60

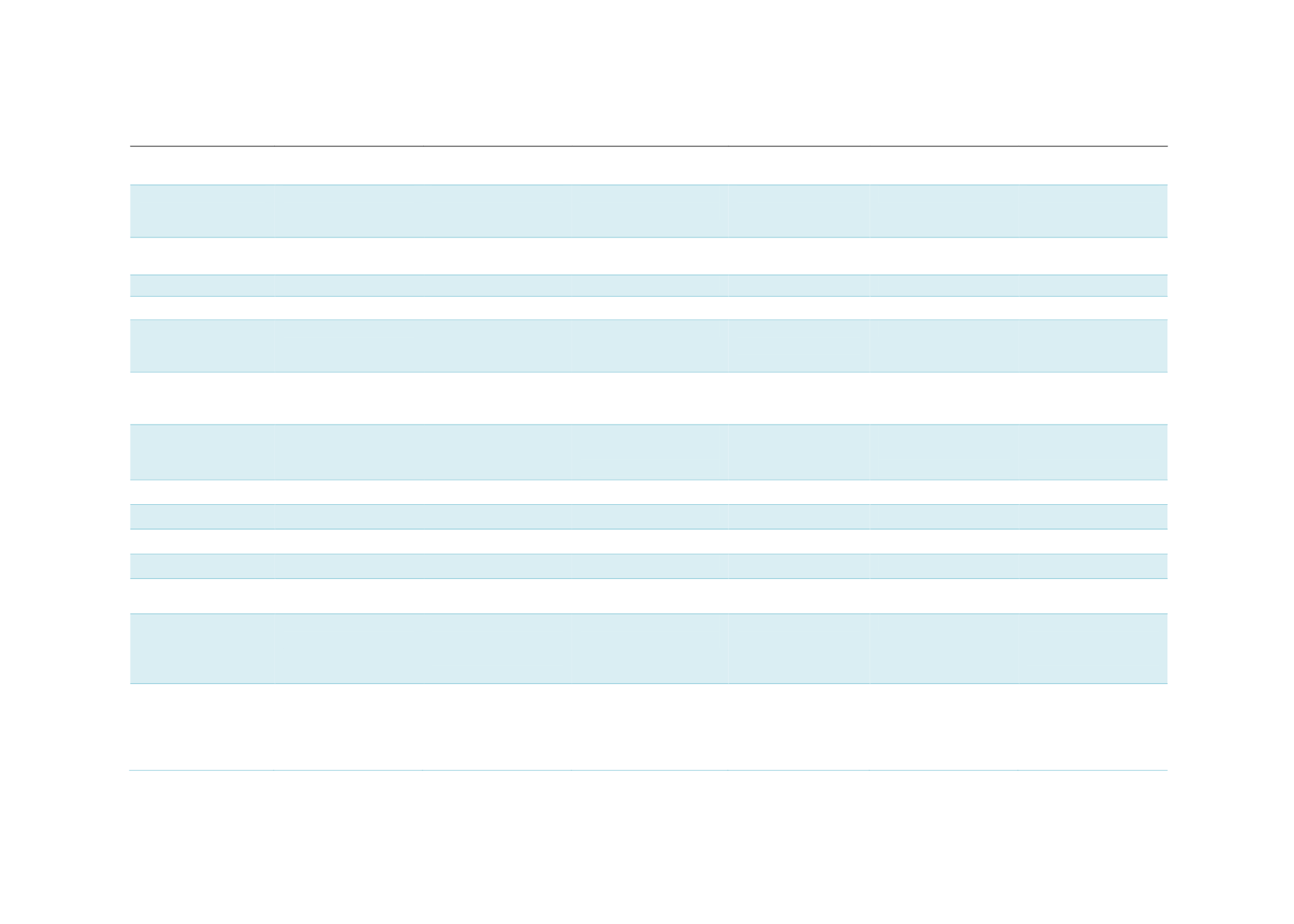

Table 3.11: A Snapshot of Selected Sukuk Issuances by African Countries

Osun State of

Nigeria

Nigeria

Senegal

South Africa

Cote d-Ivoire

(Ivory Coast)

Togo

Sukuk Issuer

Osun Sukuk

Company Plc

FGN Roads Sukuk

Company 1 Plc

FCTC Sukuk Etat du

Senegal

ZAR Sovereign

Capital Fund

Proprietary Ltd

FCTC

FCTC

Originator/

Obligor

State Government of

Osun, Nigeria

Federal Government

of Nigeria

Government of

Senegal

Government of

South Africa

Government of Ivory

Coast

Government of Togo

Currency Format

Naira

Naira

CFA

US dollar

CFA

US dollar

Structure

Ijarah

Ijarah

Ijarah

Ijarah

Ijarah

Ijarah

Sukuk Rating(s)

Bb+ (Agusto & Co),

A (Agusto & Co)

Not rated

Not rated

BBB- (S&P), Baa1

(Moody’s), BBB

(Fitch)

n/a

n/a

Sukuk Asset(s)

Elementary, middle

and high schools

Public road

Usufruct of 3

buildings

Usufruct of

government land

Usufruct of 2

building complexes

in Abidjan

n/a

Purpose

Construct schools

Finance road

projects

Finance economic

and social

development projects

Repay maturing

debts

Finance

development

projects

Finance

development

projects

Issuance Date

10 October 2013

22 September 2017

18 July 2014

September 2014

21 December 2015

10 August 2016

Tenure

7 years

7 years

4 years

5 years 9 months

5 years

10 years

Maturity

10 October 2020

22 September 2024

18 July 2018

17 June 2020

21 December 2020

10 August 2026

Amount

Naira11.4 billion

Naira100.0 billion

CFA100.0 billion

USD500.0 million

CFA150.0 billion

CFA150.0 billion

Periodic

distribution

14.75%

16.47%

6.25%

3.90%

5.75%

6.5%

Listing

Nigerian Stock

Exchange

Nigerian Stock

Exchange, FMDQ

OTC Securities

Exchange

Regional Securities

Stock Exchange

Luxembourg Stock

Exchange

West Africa bourse

Bourse Régionale

des Valeurs

Mobilières

Geographical

Distribution of

Investors

Domestic investors

Domestic investors

West Africa (74%),

Middle East (24%),

Central Africa (1%),

Europe (1%), North

Africa (0.1%)

Middle East and

Asia (59%), Europe

(25%), US (8%),

Others (8%)

West Africa (56%),

Middle East (38%),

North Africa (8%)

n/a

Sources: Islamic Finance News (March 2016), Thomson Reuters (October 2016),

Lexology

(January 2017)