84

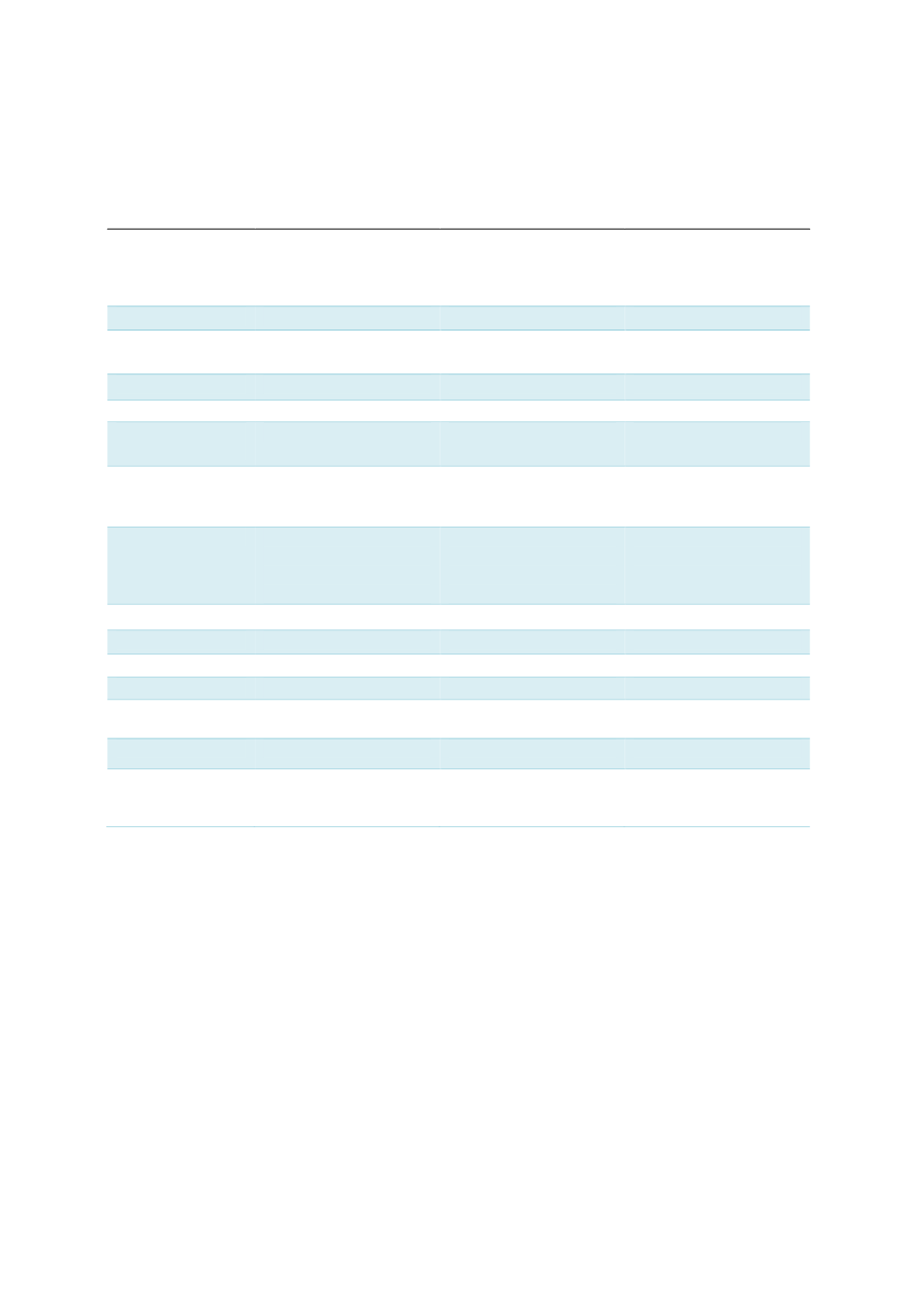

Table 4.4 provides a snapshot of benchmark corporate sukuk issued in Malaysia.

Table 4.4: A Snapshot of Benchmark Corporate Sukuk Issuances in Malaysia

Malaysia Building

Society Berhad

(First covered sukuk)

Ihsan Sukuk Berhad

(First SRI sukuk)

Tadau Energy Sdn

Bhd

(First green sukuk)

Sukuk issuer

Jana Kapital Sdn Bhd

Ihsan Sukuk Berhad

Tadau Energy Sdn Bhd

Obligor

Malaysia Building

Society Berhad

Khazanah Nasional

Berhad

Tadau Energy Sdn Bhd

Currency format

Ringgit

Ringgit

Ringgit

Structure

Murabahah

Wakalah

Ijarah, Istisna’

Obligor/sukuk

ratings

AA1 (RAM Ratings)

AAA (RAM Ratings)

AA3 (RAM Ratings)

Sukuk assets

Portfolio of securitised

assets

Tangible assets and the

commodity murabahah

investment

Solar PV Plants

Purpose

To be used for working

capital purposes,

To be used for the

purpose of funding

Shariah compliant

Eligible SRI projects

To be used to finance

the large-scale solar

project

Issue date

24 December 2013

18 Jun 2015

27 Jul 2017

Tenure

15 years

25 years

16 years

Maturity

22 December 2028

16 June 2040

27 July 2033

Amount

RM3 billion

RM1 billion

RM250 million

Period

distribution

4.4%

4.2% - 4.6%

5.0%

Listing

Not listed

Not listed

Not listed

Geographical

distribution of

investors

Domestic

Domestic

Domestic

Source: SC

Deduction of issuance costs for sukuk is one of the tax incentives provided under the

Malaysian budget. Over time and in line with the market requirement of adopting Shariah

contracts that are recognised internationally, the deduction of issuance costs moved from sale-

based contracts (particularly BBA,

bay’ al-inah

) to partnership, lease, agency and selected sale-

based contracts (i.e.

ijarah

,

musharakah

,

mudarabah

,

murabahah

based on

tawarruq

). Figure

4.3 elaborates on some tax incentives extended to Islamic financial transactions based on

Malaysia’s Budget 2018.