The Role of Sukuk in Islamic Capital Markets

57

3.4.2

ASIAN REGION

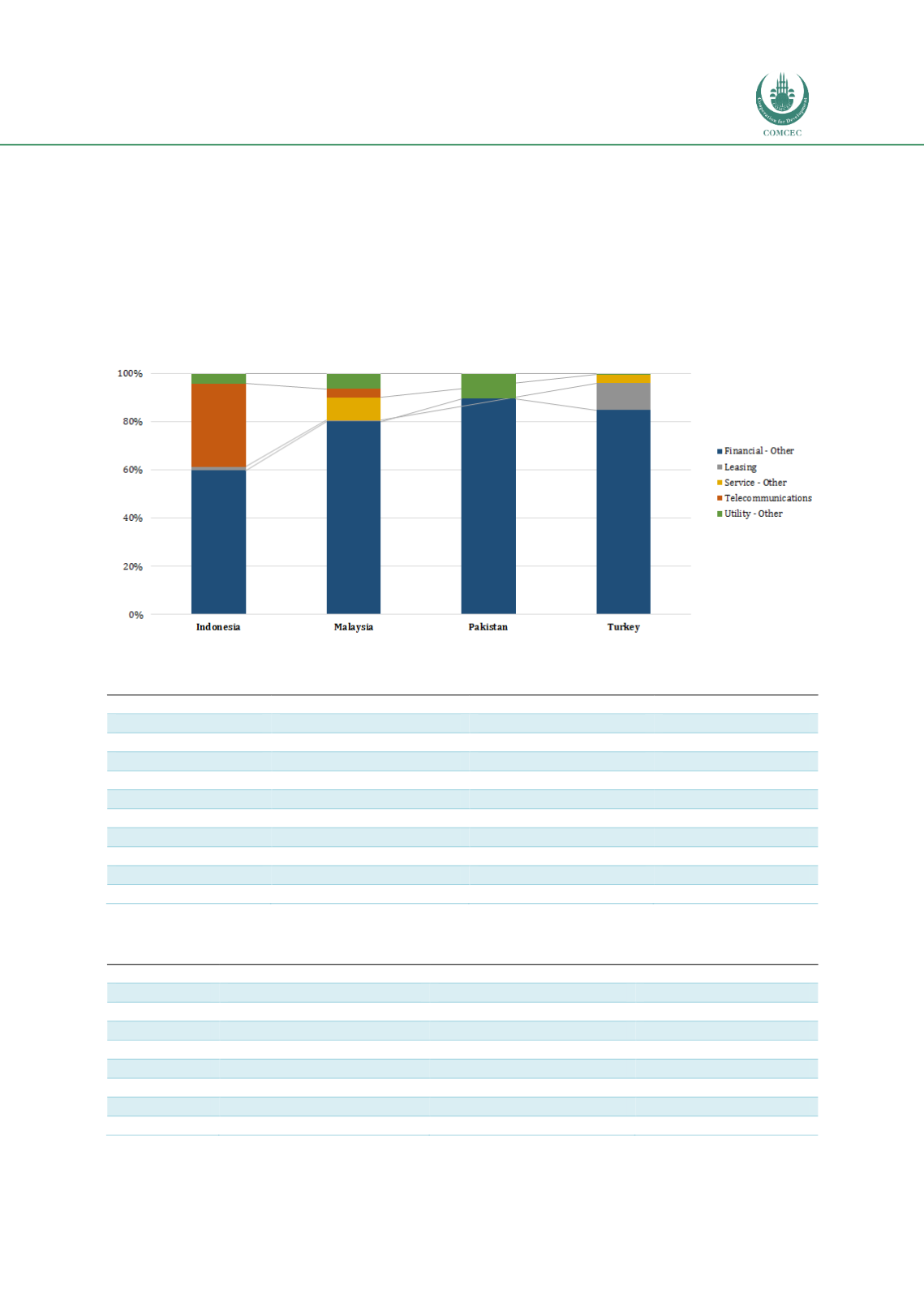

By sector, financial institutions have been the core sector raising sukuk to meet capital

adequacy requirements. Sectoral diversification can be observed in quasi-government and

corporate sukuk issuances originated in Indonesia and Malaysia (refer to Chart 3.8). In terms

of the number of issues and amount, however, Malaysia stands above its peers, as illustrated in

Tables 3.8 and 3.9. Elsewhere, sukuk issuances from Bangladesh, Hong Kong and Brunei have

all been by their governments and central banks.

Chart 3.8: Quasi-Government and Corporate Sukuk Issuances by Sector (2011-June 2017)

Source: Eikon-Thomson Reuters

Table 3.8: Asian Countries − Number of Domestic Sukuk Issuances by Country (2001-2016)

Country

Number of sukuk issues

Amount (USD million)

% of the total value

Bangladesh

4

37

0.0

Brunei Darussalam

137

8,829

1.6

Indonesia

195

31,822

5.6

Iran

1

144

0.0

Malaysia

5,106

515,662

90.6

Maldives

1

3

0.0

Pakistan

71

12,006

2.1

Singapore

12

788

0.1

Sri Lanka

1

3

0.0

Total

5,528

569,295

100.0

Source: IIFM (2017, July)

Table 3.9: Asian Countries – International Sukuk Issuances by Country (2001-2016)

Country

Number of sukuk issues

Amount (USD million)

% of the total value

China

1

97

0.2

Hong Kong

4

2,196

3.6

Indonesia

13

10,503

17.2

Japan

3

190

0.3

Malaysia

73

44,854

73.3

Pakistan

3

2,600

4.2

Singapore

4

711

1.2

Total

101

61,151

100.0

Source: IIFM (2017, July)