The Role of Sukuk in Islamic Capital Markets

53

3.4

A COMPREHENSIVE ASSESSMENT OF SUKUK ISSUANCES – SUPPLY (SELL

SIDE)

3.4.1

ARAB REGION

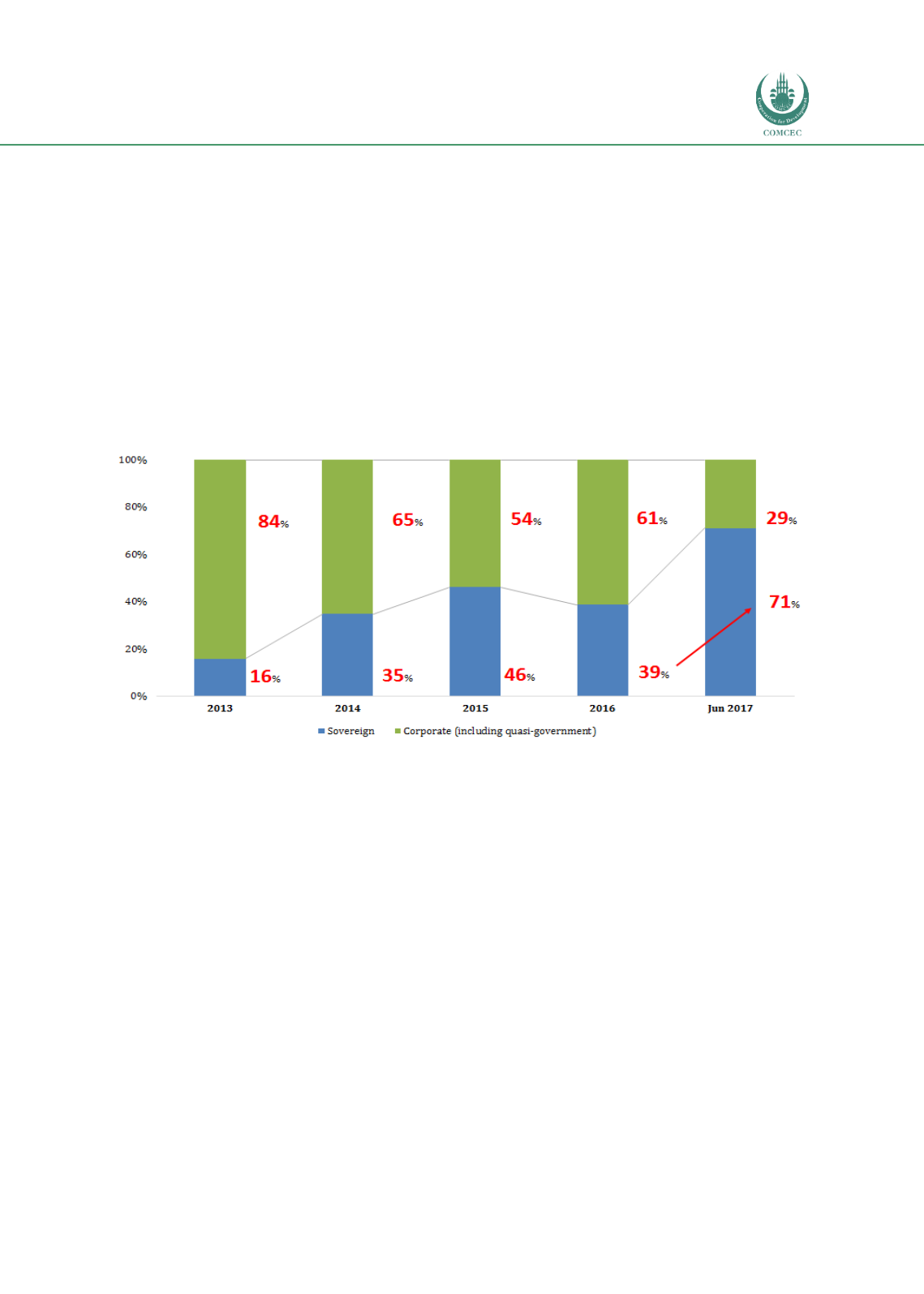

As at end-2016, corporate sukuk issuance accounted for 61.0% of total issuances by Arab

nations; the other 39.0% originated from the public sector. In 1H 2017, there was a shift

towards greater sukuk issuance by sovereigns due to Saudi Arabia’s inaugural international

USD9.0 billion sukuk in April. This segment expanded further in line with Saudi Arabia’s 3-

tranche domestic sukuk programme amounting to SAR17 billion in July 2017. Chart 3.6

illustrates the percentage of sovereign, quasi-government and corporate sukuk issuances by

the GCC countries and Jordan between 2013 and June 2017.

Chart 3.6: GCC’s and Jordan’s Sovereign and Corporate Sukuk Issuance (2013–June 2017)

Sources: Bloomberg, Eikon Thomson Reuters*

*Data extracted from Eikon Thomson Reuters is for Jordan

In the last 5 years following the plunge in oil prices, the sovereigns of Bahrain, the UAE and

Qatar have been actively issuing LCY and FCY sukuk for budget financing purposes (refer to

Table 3.4 on the GCC’s budget deficits). In 2017, Oman and Saudi Arabia made their debut in

sukuk issuance, after having raised conventional bonds in recent years, due to the urgent need

to plug their budget deficits amid the impact of weak oil prices. In April 2017, Kuwait followed

its neighbours in raising debt, but chose an international conventional bond to build is first

yield benchmark (Euromoney, 2017). Given the persistently low oil prices and the funding

requirements to bridge budget deficits, we believe the GCC sovereigns will continue combining

sukuk with conventional funding methods. In the GCC, the decision on whether sovereigns

should issue bonds or sukuk is first determined by the targeted investor base, followed by the

ease of the sukuk structure and Islamic finance strategy, since the structuring of sukuk is more

complex and time-consuming compared to traditional bonds (Gulf News Banking, 2017).