75

market has allowed the matching of long-term, capital-intensive spending with the long-term

liquidity provided by institutions, pension funds and insurance companies, among others. As a

result, the outstanding value of Malaysia’s LCY bonds has grown exponentially, from

approximately RM143.7 billion as at end-December 1997 to RM1,251.6 billion as at end-June

2017.

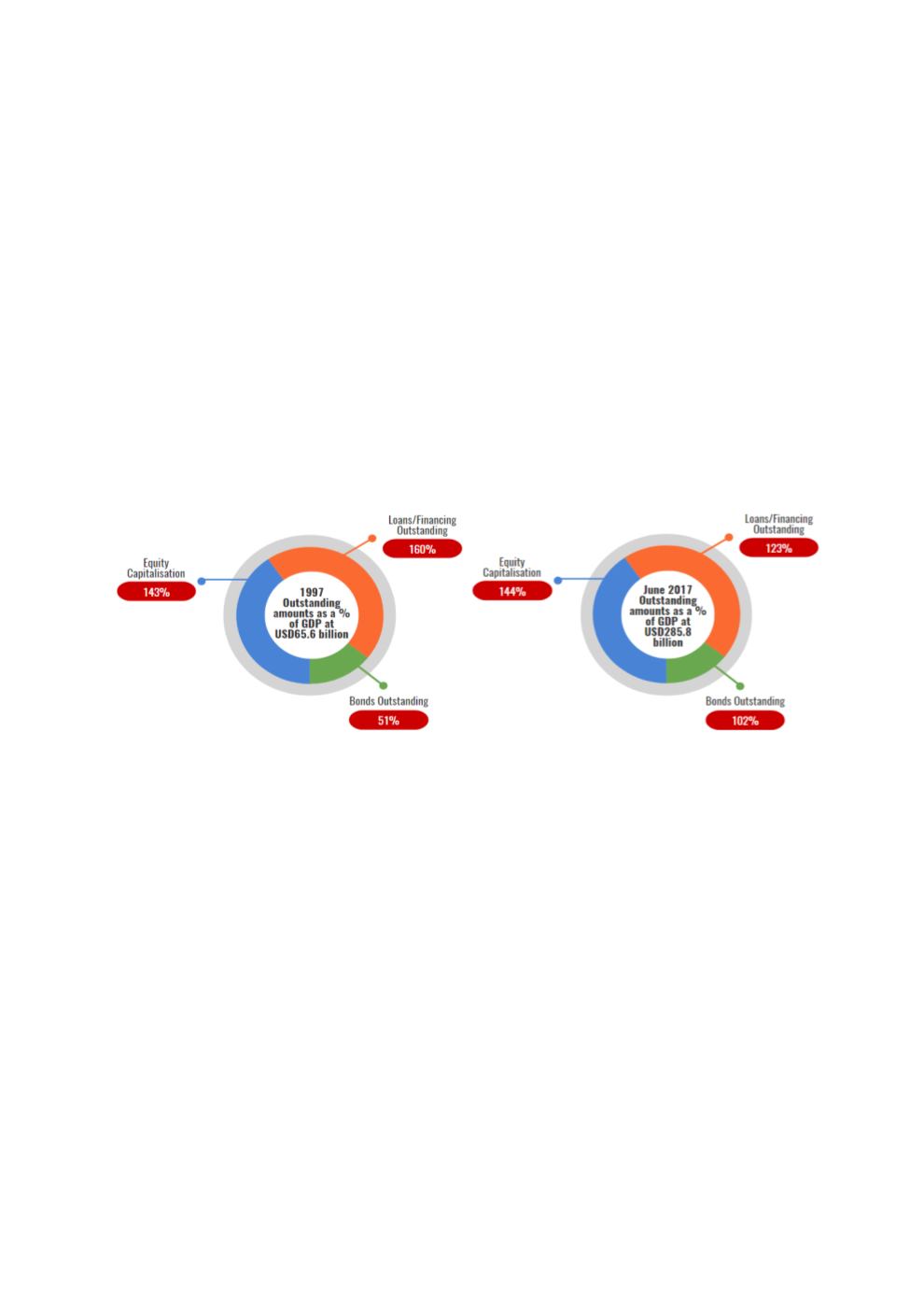

As depicted in Chart 4.2, Malaysia’s capital market and banking loans/financing position

against GDP in 1997 shows an under-developed bond market and over-dependence on bank

financing. Maturity mismatches and a sudden capital flight had pushed Malaysia into the thick

of the Asian financial crisis in 1997. As at end-June 2017, the domestic financial system

boasted a well-diversified mix of funding between the capital markets and the banking system,

which has been tested during the global financial crisis. In comparison to major financial

markets, Malaysia escaped relatively unscathed due to the strong foundation that was

established through CMP1 and CMP2 following the Asian financial crisis. Chart 4.3 outlines the

evolution of Malaysia’s bond market, which has expanded and developed steadily since 1987.

Chart 4.2: Malaysia’s Outstanding Capital Markets vs Bank Financing Relative to GDP

Sources: BNM, SC