The Role of Sukuk in Islamic Capital Markets

50

3.3.4

NON-OIC COUNTRIES

In 2014, the UK became the first government from the West to tap the sukuk market. Since

then, other non-OIC countries (e.g. France and Luxembourg) have joined the ranks in making

tax-related adjustments in support of sukuk issuance. The rationale behind these sukuk

issuances is to provide financial intermediation and support to the Islamic financial services

industry, as a complementary activity to their existing positions as international hubs in their

respective jurisdictions. Table 3.3 gives a snapshot of sovereign

ijarah

sukuk issued by

selected non-OIC countries. Meanwhile, Figure 3.5 illustrates the

ijarah

sukuk structure used

in the UK’s sovereign sukuk issuance.

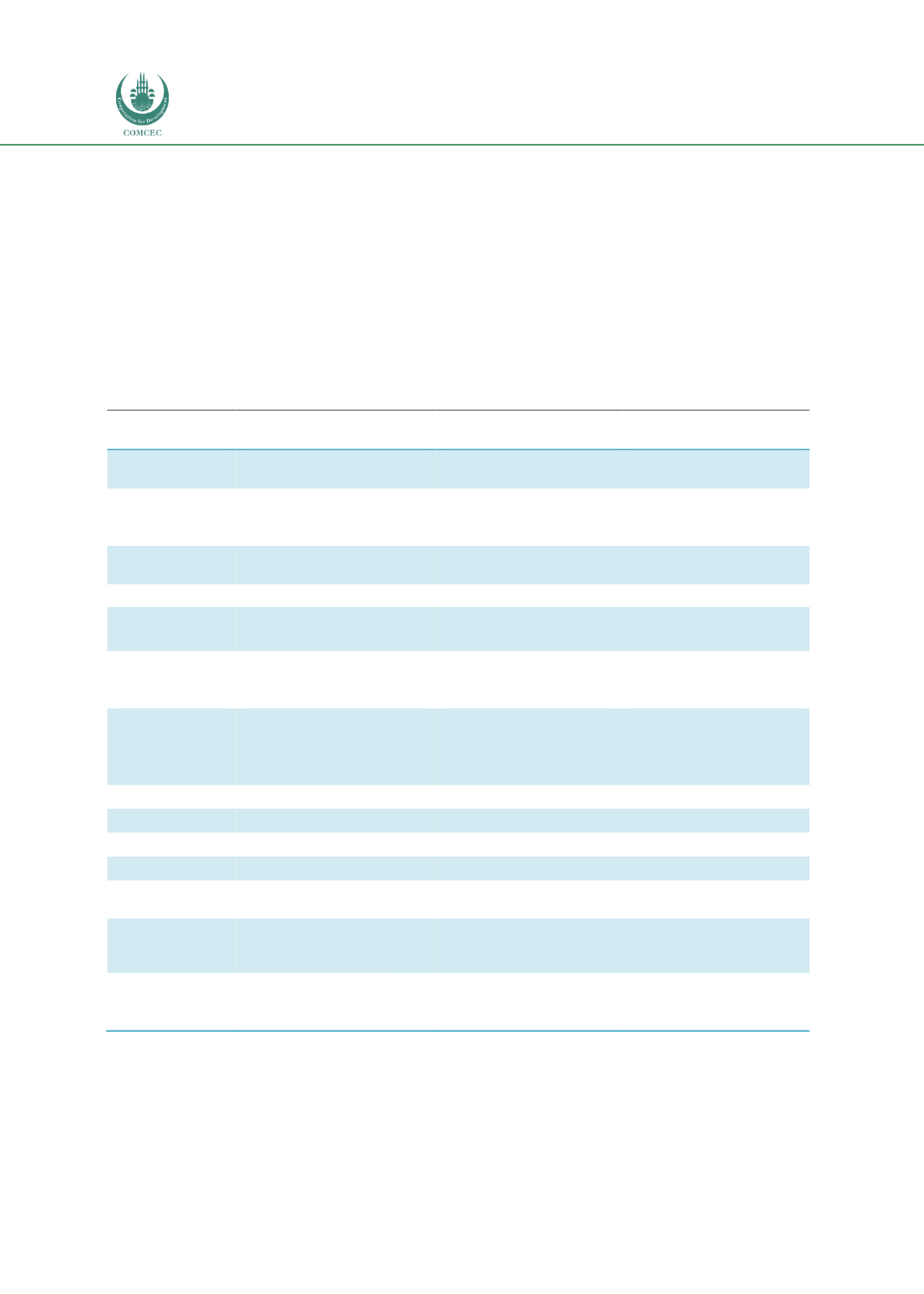

Table 3.3: A Snapshot of Sovereign Ijarah Sukuk Issuances by Selected Non-OIC Countries

United Kingdom

Luxembourg

Saxony Anhalt

(Germany)

Sukuk issuer

HM Treasury UK

sovereign sukuk PLC

Luxembourg Treasury

Securities SA

Stichting Sachsen-

Anhalt Trust

Originator

Government of United

Kingdom

Grand Duchy of

Luxembourg

Federal State of Saxony-

Anhalt (through the

Ministry of Finance)

Currency

format

Pound

Euro

Euro

Structure

Ijarah

Ijarah

Ijarah

Obligor/sukuk

rating(s)

Unrated

AAA (S&P), Aaa

(Moodys)

AAA (Fitch), AA-

(Standard & Poor’s)

Sukuk assets

Government buildings

and land

Government buildings

and land

Specific buildings

owned by the Ministry

of Finance

Purpose

Proceeds from the sukuk

paid for the premium for

the 99-year lease on the

premises

To finance government

spending

General budgetary

purposes

Issuance date

2 July 2014

7 October 2014

August 2004

Tenure

5 years

5 years

5 years

Maturity

22 July 2019

7 October 2019

August 2009

Amount

GBP200 million

EUR200 million

EUR100 million

Period

distribution

2.036%

0.436%

6-month EURIBOR + 1

bps

Listing

London Stock Exchange

Luxembourg Stock ExchangeLuxembourg Stock

Exchange

Geographical

distribution of

investors

Middle East, Asia and

Britain

n/a

n/a

Sources: Offering Circular of HM Treasury UK sovereign sukuk PLC, Prospectus of Luxembourg Treasury Securities

SA, Structure Document of Stichting Sachsen-Anhalt Trust