80

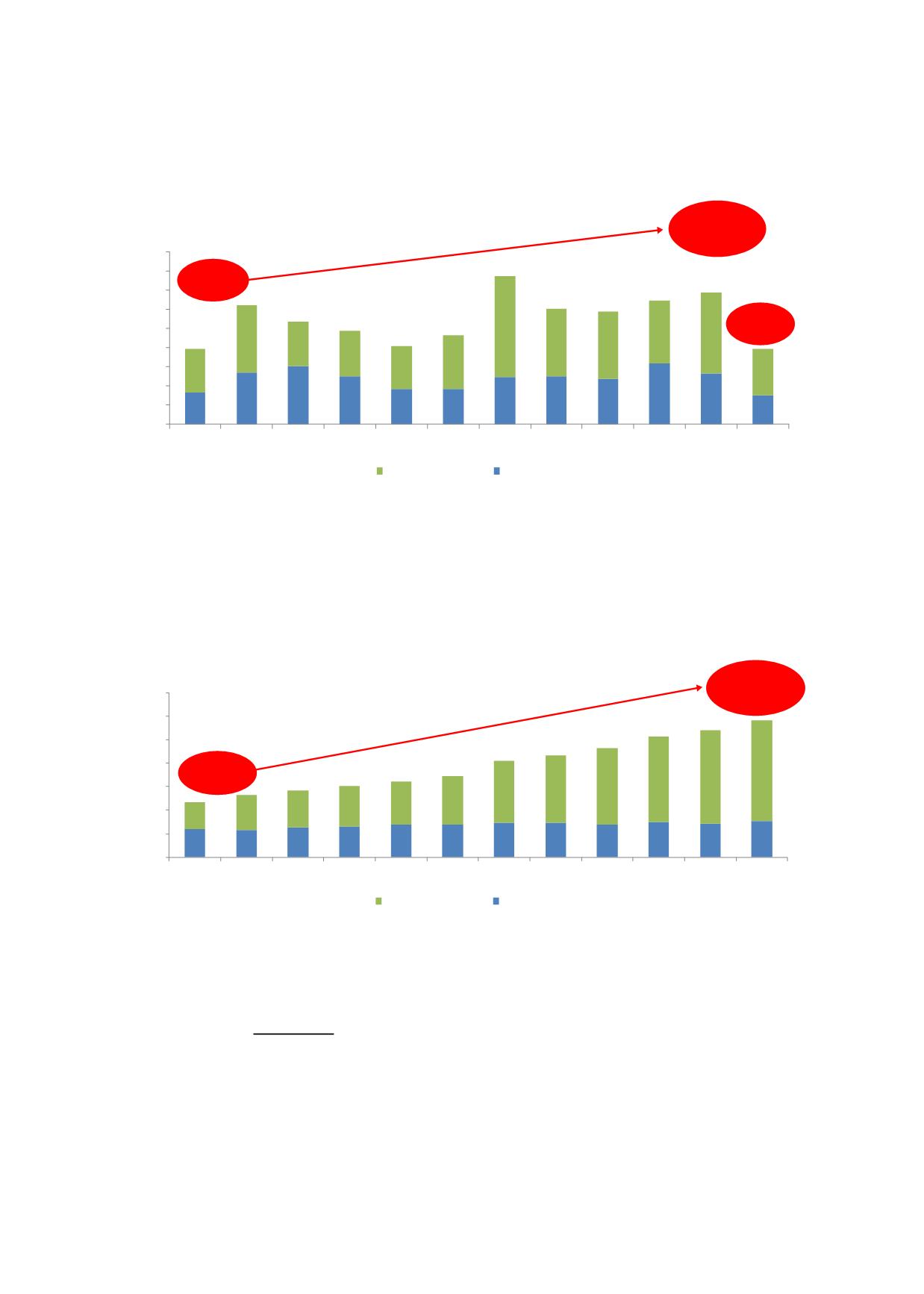

Chart 4.6: Malaysia’s Corporate Sukuk vs Conventional Issuance (2006-June 2017)

0.00

20.00

40.00

60.00

80.00

100.00

120.00

140.00

160.00

180.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June 2017

RMbillion

Sukuk issuance

Conventional issuance

RM79.3

billion

RM137.7

billion

62

%

RM78.9

billion

58

%

Source: BPAM

As at end-June 2017, sukuk issuance represented a hefty 73% of total outstanding quasi-

government and corporate bond issuance (refer to Chart 4.7). Based on our analysis, the

tipping point for the private sector to choose sukuk centres on its value proposition.

Chart 4.7: Malaysia’s Corporate Sukuk vs Conventional Outstanding (2006-June 2017)

0.00

100.00

200.00

300.00

400.00

500.00

600.00

700.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June 2017

RMbillion

Sukuk issuance

Conventional issuance

73

%

RM582.6

billion

RM232.5

billion

49

%

Source: BPAM

4.2.3

ANALYSIS OF SUKUK STRUCTURES, ISSUANCE AND INVESTMENT

Analysis of Sukuk Structures

From predominantly debt-based Shariah contracts in 2005 (refer to Chart 4.8), the market has

evolved through the last decade. Key developments include the establishment of Bursa Suq Al

Sila (BSAS) in August 2009, and the publication of the AAOIFI’s Shariah Standards in 2010.