The Role of Sukuk in Islamic Capital Markets

54

Table 3.4: GCC Countries’ Budget Deficits (2014-2017f/ USD billion)

Country

2014

2015

2016

2017f

Saudi Arabia

(25.9)

(102.9)

(84.5)

(56.4)

Qatar

25.3

1.9

(11.9)

(18.3)

Kuwait

13.7

(19.6)

(15.0)

(9.6)

United Arab Emirates

19.7

(7.7)

(14.4)

(7.8)

Oman

(2.7)

(11.6)

(12.5)

(7.5)

Bahrain

(1.2)

(4.0)

(4.6)

(4.2)

Total

28.9

(143.9)

(143.0)

(103.8)

Source: RAM (2017, March)

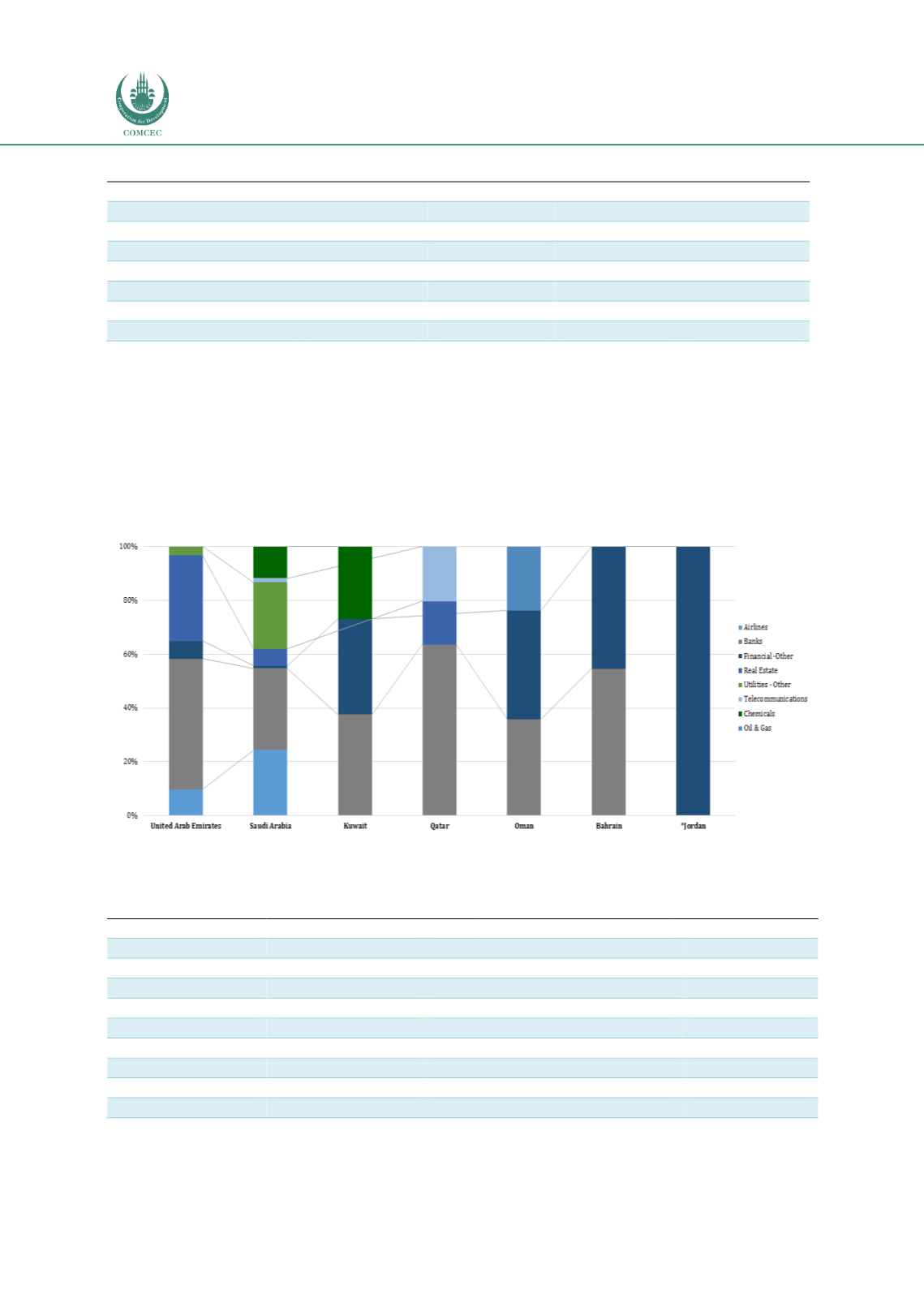

The GCC countries boast a healthy pipeline of corporate sukuk issuances, predominantly

driven by Islamic financial institutions and government-related entities. Only Saudi Arabia has

provided some diversification into other corporate sectors (i.e. aerospace, chemical, food

processing, industrial, and O&G). Chart 3.7 shows corporate sukuk issuances based on a sector

by the GCC countries and Jordan. Tables 3.5 and 3.6 indicate the number of domestic and

international sukuk issuances by Arab countries from 2001 to 2006.

Chart 3.7: Quasi-Government and Corporate Sukuk Issuances by Sector (2011-June 2017)

Sources: Bloomberg, Eikon Thomson Reuters*

*Data extracted from Eikon Thomson Reuters is for Jordan only

Table 3.5: Arab Countries – Number of Domestic Sukuk Issuances by Country (2001-2016)

Country

Number of sukuk issues

Amount (USD million)

% of total value

Bahrain

265

14,748

19.3

Jordan

3

272

0.4

Kuwait

1

332

0.4

Oman

3

825

1.2

Qatar

16

14,416

18.9

Saudi Arabia

52

37,179

48.7

UAE

14

8,251

10.8

Yemen

2

253

0.3

Total

356

76,276

100.0

Source: IIFM (2017, July)