77

In comparison to other debt markets in Asia, Malaysia’s bond market remains competitive

against the other big economies in the region, as explained in Box 4.3.

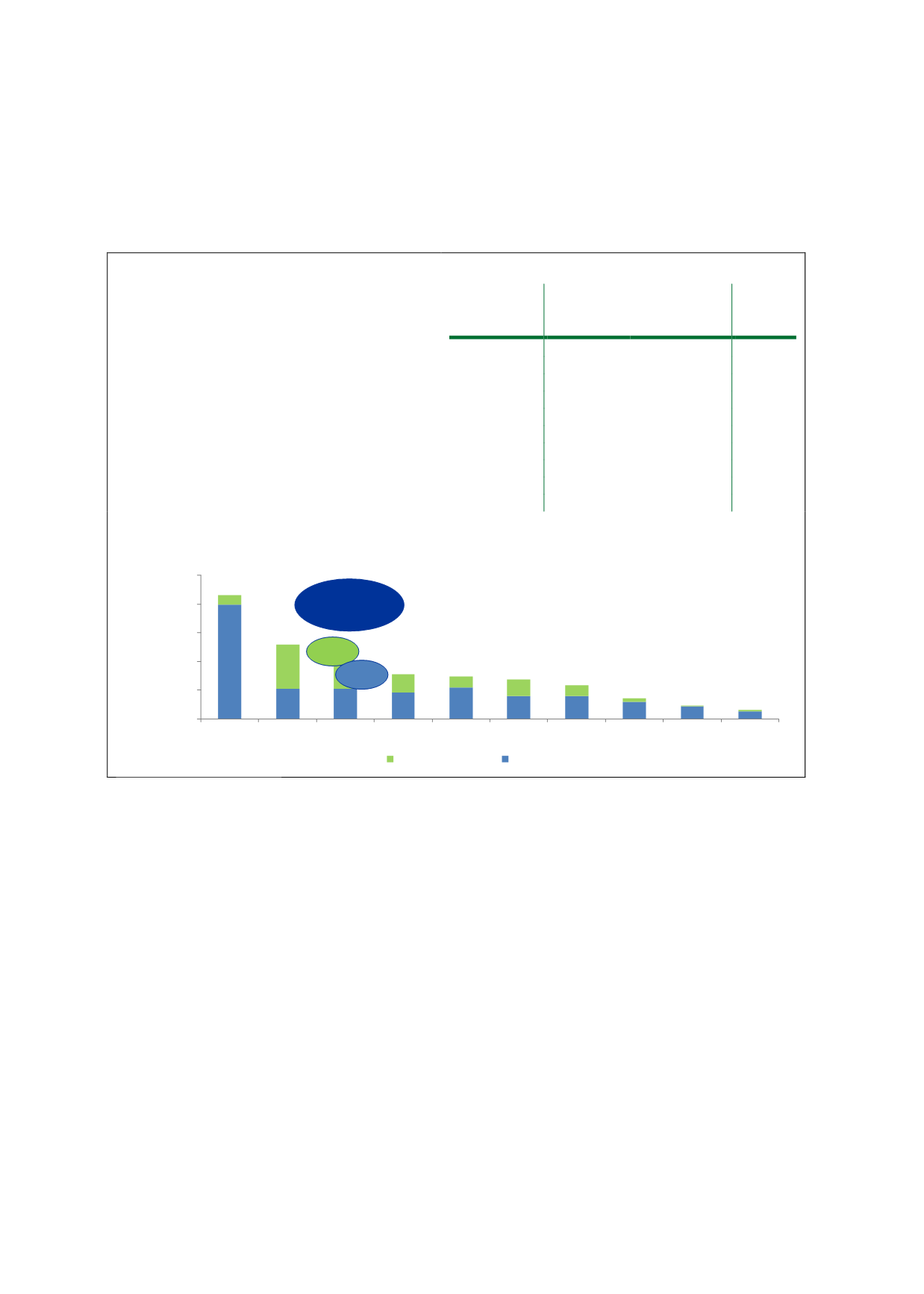

Box 4.3: Size of Selected Asian Debt Markets as at end-2016 (USD billion)

Malaysia’s sizeable corporate bond market

As a percentage of GDP, the size of Malaysia’s

bond market ranked third after those of Japan

and South Korea as at end-2016. In terms of

absolute value, the USD260.2 billion Malaysian

bond market was placed fifth after Japan, China,

South Korea and Thailand as at end-2016.

The GoM’s pragmatic approach to developing

the domestic bond market is in line with its

objective of attaining “developed nation” status

by 2020.

Corporate

bond

market

Government

bond

market

Total

Japan

670.8

8,965.8 9,636.6

China

2,155.0

4,974.0 7,129.0

Korea

1,010.9

702.0 1,713.7

Thailand

81.5

221.5

303.0

Malaysia

119.0

141.2

260.2

Singapore

99.0

137.0

236.0

Hong Kong

97.0

133.0

230.0

Indonesia

23.0

139.0

163.0

Philippines

18.0

80.0

98.0

Vietnam

2.0

42.0

44.0

Size of Selected Debt Markets Relative to GDP (as at end-2016)

0.0%

50.0%

100.0%

150.0%

200.0%

250.0%

Japan

Korea Malaysia Singapore Thailand Hong Kong China Philippines Vietnam Indonesia

%ofGDP

PrivateSector

PublicSector

Balanced

Mix

46%

54%

Source: Asian Bonds Online

4.2.2

GROWTH OF THE SUKUK MARKET IN MALAYSIA

Spurred by the success of the corporate bond market, the GoM and regulators had the foresight

to strengthen its Islamic finance ecosystem, which has propelled Malaysia into the

international financial markets as a world leader in sukuk issuance. To incentivise an already

active corporate bond market, additional fiscal and financial stimuli had been introduced, such

as a tax-neutral framework and tax deductions for sukuk issuance expenses, which have honed

sukuk’s competitive advantage against conventional bonds.

As a result, the outstanding value of sukuk issued in Malaysia shows an average annual growth

rate of 13% over the last decade, compared to 4% for conventional bonds. As at end-June

2017, the outstanding value of LCY sukuk amounted to RM718.4 billion, against RM534.0

billion for conventional bonds. Since 2014, outstanding sukuk has surpassed outstanding

bonds by more than half, and the percentage has been rising steadily as the quasi-government

and corporate sectors have been opting to issue sukuk instead of conventional bonds.