146

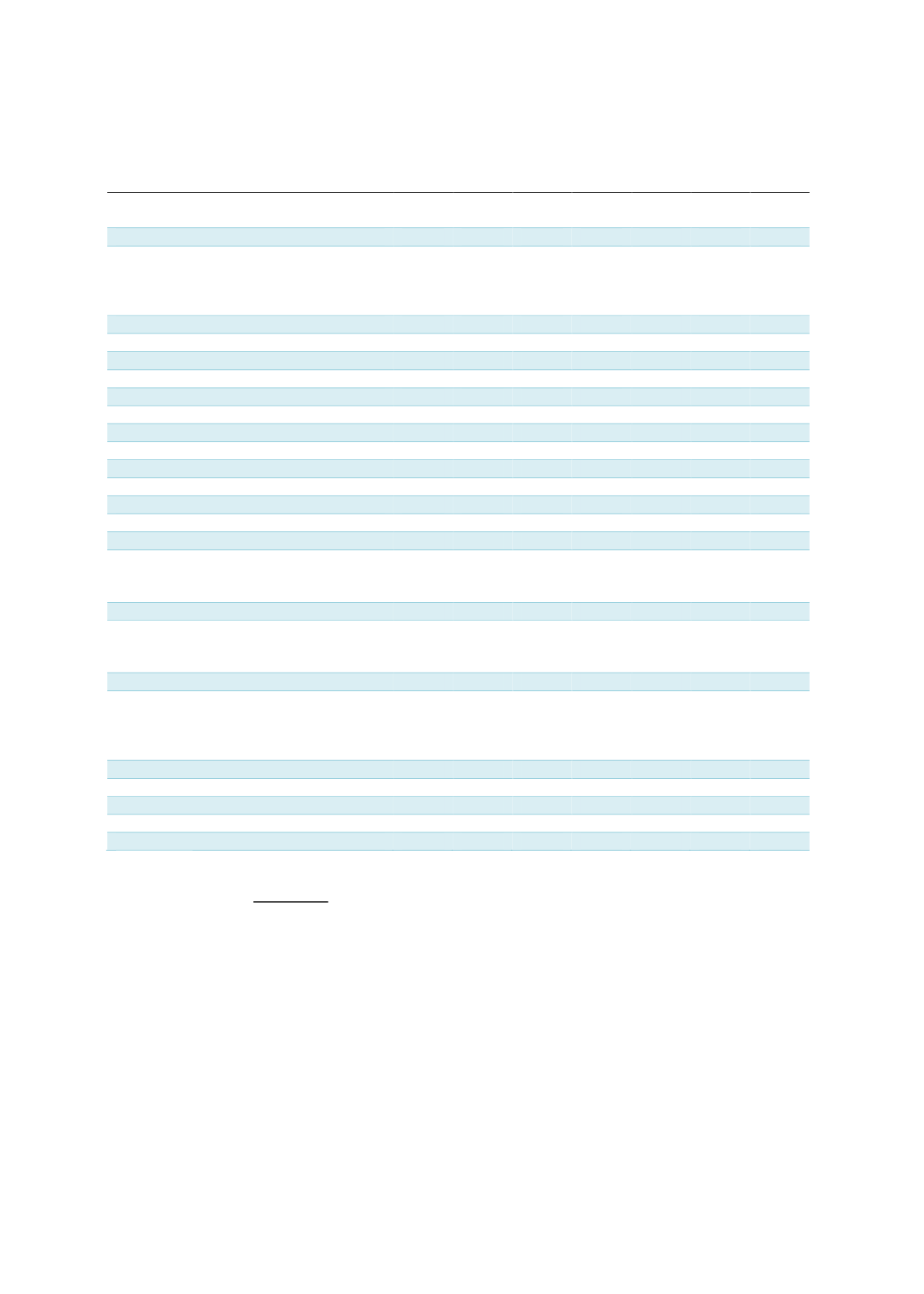

Table 4.23: Number of Lease Certificates Issued by Corporates (2010-August 2017)

Issuer

2011

2013

2014

2015

2016

Aug

2017

Total

Aktif Bank Sukuk Varlik Kiralama AŞ

-

2

2

2

3

9

18

Aktif Yatirim Bankasi

IFM Istanbul Finans Merkezi Insaat

Taahhut

GAP Insaat Yatirim ve Dis Ticaret

-

-

-

-

2

-

1

1

-

2

-

-

3

-

-

8

-

1

14

3

1

Asya Varlik Kiralama AŞ

-

5

4

-

-

-

9

Bankasya

-

5

4

-

-

-

9

Bereket Varlik Kiralama AŞ

-

-

1

-

4

7

12

Albaraka Turk Katilim Bankasi

-

-

1

-

4

7

12

Halk Varlik Kiralama AŞ

-

-

-

-

-

1

1

Halk Gayrimenkul Yatirim Ortakligi

-

-

-

-

-

1

1

Kabtek Varlik Kiralama AŞ

-

1

-

-

-

-

1

Kablotek Kablo Sanayi Ve Ticaret

-

1

-

-

-

-

1

Katilim Varlik Kiralama AŞ

-

-

-

-

-

2

2

Zorlu Enerji Elektrik Uretim

-

-

-

-

-

2

2

KT Kira Sertifikalari Varlik Kiralama AŞ

-

1

6

24

14

15

60

Kuveyt Turk Katilim Bankasi

-

1

6

24

14

15

60

KT Sukuk Varlik Kiralama AŞ

1

-

-

-

-

2

3

Derindere Turizm Otomotiv San Ve Tic

Kuveyt Turk Katilim Bankasi

Toprak Mahsulleri Ofisi

-

1

-

-

-

-

-

-

-

-

-

-

-

-

-

1

-

1

1

1

1

TF Varlik Kiralama AŞ

-

1

7

12

10

14

44

Turkiye Finans Katilim Bankasi

Turkiye Finans Katilim Bankasi (Fon

Kullanicisi Cetin Civata)

-

-

1

-

5

2

12

-

10

-

14

-

42

2

TFKB Varlik Kiralama AŞ

-

-

1

2

-

-

3

Gama Guc Sistemleri Muhendislik Ve

Taahhut

Tirsan Treyler Sanayi Ve Ticaret

Zorlu Holding

-

-

-

-

-

-

-

1

-

1

-

1

-

-

-

-

-

-

1

1

1

Vakif Varlik Kiralama AŞ

-

-

-

-

-

7

7

Vakif Katilim Bankasi

-

-

-

-

-

7

7

Ziraat Katilim Varlik Kiralama AŞ

-

-

-

-

3

9

12

Ziraat Katilim Bankasi

-

-

-

-

3

9

12

Grand Total

1

10

21

40

34

66

172

Source: CMB

Analysis of Sukuk Issuances – Supply (Sell Side)

The basic building block of a robust domestic bond market is the development of a sustainable

supply of domestic debt securities from both the public and private sectors. Key to this is the

establishment of a sovereign benchmark yield curve. Benchmarks play a crucial role in the

efficient functioning of the primary and secondary bond markets. The development of a liquid

sovereign benchmark is essential towards improving the liquidity of the bond market and

providing a risk-free yield curve. The Turkish government and regulators have done well in

making available different maturities for sovereign conventional and sukuk issues, as depicted

in Chart 4.49.

Nonetheless, Turkey needs to diversify the funding sources for corporates and reduce their

over-reliance on bank credit. A well-functioning corporate bond market will enable banks and