The Role of Sukuk in Islamic Capital Markets

47

countries in this grouping, only Hong Kong has returned to the debt market 3 times, to expand

its Islamic finance reach in building its sukuk benchmark yield curves.

In Malaysia, the resolutions by the SAC of the SC have become the overarching guide in the

interpretation of Shariah principles, which have facilitated product development and the

structuring of innovative financial instruments in its ICM. The top-down approach by the

government and the regulators in implementing a centralized SAC within the SC had been a

foresight that has turned Malaysia’s financial landscape into a successful dual-banking model.

The resolutions and the Islamic Securities Guidelines are aimed at enabling and developing a

more innovative and sophisticated ICM, as well as facilitating the introduction of a wider range

of Islamic instruments.

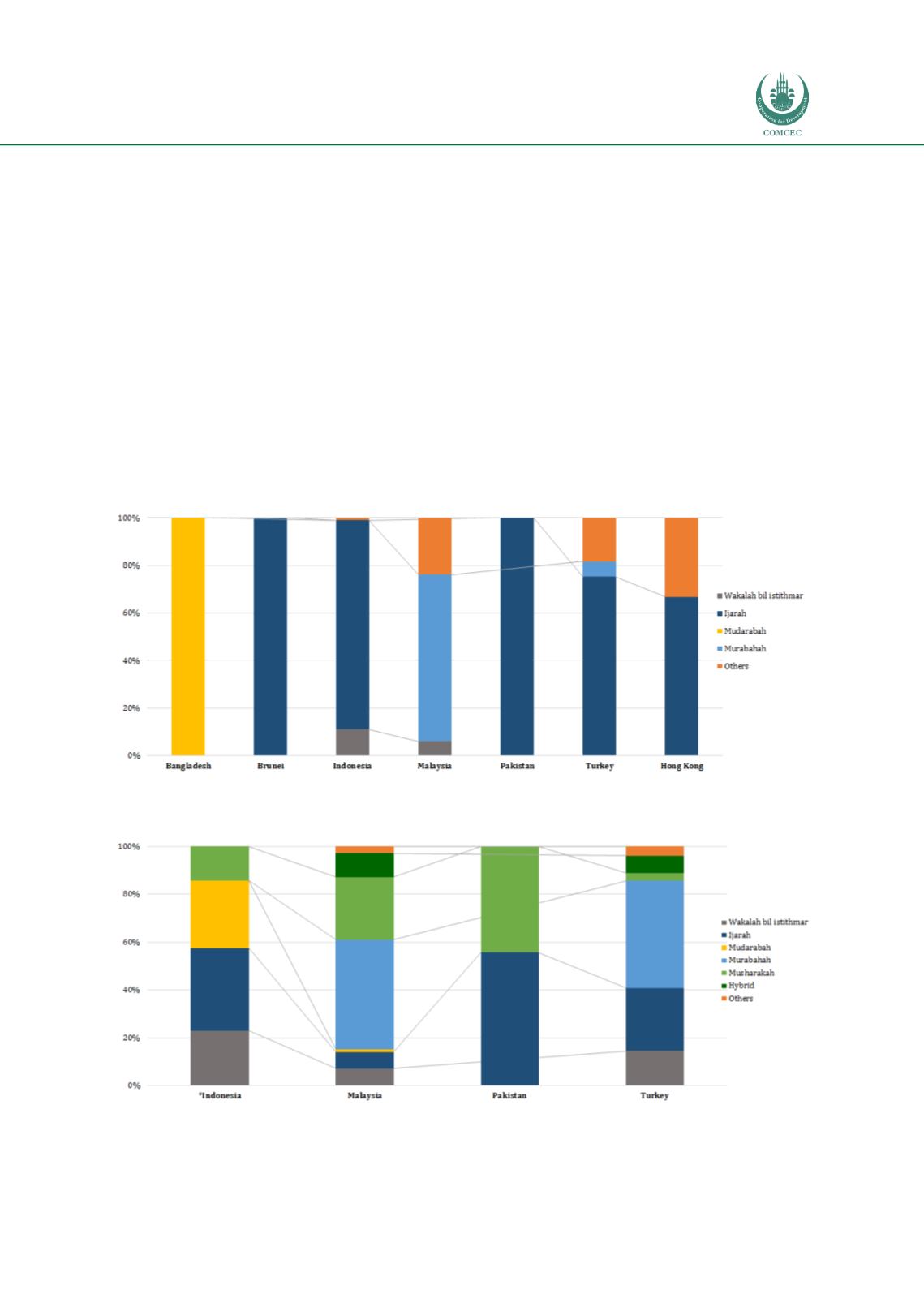

Chart 3.3 depicts sukuk issuance by sovereigns, with

murabahah

accounting for the largest

share in Malaysia. Other sovereign sukuk issues in the Asian region predominantly use

ijarah

structures. This, we believe, is in line with the AAOIFI’s requirement on the trading of debt.

Chart 3.3: Selected Asian Sovereign Issuances by Contracts (2011-June 2017)

Source: Eikon-Thomson Reuters

Chart 3.4: Quasi-Sovereign and Corporate Issuances by Shariah Contracts (2011-June 2017)

Sources: Bloomberg*, Eikon Thomson Reuters

*Data extracted from Bloomberg is for Indonesia only.