The Role of Sukuk in Islamic Capital Markets

58

The GoM’s concerted efforts to include Islamic banking and Islamic finance as policy tools in its

economic agenda have been the driving force behind the country’s rise in the mainstream

financial markets. The successful inclusion of Islamic finance lends considerable strength

towards building a sustainable sukuk pipeline, not only in meeting the government’s

budgetary requirements but also by quasi-government entities and corporates. Malaysia’s

financial institutions and infrastructure sector are believed to remain the lynchpins for future

large sukuk transactions due to their financing needs, which are better matched by domestic

institutional investors’ appetite for long-term assets.

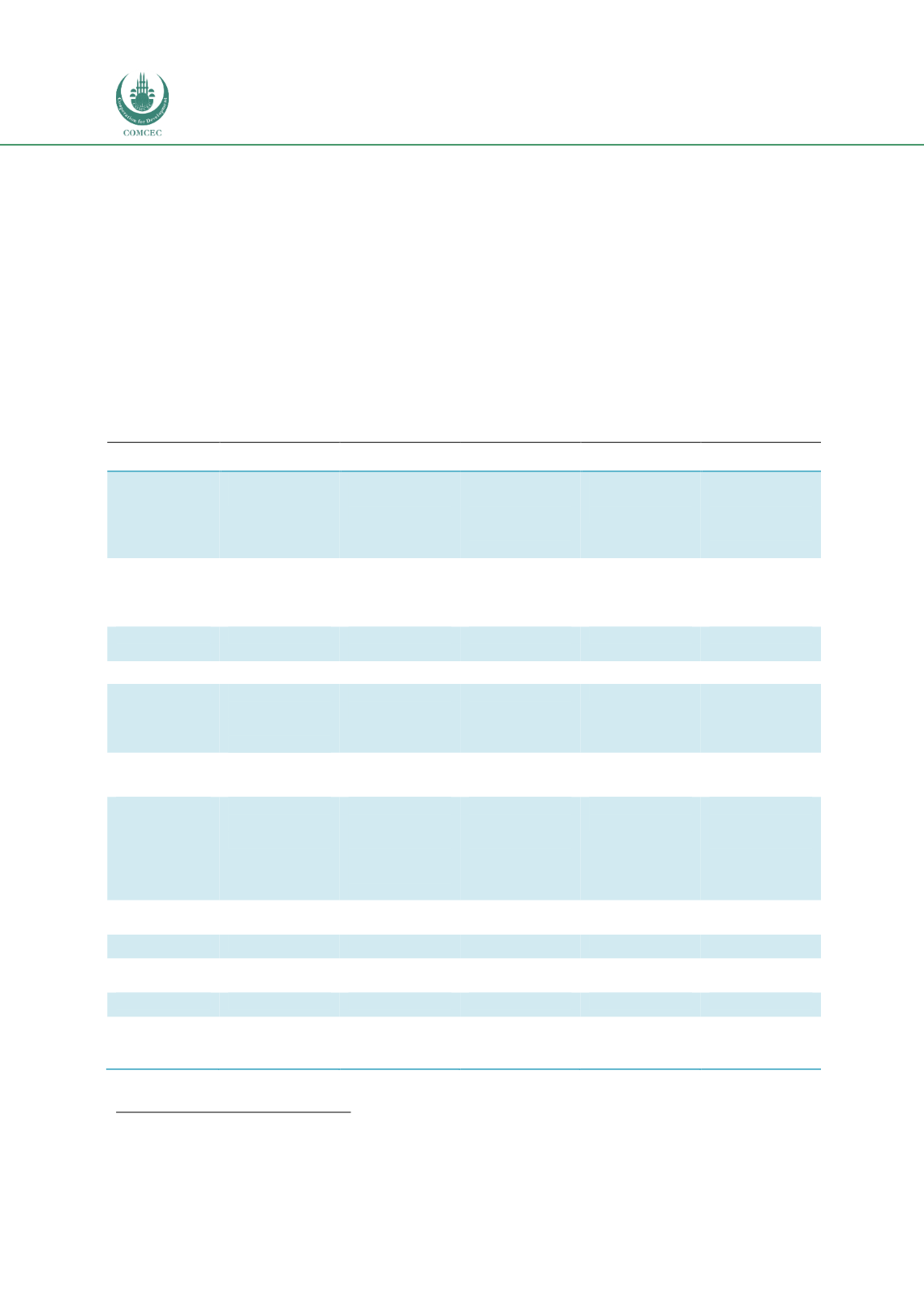

Apart from Malaysia, other Asian countries particularly Indonesia and Pakistan are steadily

increasing their volume of issuances. Table 3.10 gives an overview of selected sukuk issued by

some Asian countries.

Table 3.10: A Snapshot of Selected Sukuk Issuances by Asian Countries

Malaysia

Indonesia

Pakistan

Brunei

Japan

Sukuk issuer

Axiata SPV2

Bhd

Tiga Pilar

Sejahtera Food

Tbk PT

Neelum Jhelum

Hydropower

Company

(Private)

Limited

Brunei

Darussalam

April 2017

Bank of Tokyo-

Mitsubishi UFJ

(Malaysia)

Berhad

(“BTMUM”)

Originator/

Obligor

Axiata Group

Berhad

Tiga Pilar

Sejahtera Food

Tbk PT

Neelum-Jhelum

Hydropower

Company

(NJHPC)

Government of

Brunei

The Bank of

Tokyo-

Mitsubishi (UFJ)

Currency

format

US Dollar

Indonesian

Rupiah

Pakistani Rupee Brunei Dollar

Japanese Yen

Structure

Wakalah

Ijarah

Musharakah

Ijarah

Wakalah

Sukuk ratings

Baa2 (Moody’s),

Baa2 (S&P) –

International

rating

id

A (Pefindo)-

Domestic rating

AAA (JCR-VIS) -

Domestic rating

AAA (RAM

2

)

AAA (RAM)

Sukuk assets

Airtime

vouchers

n.a

n.a

n.a

Shariah-

compliant asset

Purpose

To improve its

capital

efficiency

To refinance its

outstanding

debt and

finance its rice

mill

construction

Finance

hydropower

project

To diversify

their portfolio

To diversify

their funding

sources

Issue date

13 November

2015

19 July 2016

21 April 2016

28 April 2016

25 September

2014

Tenure

5 years

5 years

10 years

1 year

10 years

Maturity

13 November

2020

19 July 2021

21 April 2026

13 April 2017

25 September

2024

Amount

USD500 million

IDR1.5 trillion

PKR100 billion

BND100 million

JPY2.5 billion

Period

distribution

3.466%

10.0-10.75%

0, 113 basis

points over the

6-month KIBOR

1.03%

n.a

2

RAM’s country rating for Brunei, as of 13 Dec 2016