159

In July 2017, Bond Connect was launched to further promote the development of the bond

markets between Hong Kong and Mainland China. Bond Connect is a new mutual market

access scheme that allows investors from Mainland China and overseas to trade in each

other's bond markets, through connections between the related Chinese and Hong Kong

financial infrastructure institutions. Bond Connect is expected to strengthen Hong Kong’s

position as the financial securities gateway to Mainland China, allowing overseas investors

to trade onshore bonds from Hong Kong. Bond Connect may also be the gateway for Hong

Kong to become the global Islamic finance centre, as it has been actively issuing sukuk

since 2014; it introduced a 10-year sukuk in February 2017.

The UNCTAD World Investment Report 2017 has labelled Hong Kong as a highly attractive

market for FDI. Global FDI to Hong Kong amounted to USD108 billion in 2016, placing it in

the fourth position globally, behind Mainland China (USD 134 billion). Hong Kong also

ranks seventh among the world’s top stock exchanges, and third among Asia’s stock

exchanges based on market capitalization as at end-June 2017, as shown in Table 4.27.

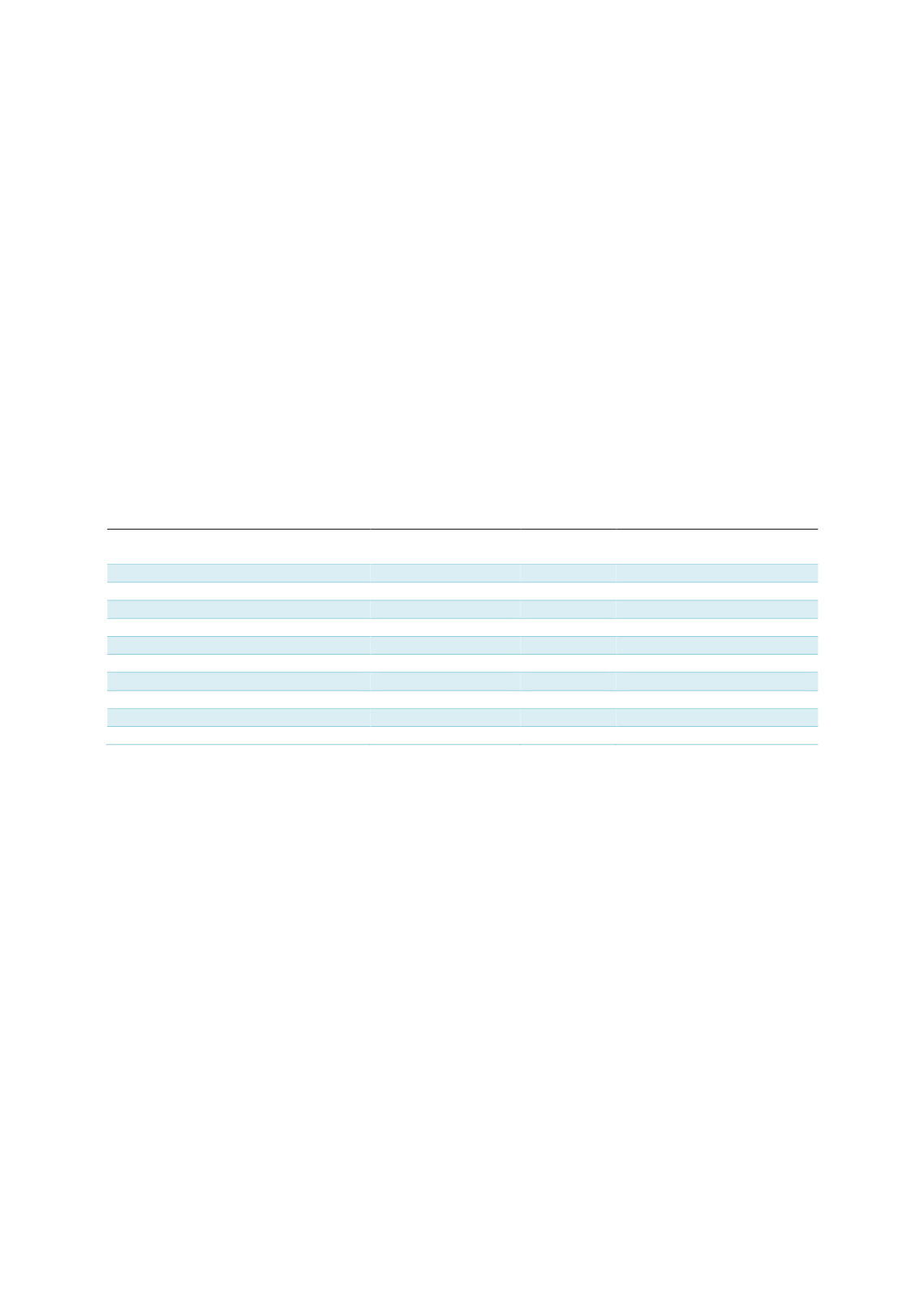

Table 4.27: Market Capitalization of the World’s Top Stock Exchanges

Worldwide

Ranking

Ranking

in Asia

Market Capitalization

(USD billion)

US (NYSE Euronext)

1

20,658.99

US (Nasdaq)

2

8,745.95

Japan (Japan Exchange Group)

3

1

5,501.98

China (Shanghai)

4

2

4,536.96

Europe (NYSE Euronext)

5

4,034.23

UK (London Stock Exchange Group)

6

4,004.81

Hong Kong

7

3

3,674.30

China (Shenzhen)

8

4

3,347.50

Canada (Toronto)

9

2,128.06

Germany (Deutsche Borse)

10

1,993.80

Source: Bloomberg, World Federation of Exchanges (WFE)

In December 2016, Hong Kong introduced its second Stock Connect with Mainland China. Since

then, stocks have been recording higher turnovers. Stock Connect strengthens the Stock

Exchange of Hong Kong as the number of IPOs in 1Q 2017 is the highest in more than 2

decades (KPMG, 2017), reflecting strong demand in the primary market. This scheme gives

Hong Kong an opportunity to be the “super connector” between China and the world.

Overall, Hong Kong features as a strong IFC, with a financial sector that is much larger relative

to its size and population; it is also dominated by international companies. Hong Kong largely

focuses on developing its capital markets to attract international issuers and investors,

particularly serving as a prime regional centre that facilitates market access for Mainland

China. Table 4.28 summarises Hong Kong’s global position and in Asia.