158

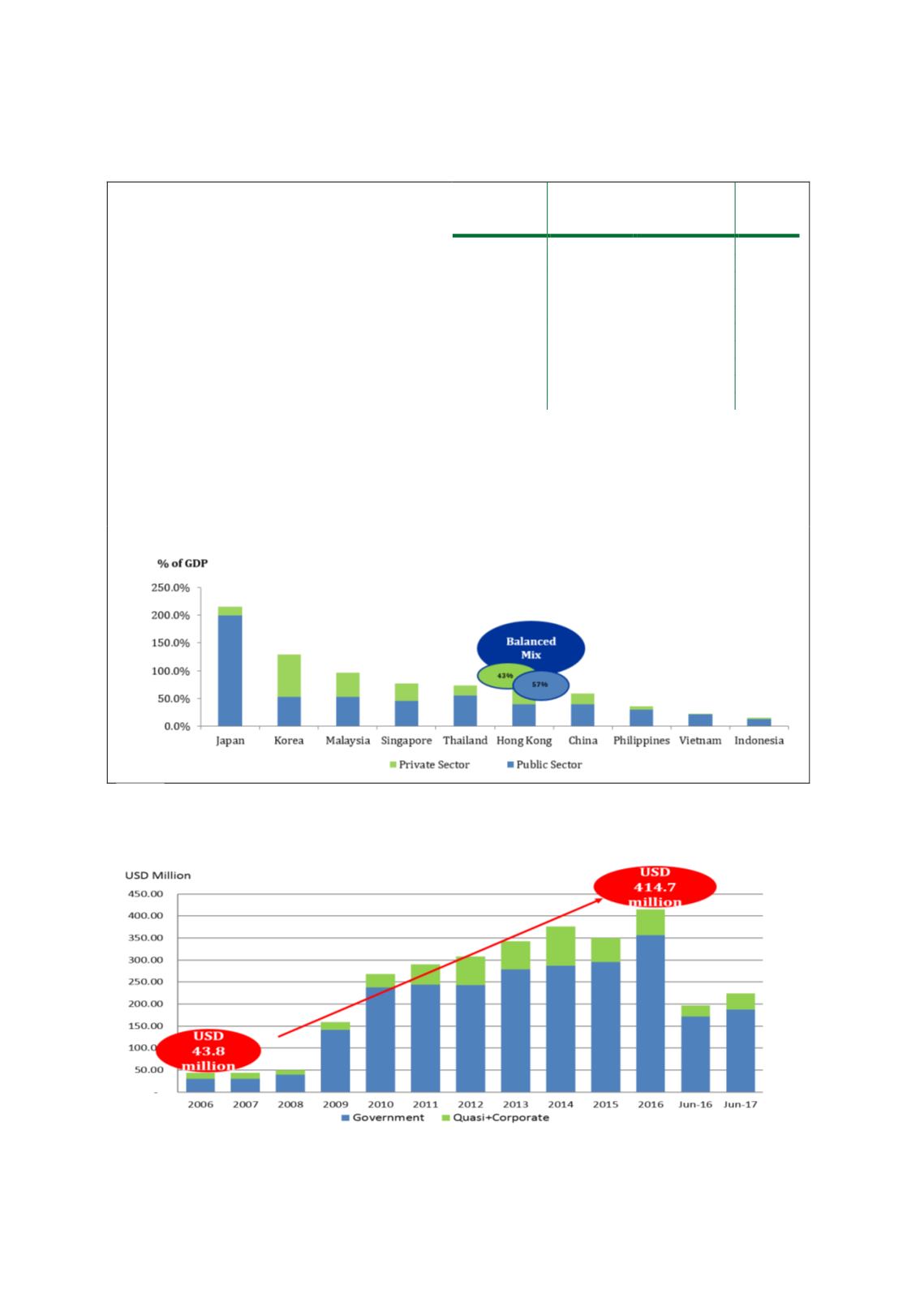

Box 4.17: Size of Selected Asian Debt Markets as at end-2016 (USD billion)

Development of Hong Kong’s bond market

The steady growth in bond issuances over the years

demonstrates the healthy development of Hong

Kong’s bond market. The broad investor base in

Hong Kong has been attracting more issuers to

expand their funding scale using the local debt

market. The market offers open access to both

domestic and international issuers and investors, in

both domestic and foreign currencies. The Hong

Kong Monetary Authority (HKMA) continues to

support the sustainable development of the local

bond market through the Government Bond

programme involving institutional bond issuances

as well as retail issuances such as the inflation-

linked retail bond (iBond) and the inflation-linked

Silver Bond which targets Hong Kong residents

aged 65 and above. Apart from the Hong Kong

dollar bonds, two US dollar sukuk issues were also

outstanding as at 2016.

Corporate

bond

market

Government

bond

market

Total

Japan

670.8

8,965.8 9,636.6

China

2,155.0

4,974.0 7,129.0

Korea

1,010.9

702.0 1,713.7

Thailand

81.5

221.5

303.0

Malaysia

119.0

141.2

260.2

Singapore

99.0

137.0

236.0

Hong Kong

97.0

133.0

230.0

Indonesia

23.0

139.0

163.0

Philippines

18.0

80.0

98.0

Vietnam

2.0

42.0

44.0

Size of selected debt markets relative to GDP (as at end-2016)

Source: Asian Bonds Online

Chart 4.53: Bond Issuance in Hong Kong (2006-June 2017)

Source: Bloomberg