141

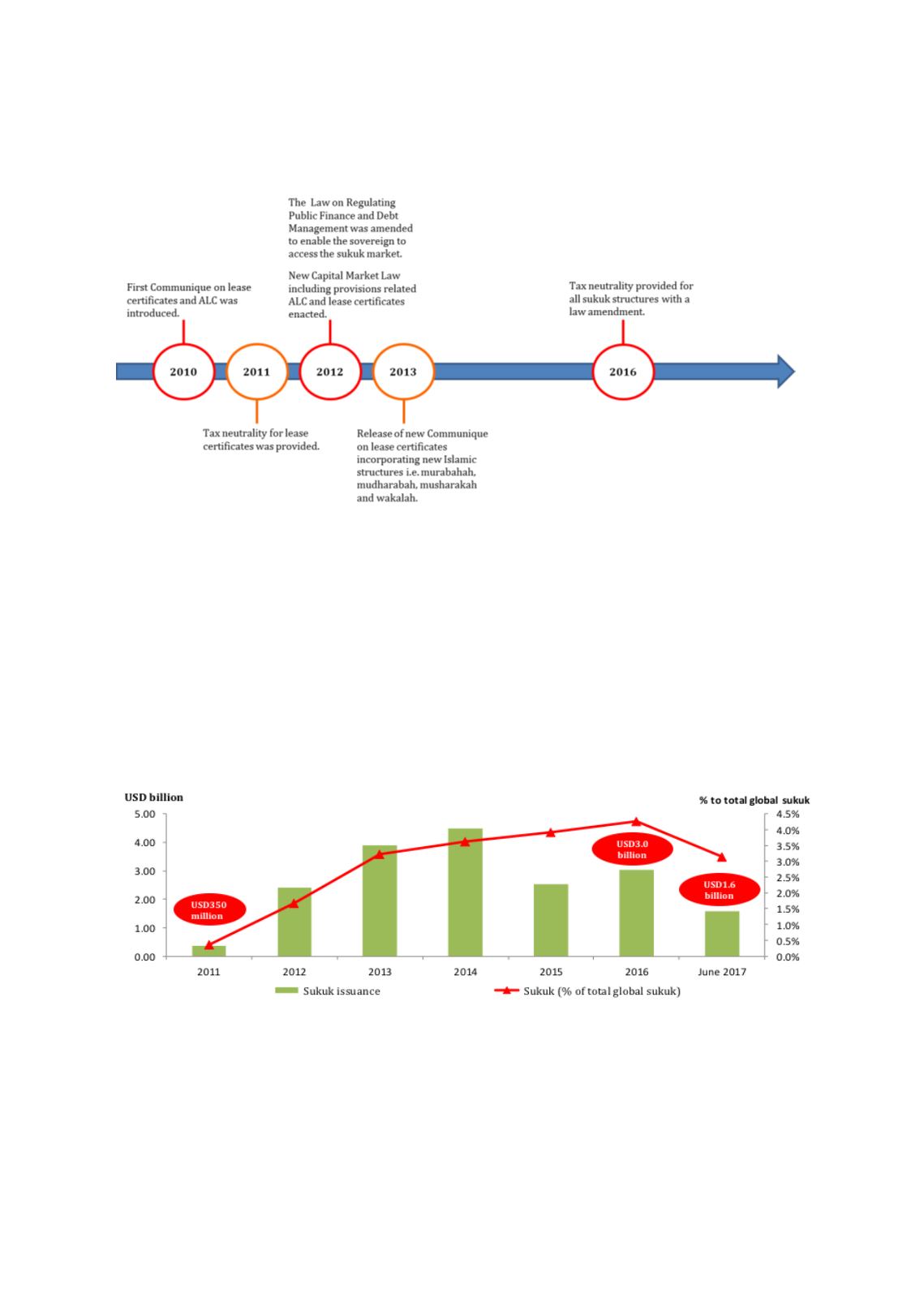

Figure 4.13: Timeline of Turkey’s Sukuk Regulation

Sources: Undersecretariat of Treasury, CMB

The revisions released in the second Communiqué allow varying sukuk structures. The

domestic sukuk market has seen an unprecedented spike in lease certificates since then. As

depicted in Chart 4.46, total Turkish sukuk issuance increased from USD350.0 million as at

end-2011 to USD3.0 billion as at end-2016. The viable solution to diversify sukuk structures

which are accorded tax neutrality were key in growing Turkey’s sukuk issuance. As at end-June

2017, a steady pipeline of sukuk issuance by the public and private sectors supported Turkey’s

USD1.6 billion contribution to total global sukuk issuance.

Chart 4.46: Turkey’s Sukuk Issuance vs Global Sukuk Issuance (2011-June 2017)

Sources: CMB, Eikon-Thomson Reuters

Domestic Market – Public Sector Issuance

In 2001, Turkey felt the brunt of the financial crisis when its public debt hit a peak of 77% of

GDP while the inflation rate came in at a record 68.5%. The Turkish government had

consequently implemented strategic economic reforms to combat its rising public debt and