The Role of Sukuk in Islamic Capital Markets

49

3.3.3

AFRICAN COUNTRIES

In the African region, The Gambia, Sudan, Nigeria, Senegal, South Africa, Togo and Ivory Coast

have successfully issued sukuk. Sukuk as an alternative tool of financing is gaining traction and

greater awareness in the African region, where requirements for infrastructure funding are

high. According to the World Bank, the continent’s infrastructure gap needs a significant

amount of investment to the tune of USD93.0 billion (International Financial Law Review,

2015). Governments all over the world generally finance their development and infrastructure

budgets through tax and other revenue (including by borrowing from the capital markets

through the issuance of various types of financial papers). Given the persistent commodity

price slump affecting extractive industries, African governments are now receiving

significantly less income from their traditional base of natural resources. As a result,

alternative sources of finance are required to fund the capital projects necessary to spur

economic growth and diversify their economies.

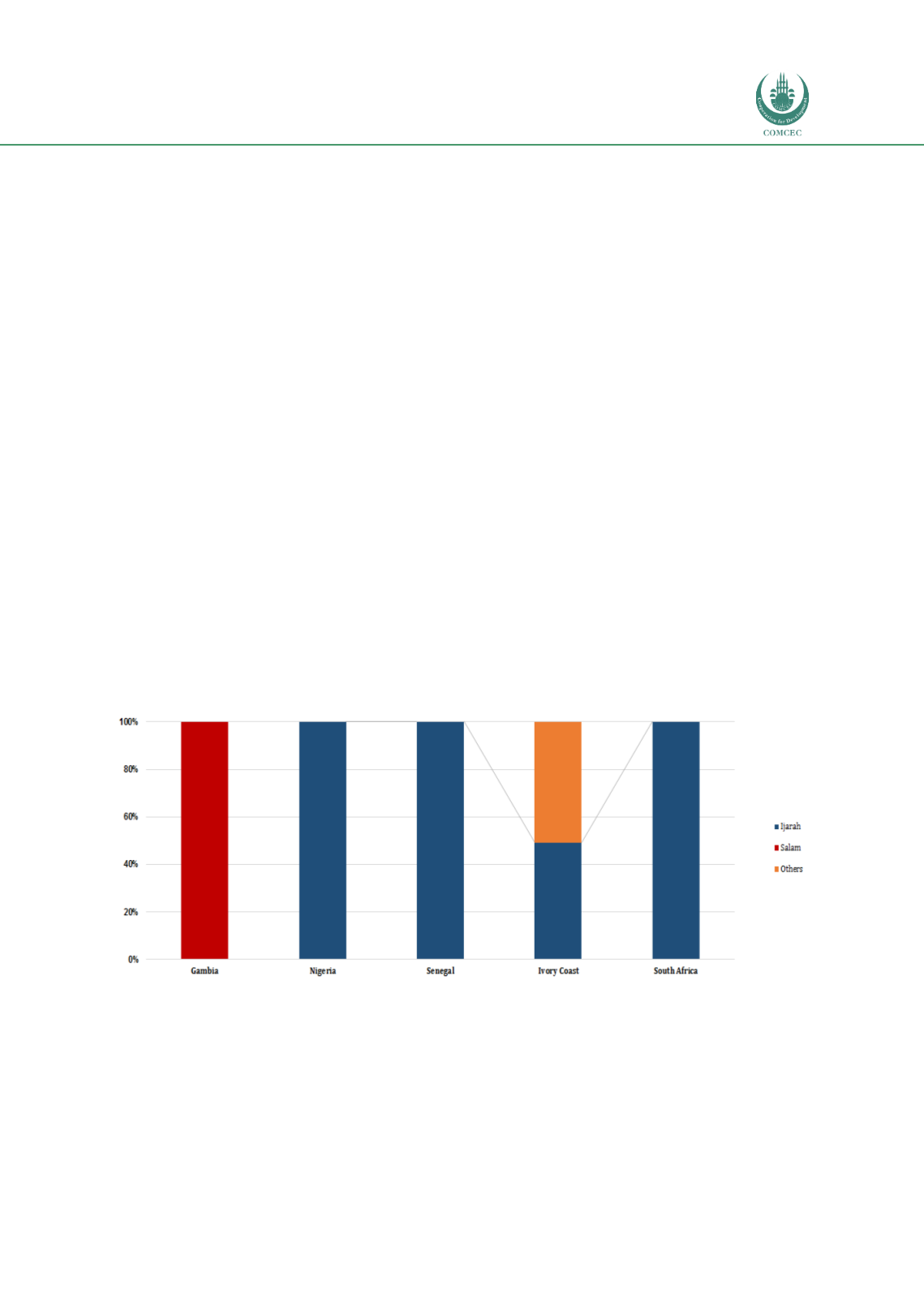

The Gambia’s

salam

sukuk have predominantly been used by the Central Bank of Gambia for

short-term liquidity management. For other selected African countries, since sukuk issuance

proceeds have been used for infrastructure-related funding, the complementary sukuk

principle has been

ijarah

. The reasons given by market players include the simplistic features

in terms of flexibility, tradability and suitability in funding construction projects. Unlike the

murabahah

structure, the

ijarah

structure enables secondary trading of the sukuk instrument

on an exchange, which in turn helps increase investors’ participation in the transaction.

Additionally, the

ijarah

contract is inherently designed to produce periodic rental payments,

which automatically act as coupon payments to sukuk investors. Chart 3.5 delineates the main

Shariah contracts used by selected African countries in their sovereign sukuk structures.

Chart 3.5: Selected African Sovereign Issuances by Shariah Contracts (2013-June 2017)

Source: Eikon-Thomson Reuters