sukuk.

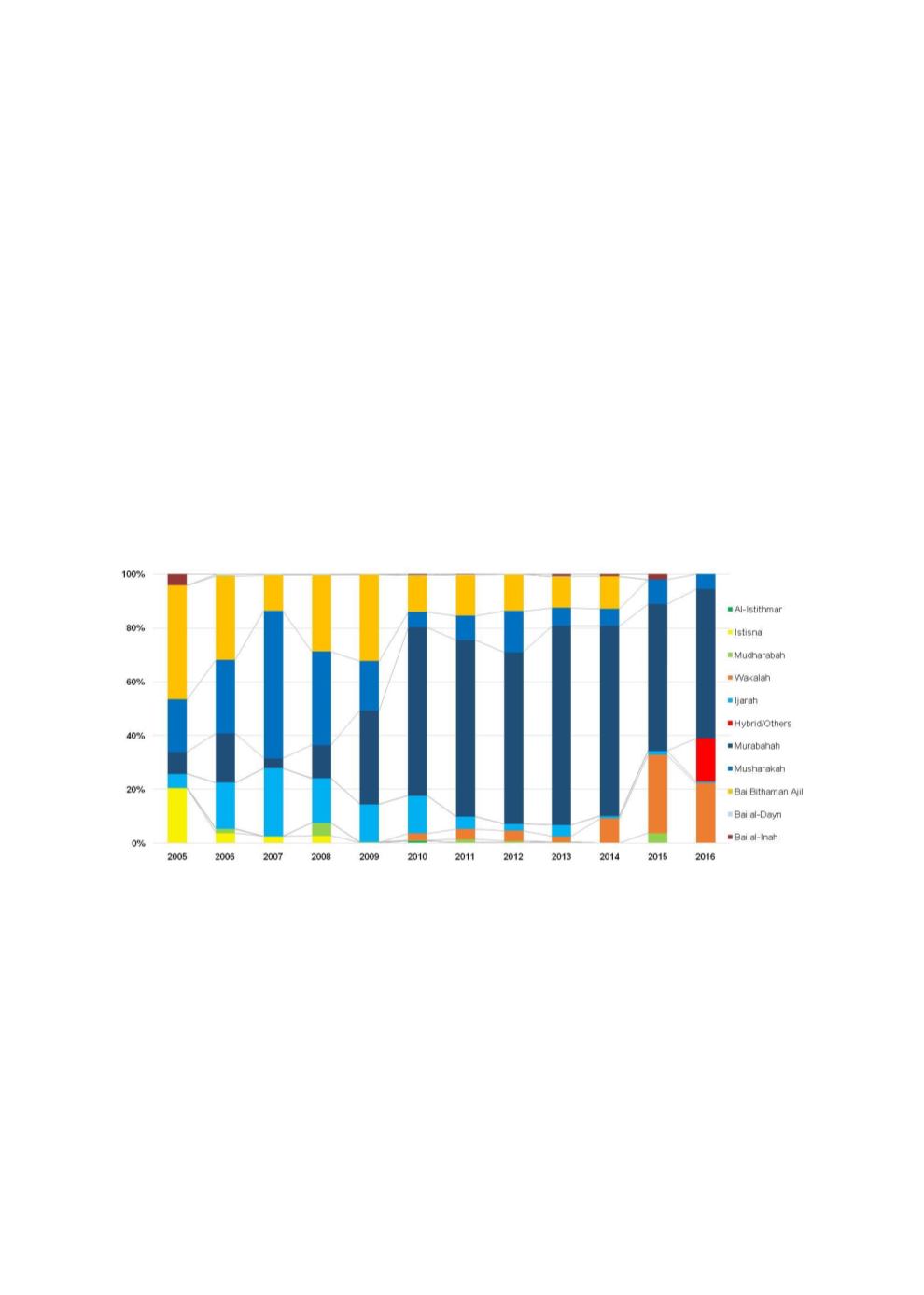

Following the release of the AAOIFI’s Shariah Standards in 2010, several countries (including

Malaysia) had aligned their operations and practices with the international standards. As a

result, even though the types of Shariah contracts used are still diverse,

murabahah, wakalah

and hybrid contracts accounted for the bulk of Malaysia’s sukuk issuance as at end-2016, as

shown in Chart 4.8.

Chart 4.8: Malaysian Corporate Sukuk Issuance by Type of Shariah Contract (2005-2016)

Sources: Eikon-Thomson Reuters, RAM

In the structuring of sukuk, the following SC guidelines are taken into consideration:

1.

Shariah Resolutions for the ICM

The initiatives by the regulators to solidify the foundation of Malaysia’s ICM include the

establishment of a centralized SAC of the SC to govern all Shariah matters related to the ICM.

Similarly, a separate SAC has been set up under BNM, to advice on all matters related to Islamic

banking and

takaful

. The SACs have from time to time issued Shariah resolutions and decisions

related to their relevant jurisdictions. The resolutions of the SACs are publicly available and

are used as a reference point by the industry and academia around the world. The proactive

approach of the SACs has allowed the ICM as well as the banking and

takaful

sectors to