The Role of Sukuk in Islamic Capital Markets

51

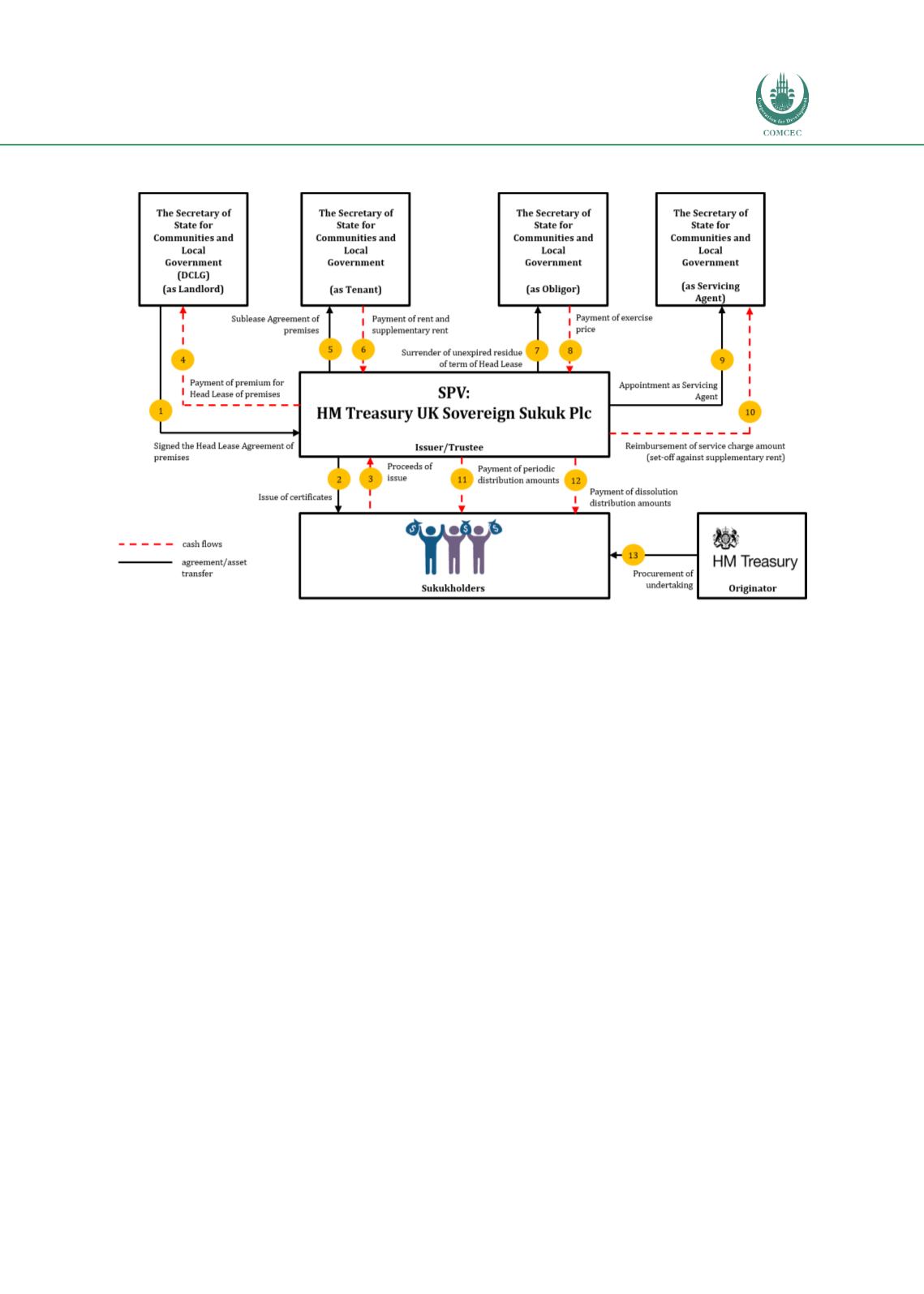

Figure 3.5: HM Treasury UK Sovereign Sukuk Plc –Ijarah Sukuk Structure

Source: HM Treasury UK Sovereign Sukuk Plc Offering Circular (30 June 2014)

3.3.5

ANALYSIS OF SUKUK STRUCTURES ISSUED BY OIC AND NON-OIC COUNTRIES

The difference in the types of Shariah contracts frequently adopted in Malaysia

(predominantly

murabahah

) compared to other countries is due to the varying opinions of

Shariah experts. For example, trading of debt or

bay’ al-dayn

is a common practice in Malaysia

following the SAC of the SC’s acceptance of the principle of

bay’ al-dayn

as one of the concepts

for the development of Malaysia’s ICM instruments in August 1996 (Securities Commission

Malaysia, 2007).

Unlike

ijarah

or equity-based Shariah contracts, which represent beneficial interests or rights

over an asset or equity venture, sale-based sukuk denotes the sukuk holders’ rights to receive

payments under the

murabahah

sale price, which is essentially a debt. The argument by the

SAC of the SC on the permissibility of

bay’ al-dayn

is explained in the Resolutions of the SC’s

SAC, which state that there is no general

nas

or consensus (

ijma’

) among Islamic jurists to

forbid it. This proactive approach has facilitated Malaysia’s success in attracting corporate

issuers that face problems in securing the requisite assets to meet the sukuk guidelines.

Some Shariah scholars may view Malaysia’s approach as accommodative. However, market

practitioners believe a balance between commercial reasoning and Shariah requirements is

pertinent to building the necessary base for a strong ICM. The tightening of Shariah

governance will always be an ongoing development as a domestic sukuk market grows in line

with international best practices that satisfy globally accepted Shariah requirements.

As described earlier in Box 3.4, the AAOIFI’s Shariah standards on sukuk, any trading of sukuk

must be backed by tangible assets. Accordingly, almost all sovereign sukuk issues have opted