73

4.2

MALAYSIA

4.2.1

OVERVIEW OF MALAYSIA’S CAPITAL MARKETS

The financial services industry has been a key driver of Malaysia’s economic development. It is

one of the 12 national key economic areas (NKEAs) under the country’s Economic

Transformation Programme (ETP), the national strategic initiative formulated by the GoM to

elevate the country to developed-nation status by

2020.Itis also the foundation of the

Financial Sector Blueprint (FSB), the 10-year masterplan implemented by its central bank

(BNM) for the management of Malaysia’s transition towards becoming a high-value-added,

high-income economy. A key recommendation under the FSB is for Malaysia to consolidate its

success and position itself as a leading international centre and global hub for Islamic finance.

Under its financial services NKEA for Islamic finance, the GoM targets this segment to

constitute 40% of total financing in Malaysia by 2020.

As a result of the GoM’s and regulators’ (i.e. BNM and the SC) concerted efforts, Malaysia has

evolved into one of the world’s most advanced and leading ICMs. Based on our methodology

for this report, we have placed Malaysia under the “matured” category due to its

comprehensive Islamic finance ecosystem, which underscores the country’s position the

world’s largest market for sukuk issuance, with 48.0% (USD15.4 billion) of total global sukuk

issues. Since Malaysia’s first sukuk issue in 1990, this financing tool has spurred its economic

growth, channeling domestic financial resources towards infrastructure development and as a

key component of the GoM’s budget management.

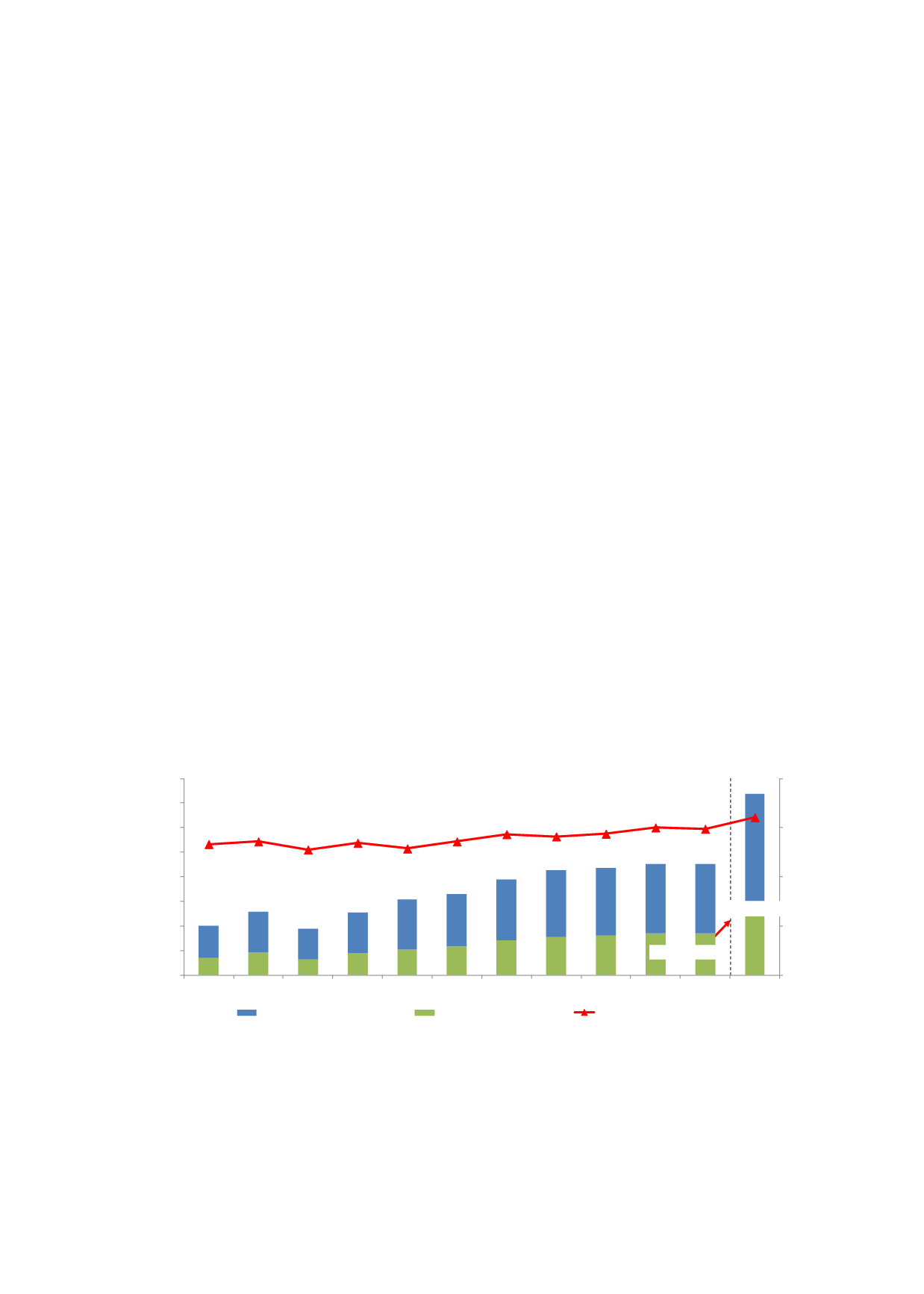

Malaysia’s ICM commanded the lion’s share of 60% of the entire capital market as at end-2016,

compared to 53% a decade earlier, as shown in Chart 4.1.

Chart 4.1: Growth of Malaysia’s ICM over a 10-Year Period

RM1.7 trillion

RM2.9 trillion

53

%

60

%

64

%

0%

20%

40%

60%

80%

-

1,000.00

2,000.00

3,000.00

4,000.00

5,000.00

6,000.00

7,000.00

8,000.00

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2020e

RMbillion

Total capital market

Total size of ICM

% ICM to total capital market

Sources: BNM, SC

Note: Based on the SC’s definition, the size of the ICM is equivalent to the total market capitalization of Shariah-

compliant securities and the amount of outstanding sukuk.

Malaysia’s capital markets have been developed through the recommendations mapped out in

the SC’s Capital Market Masterplan 1 (2001-2010) and Capital Market Masterplan 2 (2010-