The Role of Sukuk in Islamic Capital Markets

46

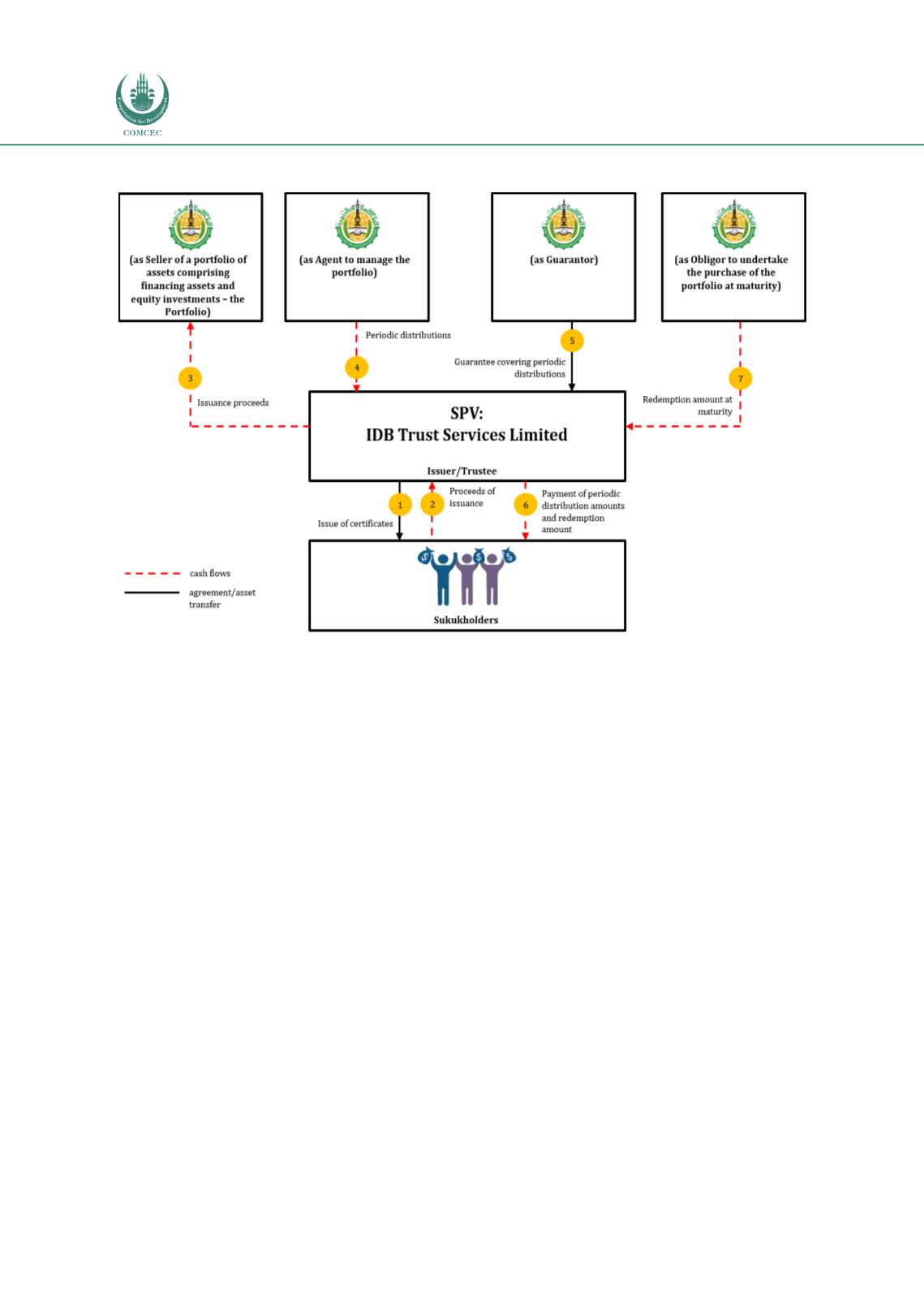

Figure 3.2: IDB Trust Services Limited –Wakalah Bil Istithmar Sukuk Structure

Source: IDB Trust Services Limited Base Prospectus (17 October 2016)

Note: Portfolio means a separate and independent portfolio of assets created by IDB, which includes:

1. At least 33% of the tangible assets must consist of leased assets, disbursing istisna’ assets, shares and/or

sukuk.

2. No more than 67% of the intangible assets must comprise istisna’ receivables and/or murabahah receivables.

A case in point is the Islamic Development Bank’s (IDB) first

wakalah bil istithmar

sukuk

,

issued in 2003. In the structure,

ijarah

assets constituted 65.8% of the entire portfolio while

murabahah

and

istisna’

receivables made up the other 34.2% (Haneef, 2009). In IDB’s

subsequent sukuk issuance, as illustrated in Figure 3.2, the proportion of tangible assets was

reduced to 33% (i.e. the level set in the AAOIFI’s Shariah Standard). Because of this

precedence, market practitioners in other countries have adopted similar benchmarks in the

structuring of their

wakalah

structures.

3.3.2

ASIAN COUNTRIES

Within the Asian region, Malaysia and Indonesia boast the largest shares in terms of sukuk

issuance. The key difference is Malaysia’s strong foothold underpinned by a sustainable supply

of corporate sukuk issuers; Indonesia’s sovereign sukuk issuance is the key driver of its

historical volume and number of sukuk issues. In September 2014, the Government of the

Hong Kong Special Administrative Region of the People’s Republic of China became the first

non-OIC country in Asia to issue a USD16.0 billion sukuk, following changes in tax legislation in

July 2013. Japan and Singapore had followed suit in enacting similar reforms, in an attempt to

eliminate asymmetries in the tax treatment of sukuk and traditional bonds. This is to level the

playing field, so that sukuk can compete with conventional debt securities. Of the non-OIC