79

Table 4.3: Malaysia’s Budget Deficits (2014–2017f)

RM billion

2014

2015

2016e

2017f

Government revenue

220.6

219.1

212.6

219.7

Government expenditure

259.1

257.8

252.1

260.8

Budget deficit

(38.5)

(38.7)

(39.5)

(41.1)

Source: Ministry of Finance, Malaysia

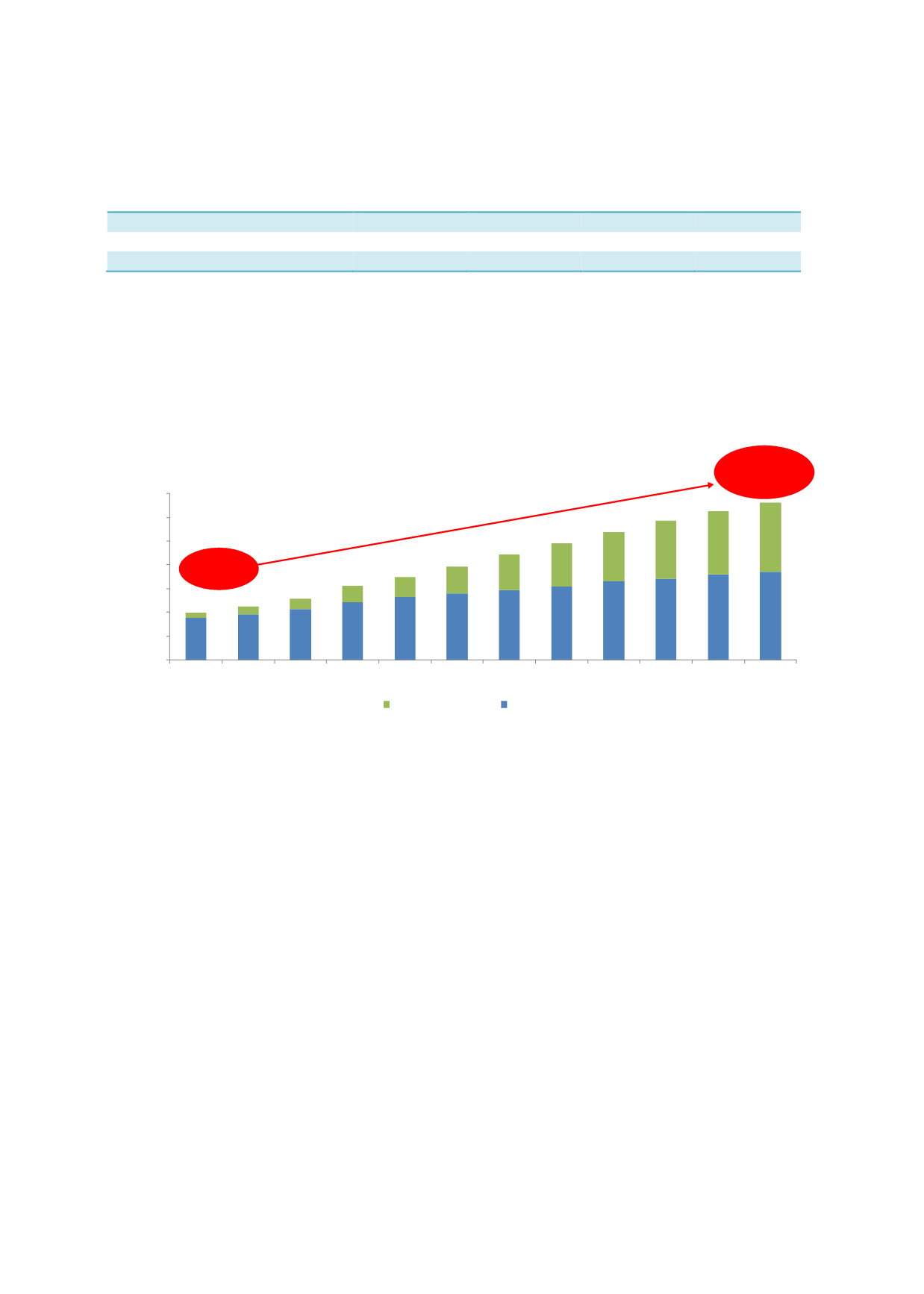

Due to the faster pace of issuance for Islamic government securities over the last decade, the

total outstanding amount of Islamic government securities has augmented from 11% (RM21.6

billion) of total issuance as at end-2006 to 44% (RM291.4 billion) as at end-June 2017, as

illustrated in Chart 4.5.

Chart 4.5: Malaysia’s Sovereign Sukuk vs Conventional Outstanding

(

2006-June 2017)

0.00

100.00

200.00

300.00

400.00

500.00

600.00

700.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016 June 2017

RMbillion

Sukuk issuance

Conventional issuance

44

%

RM662.4

billion

RM198.1

billion

11

%

Source: BPAM

Domestic Market – Private Sector Issuance

Malaysia’s economic pump-priming through infrastructure-led projects has been a boon to the

sukuk market, especially for the quasi-government and corporate sectors. Total bond issuance

by quasi-government entities and corporates swelled from RM79.3 billion as at end-2006 to a

record of RM137.7 billion a decade later. The positive momentum carried through to 1H 2017,

when total quasi-government and corporate bond issuance surged 17% y-o-y to RM78.9

billion, with sukuk accounting for 62% of the total, as illustrated by Chart 4.6.